In the era of digitalization, Fintech companies face numerous threats, particularly from the burden of regulatory challenges. Additionally, automated processes, cross-border transactions, and lack of regulatory rules in some jurisdictions create a suitable channel for criminals to launder funds, create shady shell companies, and, overall, exploit the financial system.

To combat these risks, fintech businesses must always maintain the trust of their clients and stakeholders. Not only that, but stringent laws with new amendments, such as the EU’s Anti-Money Laundering Directives (AMLDs) or the US Bank Secrecy Act (BSA), require the fintech industry to fight back against fraud.

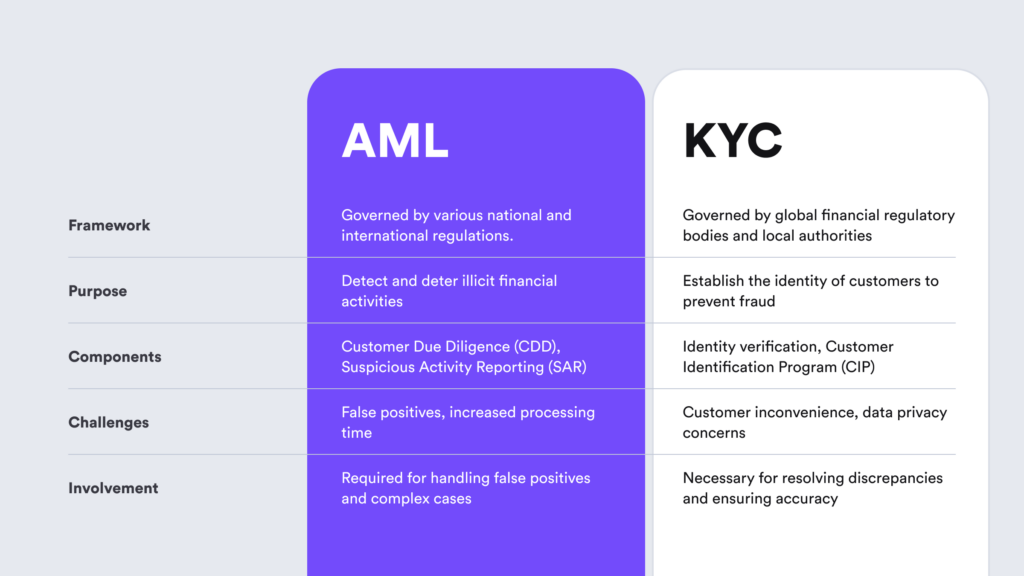

That starts with implementing proper Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance measures, which are extremely important. To actually build a robust AML program, fintechs must stick to at least five stages, which involve screening sanctions lists, looking for Politically Exposed Persons (PEPs), conducting AML training, collecting and reporting data, and much more.

In this blog post, we talk about AML/KYC obligations and how to achieve both complete compliance and great user experience for fintech companies.

What is AML in Fintech?

AML in fintech is the process of identifying people involved in money laundering, aiming to safeguard the fintech industry and other financial institutions from financial crimes. The primary goal of AML compliance is to ensure the overall security of financial institutions for all customers. Since the fintech industry is a well-known target for money laundering, it’s crucial for fintechs to detect money laundering cases as efficiently as possible.

What are the Main Fintech AML Risks?

Law enforcement and regulatory authorities establish effective fraud prevention rules for fintechs to manage their AML risks effectively. That said, fintech businesses should know the key types of AML risks to understand better how to deal with them in an effective manner:

- Transaction speeds. The rising speed of the internet and connectivity allows customers to complete their transactions in seconds. Money launderers might take advantage of this convenience by swiftly moving large sums of funds into and out of accounts or between different fintechs, avoiding the scrutiny of legal authorities.

- Customer identities. As fintech products and services operate online, money launderers exploit the anonymity associated with online transactions. They might submit incomplete, misleading, or false personal information to avoid AML controls.

- Regulatory gaps. The rapid advancements in technology-oriented sectors, such as fintech, often surpass the capability of regulators to address illicit activities promptly. Money launderers exploit this open door, identifying weaknesses and blind spots in regulations.

Given these AML risks, fintech companies must effectively combat money laundering and other financial crimes, regardless of scale.

What are Automated Fintech AML Compliance Solutions?

