Streamline Perpetual KYB with Continuous Monitoring

Ensure seamless compliance and risk mitigation with our Perpetual KYB solution. Continuously monitor company events and verify business credentials in real-time, reducing manual efforts and keeping your business secure effortlessly.

Trusted by industry experts and global leaders

Flexible data collection

Create custom onboarding questions using our forms template to gather information about the company and its shareholders. Download reports and maintain accurate records.

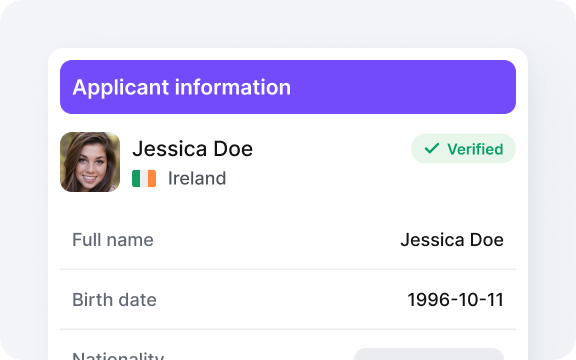

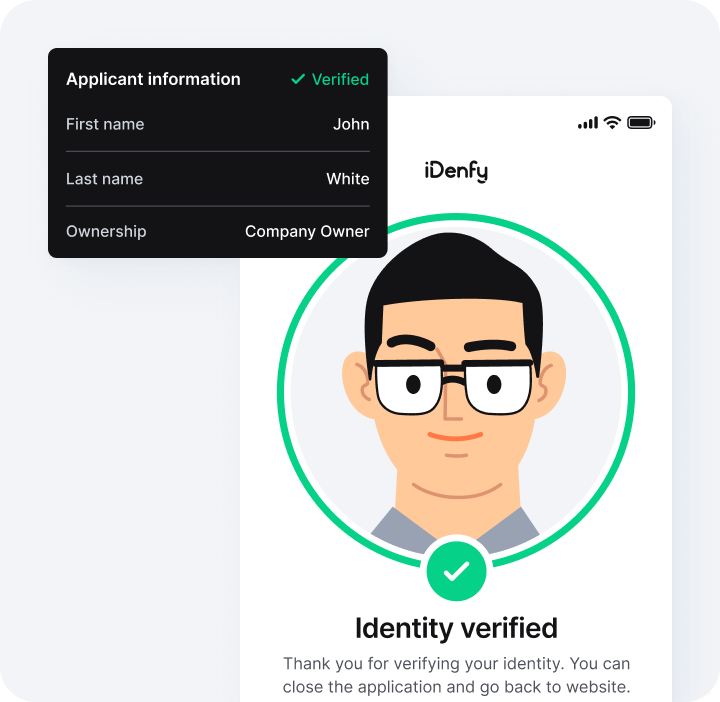

KYC management in one place

Verify the business and all related persons by generating ID verification sessions without having to leave the dashboard — all while ensuring a smooth end-user experience.

Real-time AML screening

Screen businesses against PEPs and sanctions lists, global watchlists, or adverse media, and convert more users by tailoring the KYB flow based on specific risk profiles.

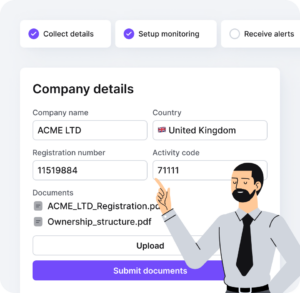

How it works?

Collect Company Details

Ask company to fill in details and upload required documents.

Setup Monitoring of the Company

Setup automations and risk factors for the monitoring of the company.

Receive Real-time Alerts

Receive ongoing information whenever issues occur to block potential risks of compliance.

