In this guide, we’ll dive deeper into Know Your Business solution for compliance officers. We’ll start by explaining custom rules and how they help to automate your ongoing compliance processes.

A brief overview of Know Your Business solution

Know Your Business is a verification standard that determines the legitimacy of the company and its ownership structure. It acts as a due diligence procedure that reviews business activities to ensure the partnering entities aren’t involved in illicit activities.

Manual verification of the companies is time-consuming (compliance officers save up to 30% of their work time after switching to an automated solution) and error-prone. The most common issues are the following:

Approval of falsified company documents. Without direct access to government registries or credit bureaus, you can’t guarantee that the uploaded documents: tax statements, incorporation, and source of funds are authentic and legitimate.

Incorrect shareholders and UBOs identification. Fraudulent companies might not provide sufficient information about their ownership structure, and without the appropriate software, it is hard to verify the data.

Failure to perform enhanced due diligence upon shareholders. Official sanction lists (OFAC, EU Consolidated List, UN Sanctions list, etc.) are updated frequently. A correct AML procedure must utilize software that provides continuous customer rescreening and ongoing monitoring.

Features of automated Business Verification software

To automate the business onboarding, the software needs to tick all required boxes during company verification:

Shareholders extractions from an official company statement. For that, you can order credit bureau reports from 160 countries. The credit bureau contains the company’s credit score, information about the company’s ownership structure, and other required details. Since credit bureau returns data up to 3 months old, you can also order official government reports with information directly extracted from government sources.

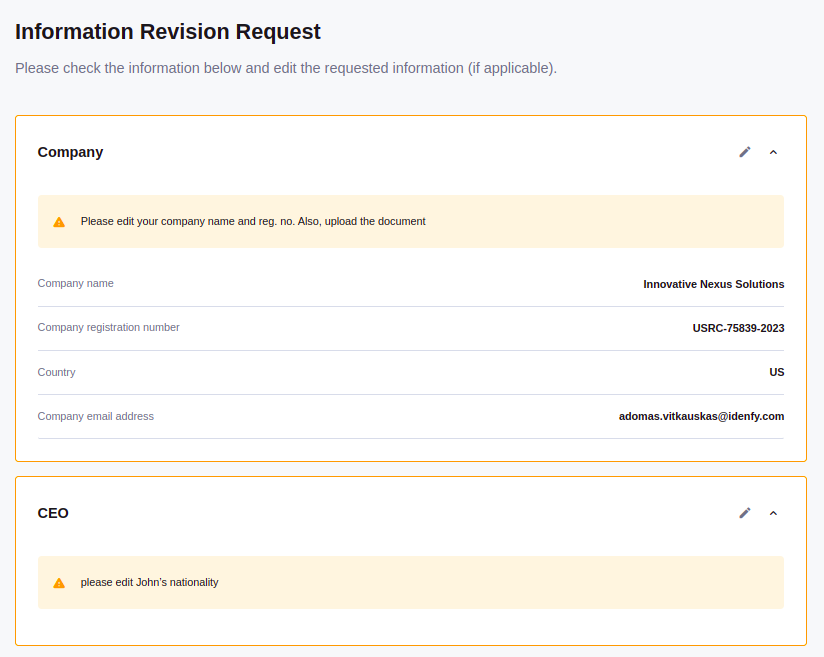

Incorporation documents upload and management software for ongoing due diligence. We’ve built custom forms where the compliance team can directly request additional documents or changes in the ownership structure.

AML screening. To have a correct compliance procedure, you need to perform sanctions checks for the company and UBOs or shareholders without significant control. More information about correct business verification practices can be found here.

KYC verification. Whenever needed, you need to have an option to initiate the KYC session for the company’s beneficiaries directly.

Address verification. To ensure that the company is legitimate, you can perform an address check, which will verify that the company’s address exists and matches the extracted data from the reports.

Getting started with custom rules for Business Verification

The custom rules are designed for you to specify the desired flow of the compliance process and receive the required information. Each custom rule performs a single action and is used together to archive the desired flow.