Fintech companies use automated AML compliance solutions to detect and report suspicious transactions, involving processes such as AML screening and ongoing monitoring to prevent money laundering. Automated AML compliance solutions facilitate global businesses in adhering to both local and international AML regulations.

The fast-paced fintech environment, where funds swiftly move across continents, requires robust financial risk analysis and due diligence, which are extremely important. In contrast, manual AML solutions can’t ensure the same level of efficiency and accuracy, which are the key factors to a successful AML program for fintech companies.

The Importance of AML and KYC in Fintech

Fintech companies face challenging regulatory requirements, which makes AML and KYC compliance one of the main priorities in this sector. Maintaining compliance means ensuring that the fintech business cares about its credibility and overall business performance. On top of that, these regulations are important because they protect both consumers and financial institutions by preventing crimes like money laundering or identity theft.

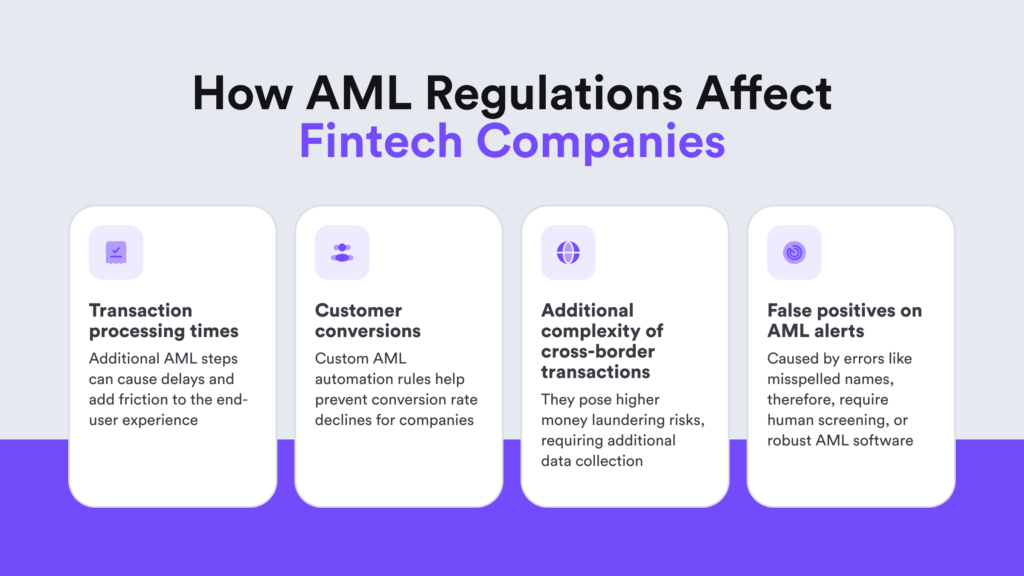

But that’s not all. While maintaining AML and KYC compliance itself is an important task, the question remains — how? To attract more customers, many fintech companies use automation. That means they don’t manually check sanctions lists or every single ID of a new user. Otherwise, manual procedures or streamlined compliance processes not done in the best manner can result in drop-offs and a poor end-user experience.

To put it simply, AML/KYC compliance procedures are like a multi-layer defense against fraudulent practices, consisting of many steps. That’s why fintech businesses must comply with local and global regulations for customer due diligence (CDD), encompassing identity verification, risk-based assessments, ongoing monitoring, as well as screening sanctions lists, PEP lists, and other sources, such as adverse media.

Related: What is the Difference Between KYC and CDD?

Common Security Issues in the Fintech Industry

One of the oldest tricks in the book for fraudsters, unfortunately, is money laundering. For example, criminals hide under the anonymity shield of cross-border transactions to launder illicit funds. Fintech’s digital nature helps criminals successfully conduct account takeovers or use stolen identities to launder illicit funds. Once that happens, the consequences in this sector are severe, leading to substantial financial losses and reputational damage.

On top of that, the large data volumes that fintech businesses handle daily make them an attractive target for data breaches. This is a common method to conduct fraud and initiate data breaches through phishing attacks. In this scenario, criminals create deceptive messages that appear to be from legitimate sources such as fintech platforms. These messages often contain links or attachments that, when clicked or opened, deploy malware onto the user’s device. The malware then compromises the user’s login credentials, providing unauthorized access.