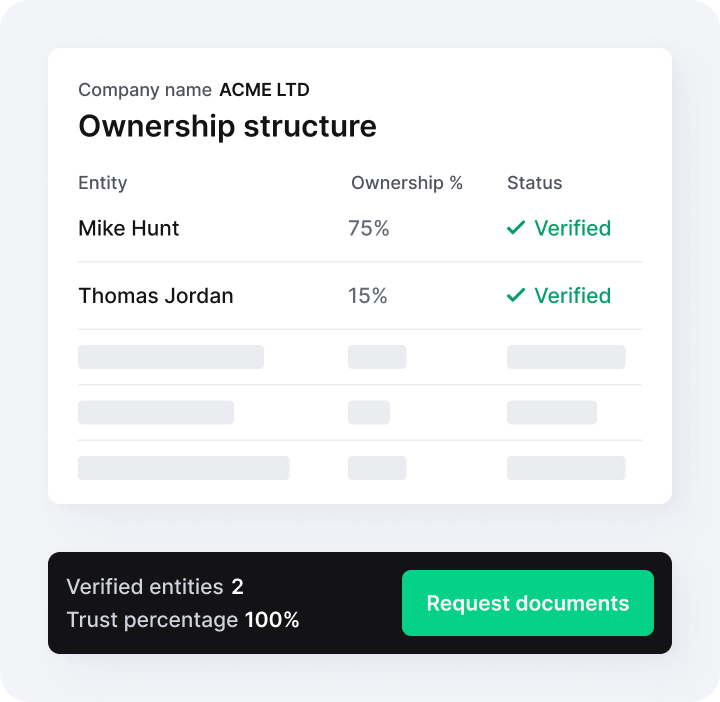

Request documents for streamlined data collection

Easily request any business information you need to know about the company and its associated individuals, all without disrupting the end-user experience. Our automated Perpetual KYB form simplifies data collection, making it seamless and efficient.

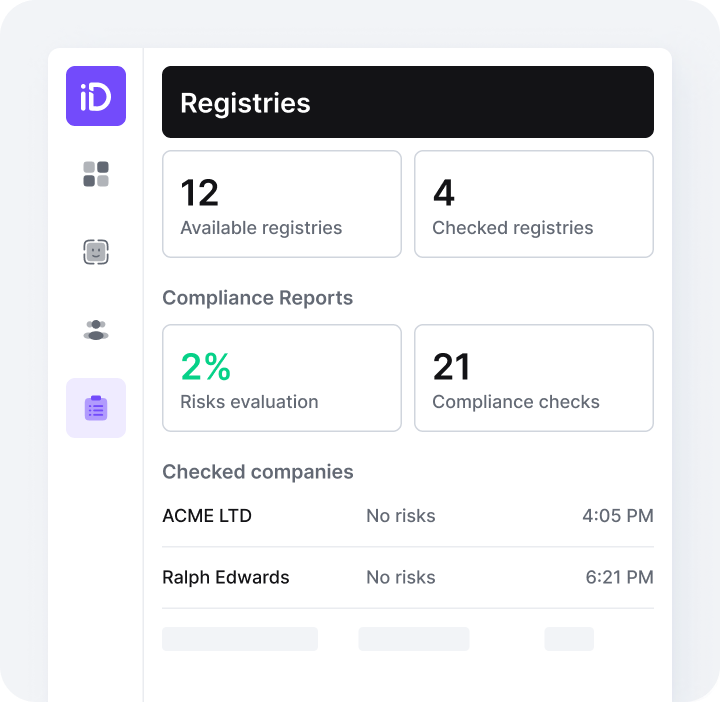

Connect to global company registries

Gain access to over 180 company registries in 120+ countries to verify business legitimacy and automatically assess risk signals. Screen against watchlists and adverse media to ensure comprehensive risk management.

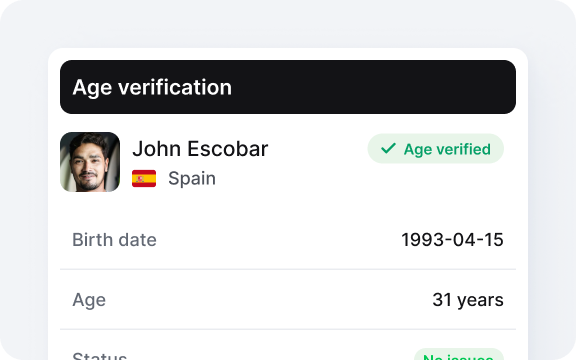

Ensure compliance with accurate UBO verification

Break down complex ownership structures and identify Ultimate Beneficial Owners (UBOs) through triggered KYC checks. Ensure a compliant Perpetual KYB process while providing a seamless user experience.

