You can say that adverse media checks are one of the most effective ways to see the whole picture of the entity that you’re screening, helping you protect your business against various risks. However, these potential threats aren’t the only reason why adverse media screening has become popular over the past few years.

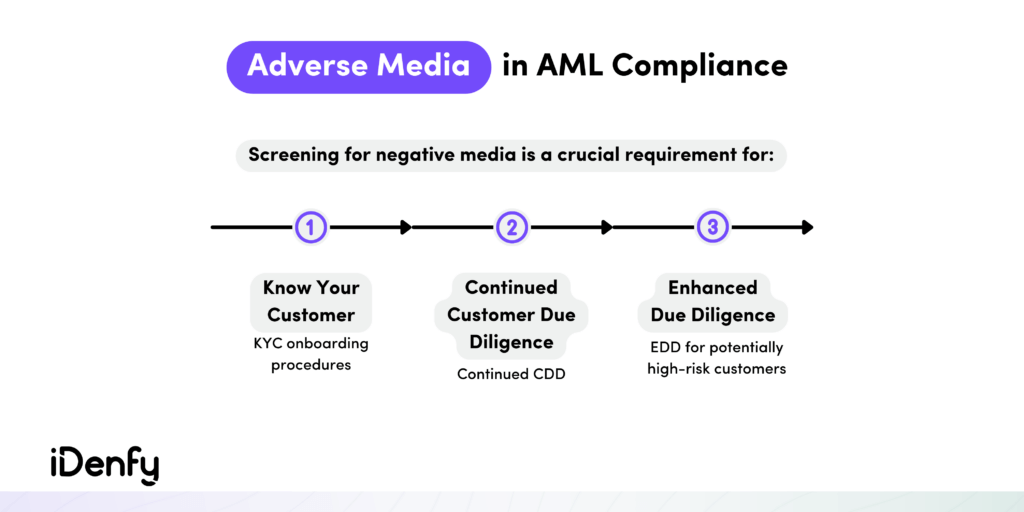

Adverse media screening is part of Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance processes. That means if you’re operating in a regulated industry, you may be legally obliged to conduct these negative news checks.

Despite the mandatory requirements, we explain in this article why adverse media screening benefits all sorts of businesses.

The Process of Adverse Media Screening

Adverse media screening, often also called negative news screening, is the process of investigating negative information about an individual or business that you intend to engage with. The goal of this check is to reveal an entity’s involvement in fraudulent activities.

In brief:

- Adverse media is a crucial competent of customer due diligence (CDD).

- It’s an effective way to maintain a reputation and reduce the risks of getting involved in criminal activity.

- Although rules on screening for adverse media are less structured than for other compliance requirements like sanctions and politically exposed persons (PEPs), it has become a crucial part of successful AML programs.

- Automated adverse media checks can scan and review large media sources, allowing businesses to review data accurately in less time.

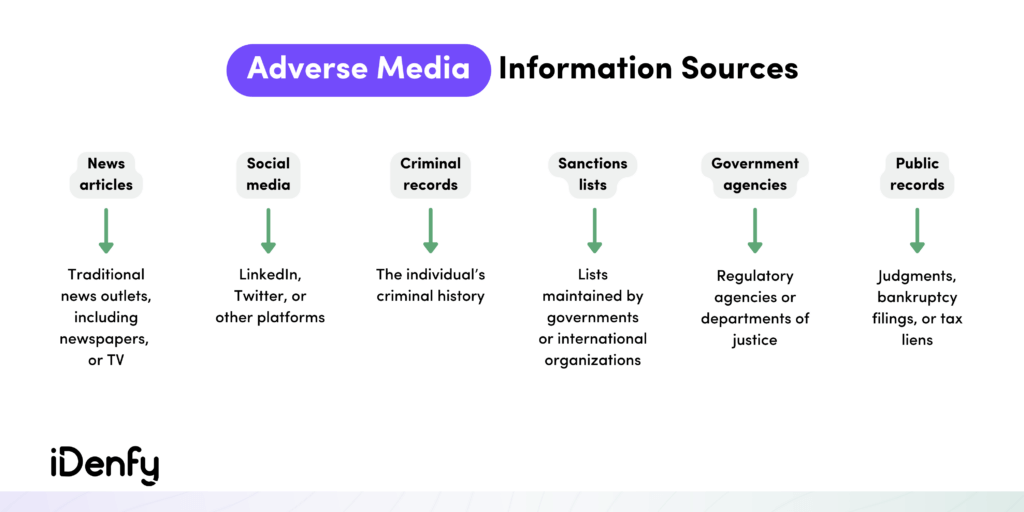

Adverse media screening involves reviewing both online and offline news sources, including blogs, websites, social media, television, and radio.

Financial institutions are the primary users of adverse media screening to identify and prevent potential money laundering risks. However, other industries are also using this screening process to identify other types of risks, such as environmental, social, and corporate governance (ESG) risks.

Why is Adverse Media Important?

Adverse media screening is crucial because it helps detect risks and assists the business in deciding how to handle potential threats to its reputation, particularly from business partners who pose sudden risks. Companies need to continuously monitor news sources for any negative information regarding their current or potential clients.

Regular adverse media checks demonstrate the company’s commitment to responsible compliance and its efforts to prevent illegal activity. According to AML obligations, regulated companies must conduct ongoing customer due diligence (CDD).

These requirements were defined by the Final CDD Rule, explaining that companies must screen and monitor each customer throughout their business relationship, especially during the KYC onboarding process.

This is when negative news screening prompts a company to expand its compliance program.

Compliance Guidelines for Adverse Media Checks

With the increasing regulatory requirements regarding money laundering and related financial crimes, integrating adverse media screening into your compliance practices can bring significant benefits.