Another rising issue in fintech is chargebacks, affecting both their financial stability and operational efficiency. Firstly, chargebacks result in direct financial losses for the platform. When users dispute transactions and initiate chargebacks, fintech companies not only lose the transaction amount but may also incur additional chargeback fees imposed by payment processors. These fees can accumulate quickly, cutting into the platform’s revenue and profitability.

Additionally, chargeback fraud can lead to indirect costs and operational challenges. For instance, the platform may experience a loss of shipping costs linked to disputed transactions. With that in mind, balancing user-friendly onboarding with robust security measures remains a persistent challenge for these businesses. That’s why automation tools, designed to prevent fraud and help fintech businesses comply with AML/KYC rules, are instrumental in striking this delicate balance.

What is the Level of Money Laundering Risk in Fintech?

With the continual growth of the fintech sector, there’s a parallel increase in concerns about money laundering. The ease of unrestricted money flow and the anonymity associated with specific accounts make money laundering activities more accessible. Consequently, the level of financial crime in fintech is relatively high compared to other industries.

Forms of Money Laundering in Fintech

Money laundering within the fintech sector can take on several familiar forms, including:

- Shell companies. These are business entities employed by criminals to conceal the illicit sources of funding, including the true owners of the funds.

- Structuring. In this form of money laundering, large sums of cash are intentionally divided into smaller amounts under the reporting threshold. In structuring, the goal is to evade detection and minimize suspicions of money laundering.

- Bulk cash smuggling. This method entails the illicit physical transportation of cash across borders and its subsequent deposit into banks.

- Money-mulling. This is a method where criminals enlist third parties to interact with fintech services on their behalf, introducing illicit funds into the financial system. These individuals, or ‘money mules,’ can be vulnerable members of society, including the elderly or disabled. They’re often implanted into the criminals’ schemes without knowing about them.

Related: Smurfing in Money Laundering Explained

AML/KYC Compliance Challenges in Fintech

Fintech companies must comply with AML/KYC requirements, which include various processes, such as document verification, AML screening, as well as reporting suspicious activities, among other obligations. That said, compliance challenges don’t stop here.

Here are some of the key compliance challenges that fintech companies face:

- Data privacy. Gathering and processing large data volumes for AML/KYC purposes raises concerns about data privacy. As a result, fintech companies must ensure that they comply with data protection regulations, such as the GDPR, while conducting thorough customer due diligence.

- Technological advancements. The rapid evolution of technology introduces both opportunities and challenges for fintech AML/KYC compliance. While AI can enhance internal compliance workflows, it also brings new risks. Criminals exploit sophisticated techniques to circumvent traditional identification methods. For instance, they use deepfakes or create fake documents to bypass age verification systems.

- Regulatory differences. One of the primary challenges in fintech compliance is the diversity and complexity of global regulatory frameworks. Each country has its own set of rules, making it challenging for companies to navigate and ensure compliance on a global scale. For example, the documentation required for customer identification may differ between regions. This creates a compliance hassle for fintech platforms operating in multiple jurisdictions.

- User experience. Fintech companies often struggle to strike a balance between providing a seamless user experience and implementing proper AML/KYC processes. Lengthy onboarding processes can deter users, while overly simplified procedures can compromise compliance. For this reason, there’s a tension between implementing thorough due diligence and maintaining a frictionless user experience.

Being a high-risk industry, especially when dealing with millions of customers, fintech companies use automated approaches to ensure AML compliance. And that’s not an easy task. Over the last few years, the fintech industry has been navigating a multifaceted landscape marked by ongoing inflation, geopolitical tensions, stringent regulations, and increased competition from digital-first fintech firms.

Today, fintechs deal with the dual challenge of addressing rising AML/KYC regulations and adopting appropriate technology to ensure efficiency in internal compliance processes. In addition to current issues, fintech companies are preparing for upcoming regulatory changes, including those introduced by the Anti-Money Laundering Act (AMLA). These changes introduced updates in beneficial ownership reporting and enhanced whistleblower protections.

What is a Risk-Based Approach to AML in Fintech?

The most effective method for addressing financial crime in the fintech sector involves adopting a risk-based approach (RBA). This approach entails creating an AML compliance program customized to the specific risk levels associated with each customer.

In practical terms, a risk-based approach to AML includes evaluating the potential risk of money laundering activities and implementing suitable measures to identify, prevent, and mitigate that risk.