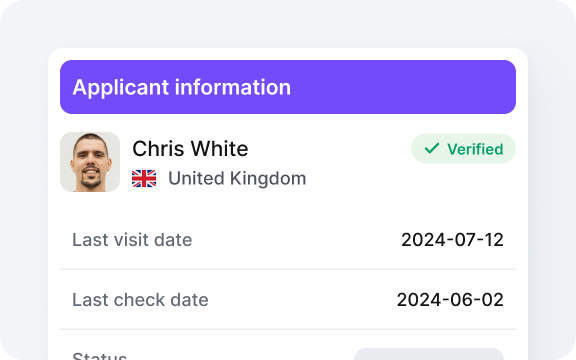

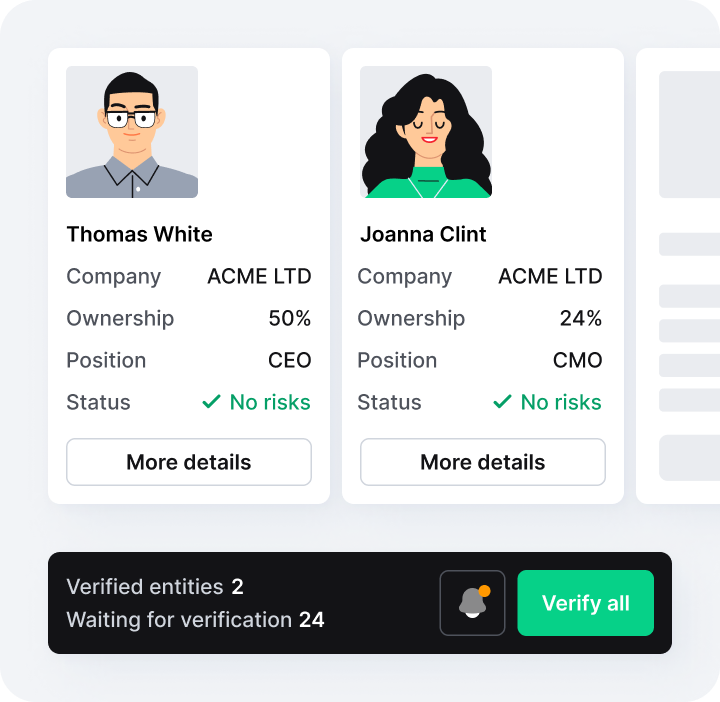

Conduct AML screening from the same dashboard

Screen representatives and high-risk clients like UBOs against authoritative databases, including PEPs and sanctions lists. Enable ongoing monitoring to receive alerts and catch potential issues promptly.

Frequently asked questions

What is Perpetual KYB?

Perpetual KYB, or pKYB, is a continuous verification of a business, which includes monitoring the company’s information regarding its related persons and partners. It’s an ongoing due diligence procedure designed to assess another business that the company engages with to prevent partnering with fraudulent entities. This is a regulatory requirement for banks and other financial institutions to verify the authenticity of their potential business partners and ensure that the business relationship remains transparent while preventing financial crimes like money laundering and terrorism financing.

Why is the process of pKYB important?

What are pKYB checks?

Can you use iDenfy’s pKYB solution for pKYC?

Outperforming competitors. Discover G2 ratings

See how we rank with competitors in key areas, backed by top ratings

and user reviews on G2.

| iDenfy | Jumio | Onfido | SumSub | Veriff | |

|---|---|---|---|---|---|

| Product Direction | 10.0 | 9.0 | 8.9 | 9.4 | 8.8 |

| Quality of Support | 9.8 | 9.0 | 8.5 | 8.9 | 8.3 |

| Ease of Use | 9.7 | 9.0 | 9.0 | 8.8 | 8.3 |

| NPS | 9.7 | 8.7 | 8.8 | 9.2 | 8.9 |

* According to G2 2024 Identity Verification Summer report.

Save costs by onboarding more verified users

Join hundreds of businesses that successfully integrated iDenfy in their processes and saved money on failed verifications.