AML Sanctions Screening Software for Effortless Compliance

Perform daily sanctions and PEP screenings with ease. Ensure compliance, mitigate risks, and build trusted business relationships—all in one platform.

Trusted by industry experts and global leaders

How Sanctions Screening works?

01

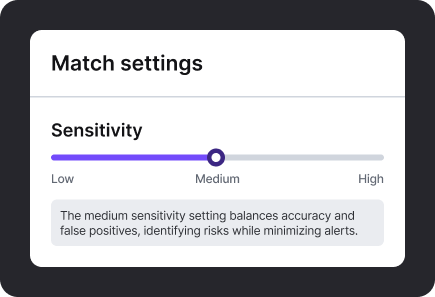

Set Up Match Settings

Customize match sensitivity to reduce false positives while ensuring accurate screening results.

02

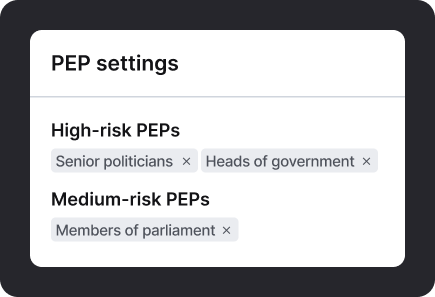

Apply PEP Filters by Category

Enhance security by selecting specific PEP levels, categories, and countries that align with your compliance needs.

03

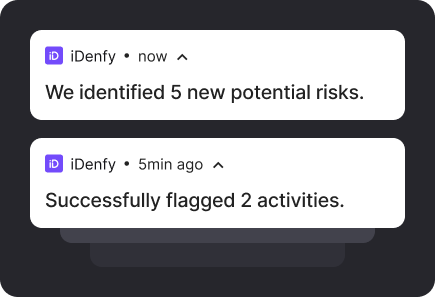

Set Up Notifications

Receive timely email and webhook alerts for flagged activities and potential risks.

04

Select Screening Intervals

Determine how often to screen customers—daily, monthly, or custom intervals based on your needs.