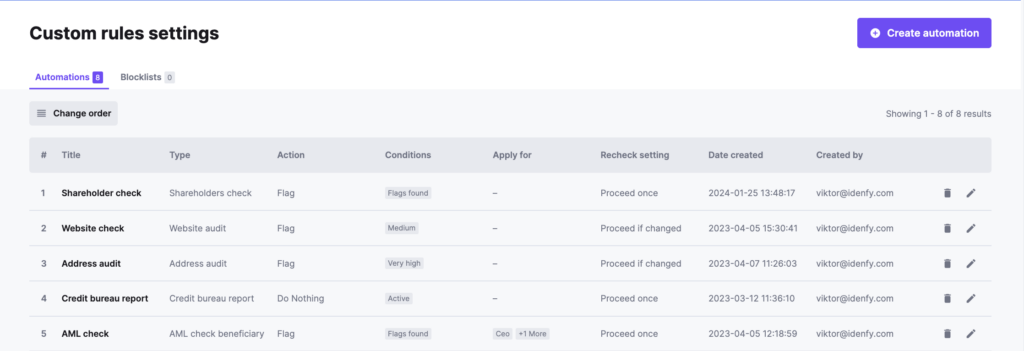

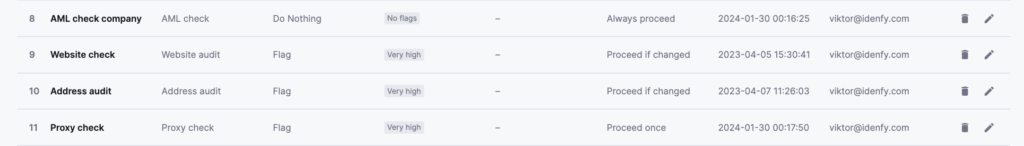

All your custom rules are available in the dashboard. Here is an example of multiple custom rules, which are then used for specific business verification flows.

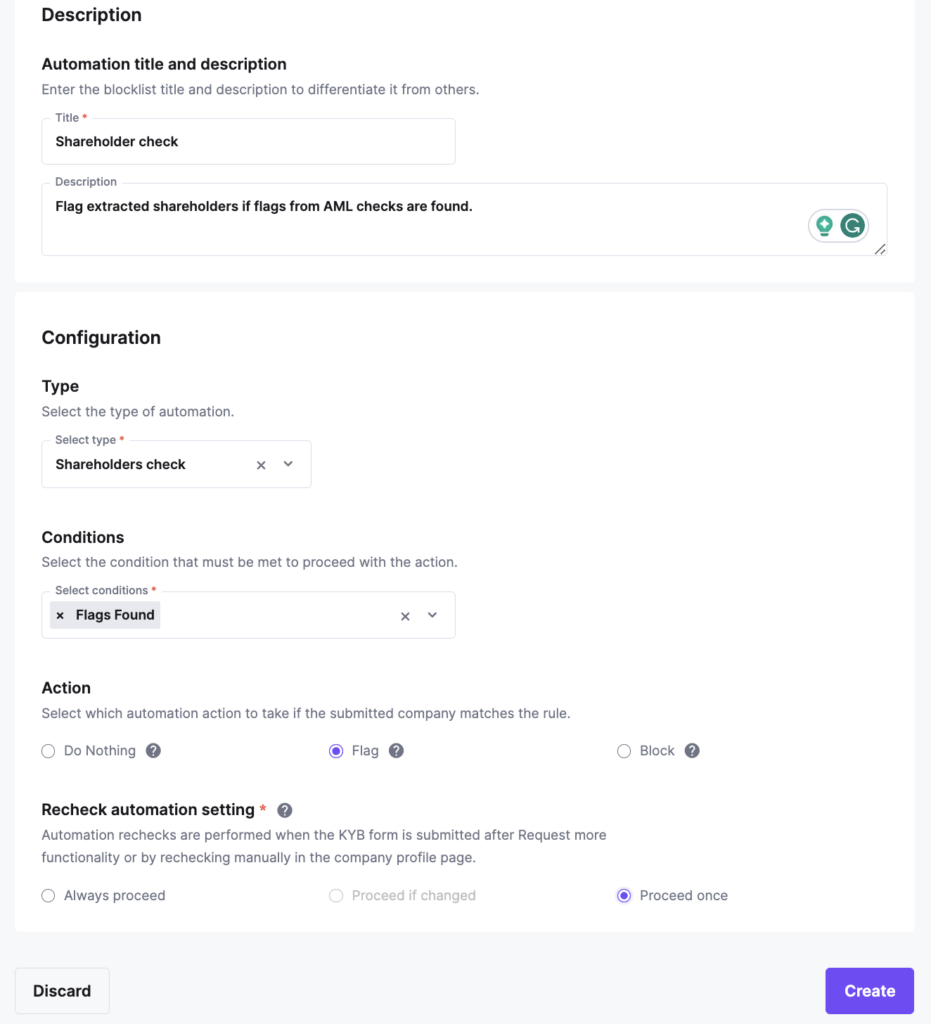

Example #1. Flag all shareholders if they are sanctioned

- First, you need to navigate to the custom rules section in the dashboard and create a new rule – Shareholders check.