To follow a risk-based approach, fintech companies must adopt these measures:

- Know Your Customer (KYC). Fintech businesses must conduct KYC verification to identify and onboard verified users to meet regulatory requirements.

- AML compliance team. Depending on the jurisdiction, fintech companies must appoint a dedicated AML compliance officer and a Money Laundering Reporting Officer (MLRO), who will be responsible for all internal compliance processes, such as ongoing monitoring and reporting.

- Employee training. Fintech companies must educate employees on financial crime prevention. At the same time, they should educate their staff on evolving regulations and regulatory changes.

- Record keeping. Regulators mandate businesses to collect and store results from due diligence checks and other reports for potential regulatory audits.

- Suspicious activity reporting. Fintech companies must promptly spot and report red flags, such as the submission of fake documents, unusually large transactions, or attempts to open a bank account with insufficient customer information.

Fintech Compliance Processes

According to the Financial Action Task Force (FATF) recommendations, fintech companies must adopt a risk-based approach to regulatory compliance. This involves implementing AML/KYC measures in proportion to the level of risk they encounter. In the context of fintech and money laundering, this requires establishing the mentioned AML program tailored to address the specific AML risks and compliance challenges outlined earlier.

In practice, to stay compliant and build an effective AML program, fintech companies must implement the following processes:

1. Customer Due Diligence

Fintech companies need to establish and verify the identities of their customers, including the beneficial ownership of entities, to develop accurate risk profiles. While traditional Customer Due Diligence (CDD) typically involves gathering user names, addresses, and birthdates, the anonymity complexities of online services necessitate additional measures. Fintech firms should consider enhanced CDD methods, such as collecting biometric data like selfie scans.

Related: A Quick Guide to Simplified Due Diligence (SDD)

2. Transaction Monitoring

Identifying unusual transactional behavior is a valuable indicator of potential fintech money laundering. To address this, fintech companies use transaction monitoring. This process involves continuously observing customer transactions and evaluating both historical and current customer information to gain a comprehensive understanding of customer activity.

This type of monitoring includes various transactions, such as transfers, deposits, and withdrawals. That’s why it’s crucial for fintech companies to stay particularly vigilant for uncommon patterns and volumes of transactions, as well as transactions involving high-risk jurisdictions.

3. Politically Exposed Persons Check

Politically Exposed Persons (PEPs) are high-risk clients with a greater likelihood than ordinary people to gain assets through illicit means. For example, it can be bribe-taking or money laundering. Their elevated risk stems from the potential exploitation of their status for crime, making them individuals of heightened concern. Fintech firms should consistently screen their customers to determine their PEP status and manage associated risks proactively.

4. Sanctions Screening

Sanctions screening is the process of regularly checking against a dynamic watchlist of businesses, individuals, and government agencies to safeguard against fraud and illicit activity. Criminals can exploit fintech companies under international sanctions, seeking to bypass economic restrictions. To counter this AML challenge, fintechs conduct a thorough screening of their customers using applicable international sanctions lists, such as the OFAC SDN list or the UN consolidated list.

5. Adverse Media Screening

Adverse media refers to negative or unfavorable information about individuals, entities, or organizations. This information can indicate potential involvement in financial crimes, corruption, or other illicit activities. To address this, fintech companies consistently screen for negative news related to their customers, considering information from both traditional print sources and online outlets.

In general, adverse media consists of reports, articles, and publicly available information from reputable sources such as news outlets, regulatory bodies, and government agencies. This screening process is crucial for identifying and effectively evaluating potential risks associated with customers or business partners.

Streamlining Regulatory Compliance for the Fintech Sector

Onboarding customers through an AI-powered identity verification solution is one thing, but ensuring ongoing compliance and building a robust AML program is a whole different story. At iDenfy, we understand the best of both words and specialize in complete fintech compliance.

Our in-house KYC specialists can manually review each verification result to ensure complete accuracy and compliance with Know Your Customer requirements with a unique pricing model where you pay only for approved verifications. That means all failed attempts to complete the KYC check are free of charge.

What’s best about our fraud prevention hub is that we have crafted all the AML/KYC tools you need to ensure compliance for your fintech, including AML screening, adverse media checks, PEPs and sanctions screening, and watchlist screening. Additionally, we offer Business Verification services for corporate customers with the option to download government reports and integrate custom KYB workflows tailored to your business needs.

Get started right away, and don’t forget to check out our customer success stories.