To establish an effective compliance program, businesses must adhere to the following regulations:

In the United States

- The Financial Crimes Enforcement Network (FinCEN) requires regulated businesses to comply with the Bank Secrecy Act (BSA).

- Adverse media screening plays a crucial role in facilitating the filing of Suspicious Activity Reports (SARs).

In Europe

- Under the 6th Anti Money Laundering Directive (6AMLD), banks are required to conduct enhanced due diligence for customers who are deemed high-risk.

- Similarly, Financial Action Task Force (FATF) guidelines suggest using adverse media checks as part of enhanced due diligence.

The Challenges of Adverse Media Screening

The issue lies in the fact that there are millions of news articles published online daily, making it impossible for businesses to manually verify every single piece of information.

Using traditional third-party databases and search engines means compliance officers must collect, examine and interpret multiple articles and conduct manual, time-consuming negative news checks. This leads us to duplicates, irrelevant data, and even misinformation.

Manual screening and monitoring procedures cause unwanted headaches for multiple other reasons, including:

- Hidden data. Companies may encounter difficulties in accessing restricted information or dealing with negative news that’s provided in a different language. Additionally, sometimes acquiring such data may require additional expenses.

- Questionable reliability. Since many news platforms and outlets permit anyone to publish information without verifying its accuracy, it becomes a challenging task for companies to verify the accuracy and reliability of the information.

- Lengthy processes. Manually verifying information is a time-consuming process to confirm if the news article corresponds to the entity being screened, especially when checking customers with common names. This significantly increases the occurrence of false positives.

Due to these issues, financial institutions and other AML-regulated businesses feel the pressure to find new, efficient ways to conduct adverse media checks and fulfill their compliance obligations. To stay in the competitive market, companies need to maintain the balance between security and customer satisfaction, not to mention costs.

How to Conduct Adverse Media Screening?

Regulated entities often create their own compliance models based on the recommendations presented by the FATF. Since there isn’t clear guidance, each business must follow an individual risk-based approach using different techniques for adverse media screening.

However, when it comes to effective negative news checks, the first step in all programs should be deciding what kind of data will be counted as adverse media.

Step 1: Establish the Data Types that Will Qualify as Adverse Media

For example, companies should check:

- Who published the negative news. For example, tabloids hold less value than publications by state institutions, especially since there are risks of false information.

- If allegations can be considered negative news, or instead focus on screening conviction records.

- If misconduct can be counted as adverse media. Primarily when not related to financial crime, such as speeding tickets or public disorder offenses.

Step 2: Create a Structured Plan for Screening Adverse Media

The second step is for companies to decide on other technicalities:

- Determine how often the adverse media screening will be performed.

- Rule out who will be screened, for instance, other companies, customers, PEPs, UBOs, related parties, etc.

- Define a time limit after which the information would no longer be counted as negative news.

Step 3: Decide if the Checks will be Manual or Automated

That means you need to choose if the negative news check is going to be performed automatically, manually, or by combining both techniques.

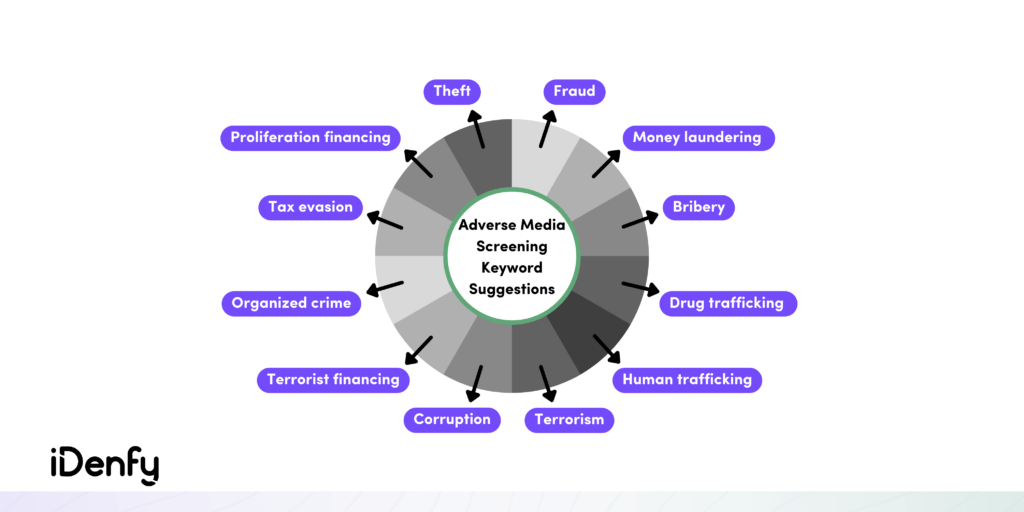

In general, you can use search engines to manually detect negative news by inserting relevant keywords.

To ensure effective adverse media screening practice, don’t forget to:

- Train your staff and provide updates on the latest adverse media screening processes.

- Ensure quality control by assessing the accuracy of the checks.

- If you’re using a third-party service, the same principle applies, so you must evaluate and supervise the effectiveness of the selected screening solution.

Automated Solutions for Adverse Media Checks

Negative news screening solutions today have been blessing companies with various automated options. And there’s no surprise here. With the booming success of ChatGPT, organizations like FATF report seeing new opportunities in adopting technology for AML compliance.

Automated screening and monitoring solutions can improve the quality, efficiency, and speed of adverse media checks while reinforcing your compliance program’s overall effectiveness.

With iDenfy, you can integrate adverse media checks into a fully automated KYC system or implement the solution into your existing workflow for AML screening to save costs and enhance operational efficiency.

Combine PEP and sanctions monitoring with regularly updated adverse media check results and much more! Try out for free, or contact us for more info.