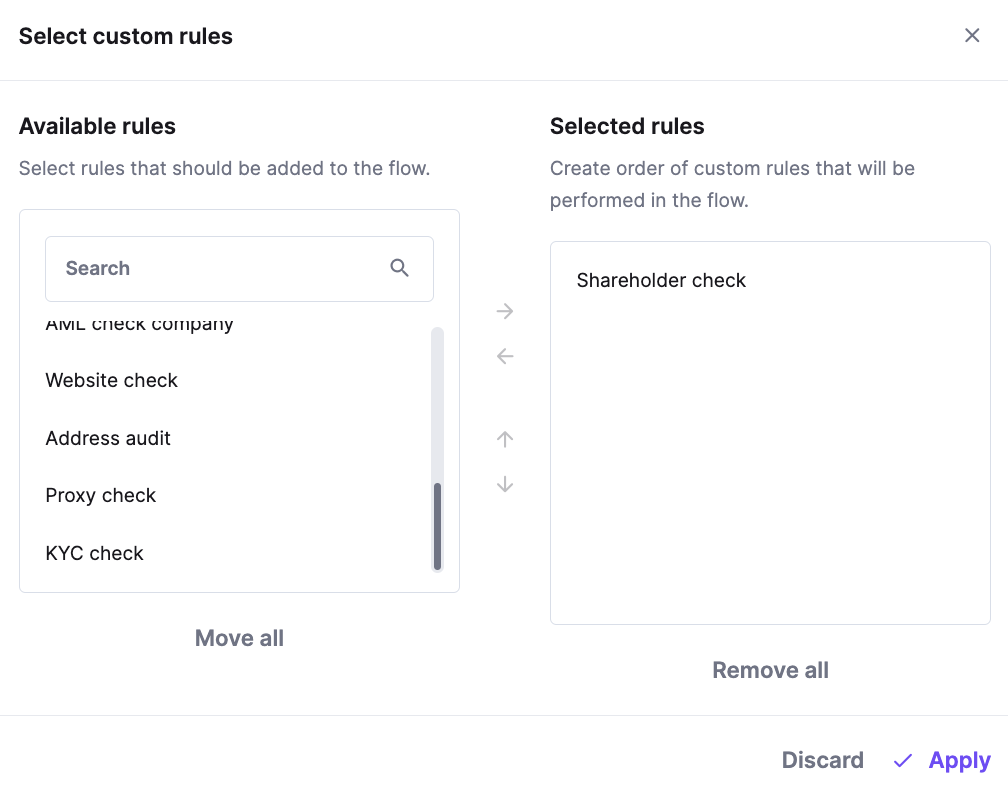

- Then, navigate to the custom flow creation and create a new flow with only this automation as the selected option.