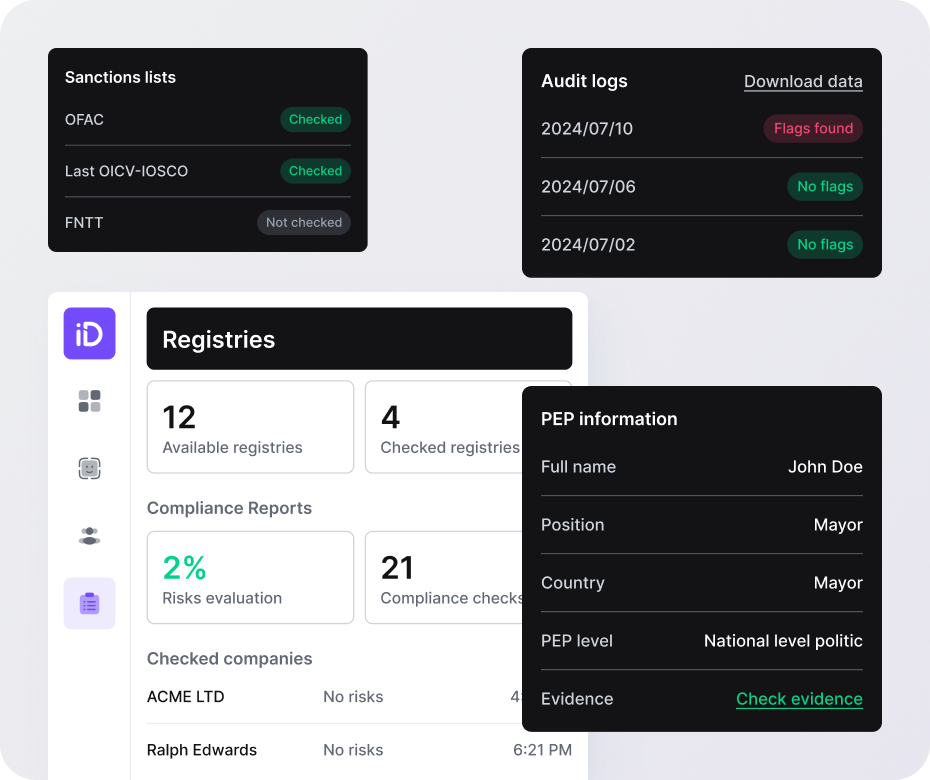

Custom sanctions and PEP screening for compliance

Screen customers against 74 global sanctions lists, including OICV-IOSCO and OFAC, tailored to your market to reduce false positives.

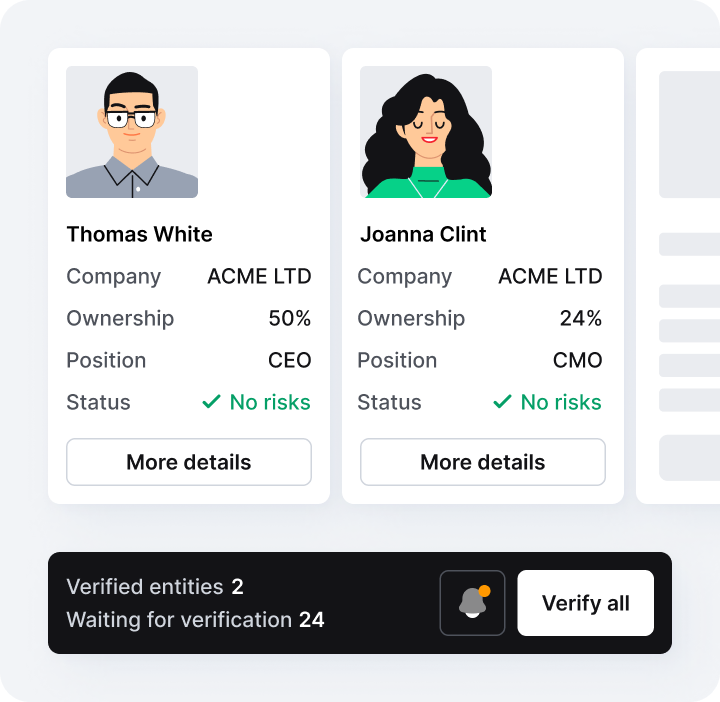

Automate screening with KYC and KYB solutions

Combine AML and KYC to monitor clients and shareholders. Save costs by screening only approved customers.

- Merge AML screening with KYC for compliance

- Monitor business legal and brand names

- Track directors, representatives, UBOs, and shareholders

- Reduce costs by auto-monitoring approved customers

Confidently prepare for any external audit

Compliance-approved review page

Access detailed findings, links to original databases, and the ability to whitelist, comment, approve, or deny customers—all from a single, streamlined page.

Outperforming competitors. Discover G2 ratings

See how we rank with competitors in key areas, backed by top ratings

and user reviews on G2.

| iDenfy | Jumio | Onfido | SumSub | Veriff | |

| Product Direction | 10.0 | 9.0 | 8.9 | 9.4 | 8.8 |

| Quality of Support | 9.8 | 9.0 | 8.5 | 8.9 | 8.3 |

| Ease of Use | 9.7 | 9.0 | 9.0 | 8.8 | 8.3 |

| NPS | 9.7 | 8.7 | 8.8 | 9.2 | 8.9 |

* According to G2 2024 Identity Verification Summer report.

Frequently asked questions

Who Needs AML Software?

Companies that are regulated by money laundering regulations, such as commercial banks, insurance companies, fintechs, luxury goods firms, etc., are required to perform AML screening and monitoring procedures to meet these requirements. In order to achieve this goal, they typically choose to automate some tasks that require AML software capabilities.

How long does the customer AML screening data is stored?

Does daily check work with a company type and other special characters?

What is whitelisting, and how does it work?

Save costs by onboarding more verified users

Join hundreds of businesses that successfully integrated iDenfy in their processes and saved money on failed verifications.