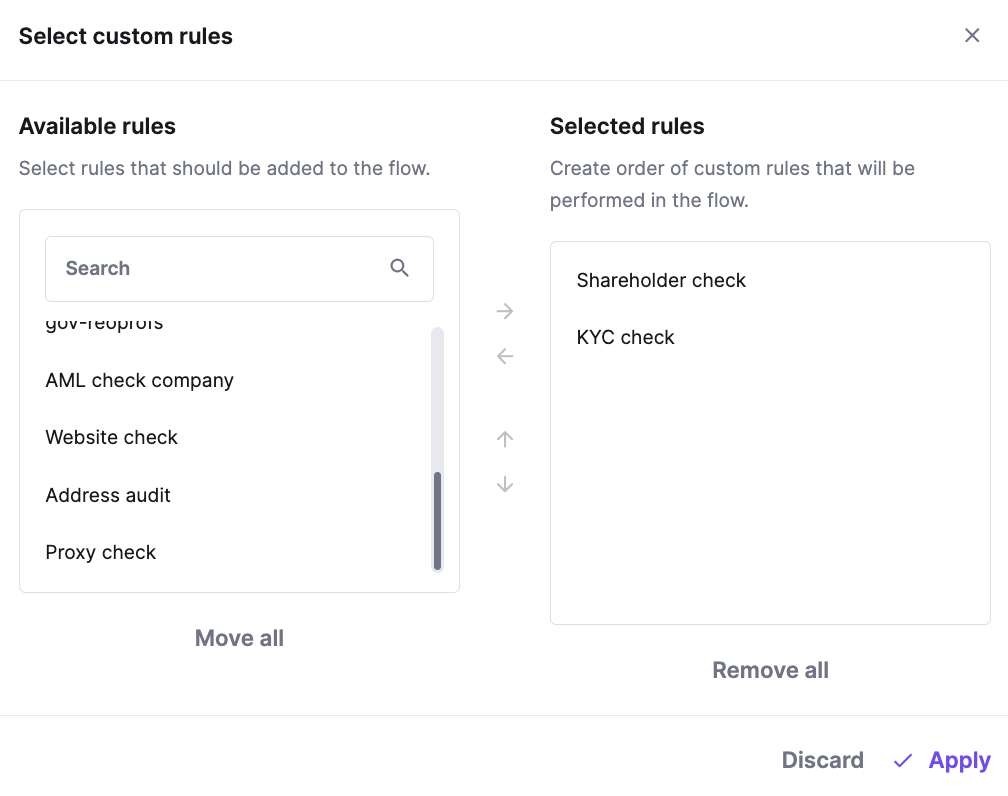

Example #2. Request KYC check per shareholders

For that, you can provide all shareholders during the form creation or configure automation rule to extract all shareholders from the credit bureau report. Our example uses the latter approach.

Example #3. Perform address audit, website audit, and Proxy check only if the company is not sanctioned

This example will have the most sophisticated case and focuses on fraud reduction. Working in compliance, we’re usually interested in high-risk cases. As a result, we configure the custom rules to react to high fraud probability and flag such companies. The example below shows that an address audit, website audit, and proxy check will add flags to the final company’s verification result only if the risk is very high.

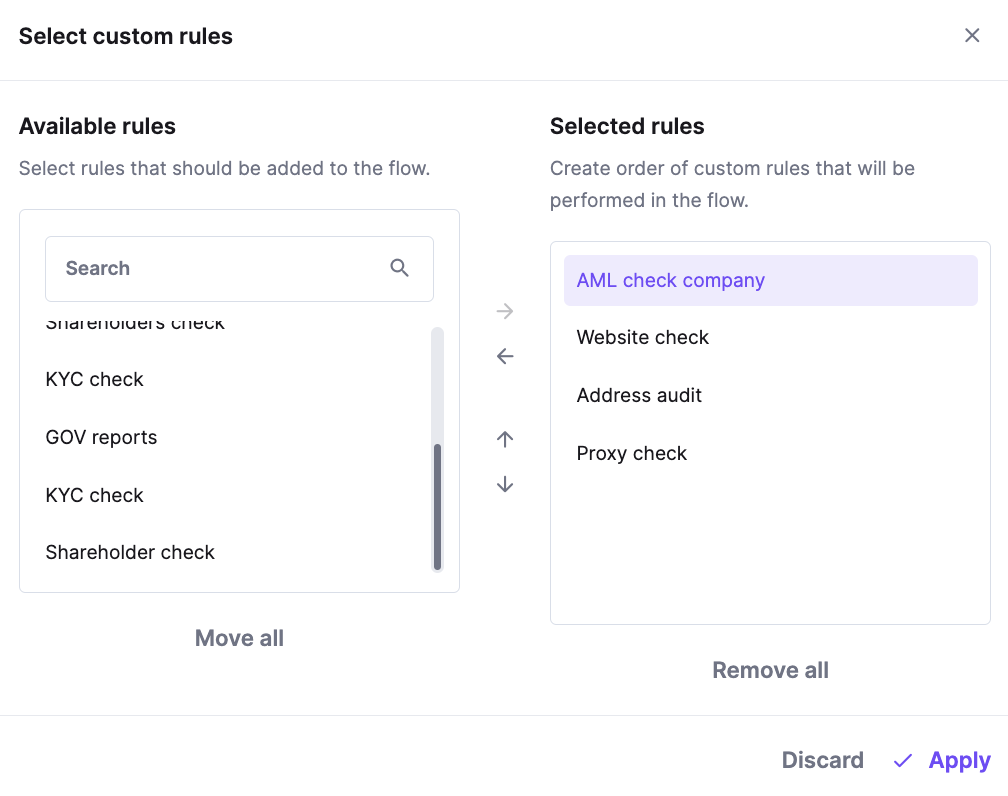

Then, in our custom flow creation, the automations will have the following order:

A complete Business Verification custom rules creation

Next steps for Business Verification solution

Custom rules are only one aspect of the automated business verification solution. They are used interchangeably with blocklist rules. Blocklist rules block companies based on specific criteria: country of origin, UBO’s nationality, activity code, registration number, etc.

As you might guess, blocklists are executed before automations to prevent the unnecessary need for compliance checks if the company is not eligible based on your internal risk assessment. Of course, after the company appears on the dashboard, you have full authority to perform further due diligence by performing AML screening or requesting additional documents from the company. Blocklists and custom rules act as a time and human error minimization mechanism, saving compliance teams up to 30% of usual activity. If configured correctly, the benefits are even higher.

To discuss further your compliance requirements, feel free to book a free demo and receive a testing environment with built in credits.