Businesses seek to reach their customers’ demands while regulators try to find new ways to ensure fair tax practices. Correspondingly, the European Commission presented a new tax directive – DAC7.

The directive came into effect on January 1st, 2023. Despite that, the newest EU tax directive brings new challenges to online marketplaces.

Continue reading the article to find out:

- What is DAC7?

- Who needs to comply with DAC7?

- What kind of data do you need to collect, verify and report?

- How to prepare for DAC7 changes?

- FAQs

What is DAC7?

Directive 2021/514, approved by the EU Council last year, better known as DAC7 regulation, is an EU tax directive that defines new obligations for digital marketplace operators. DAC7 requires digital platforms to report seller revenues along with business and personal information to tax authorities yearly.

DAC7 was created with the intention of promoting tax transparency and ensuring that no taxes are left unreported.

According to DAC7, digital platforms are defined as software that enables sellers to connect with buyers. This encompasses various activities, including digital platforms like food delivery apps or car rentals.

What are DAC7 Requirements?

Platform operators who are tax residents in an EU member state must submit their filings to the tax authority of that specific state. The new rules are set to impact both EU-resident digital platform operators and non-EU, foreign digital platform operators.

The data reporting obligations of the DAC7 regulation apply to:

- Digital platform operators that are tax-resident or established in the EU. They can be established either by incorporation or permanent establishment.

- Foreign platform operators that are involved in commercial activities in the EU but do not have any tax or legal presence in the EU.

In light of the implementation of DAC7, every marketplace founder must examine how it affects their reporting obligations. Neglecting to report can result in penalties for the marketplace.

Who is Affected by DAC7?

It’s important to note that even if a company is not based in the EU, they still have to comply with the reporting obligation if they operate in or have sellers in EU member states.

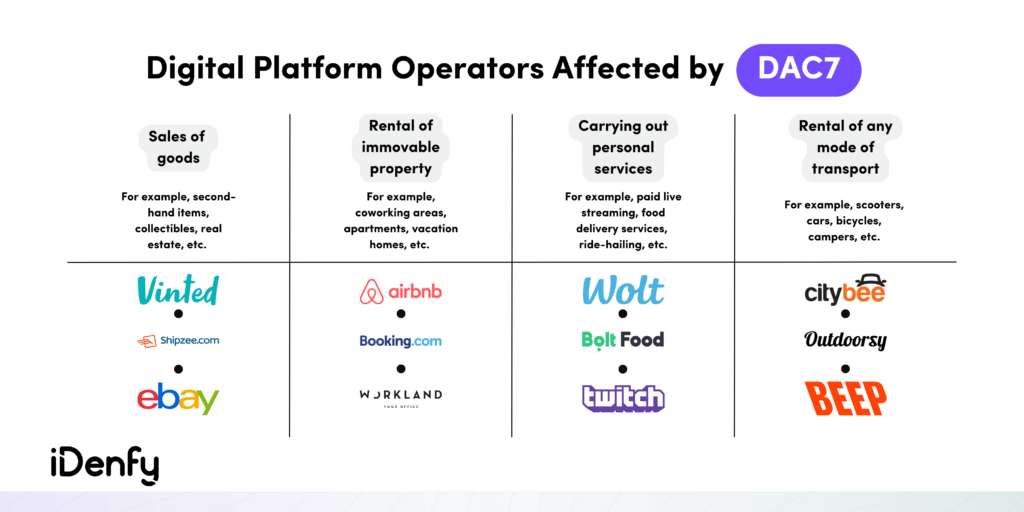

The obligation of DAC7 applies to various digital marketplaces:

- Sales of goods. For example, eBay or Amazon.

- Rental of immovable property. For example, Booking.com or Airbnb.

- Carrying out personal services. For example, TaskRabbit or Uber.

- Rental of any mode of transport. For example, Click & Boat or Turo.

According to DAC7 regulation, a digital platform is a website, mobile application, or software that has an online seller and user community. For instance, Vinted, an online second-hand item marketplace, also falls under this regulation. In other words, that means most digital platforms that allow commercial transactions are affected, including e-money and crypto platforms.

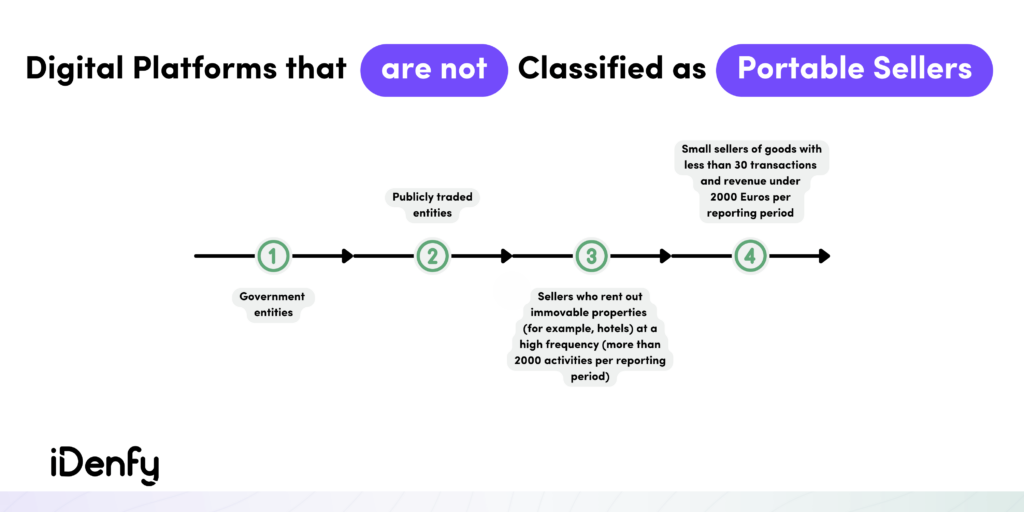

Who is Excluded From the DAC7 Obligation?

There are a few exceptions to the new DAC7 regulation. The Directive excludes some digital platforms from the obligation to report data. Such examples include:

- Platforms that solely allow the listing or advertising of goods or services, the processing of payments, and the redirection or transfer of users.

- Sellers that are listed on stock exchanges.

- Platforms where users can list items for sale, but the platform itself does not take part in facilitating the sale (for example, Facebook Marketplace).

- Payment processing platforms (for example, PayPal).

That means DAC7 does not classify payment processors like Stripe as digital platforms. Additionally, it does not apply to platforms where users advertise without payment, such as WhatsApp.

Despite being excluded from the DAC7 obligation, these sorts of digital platforms will also need to provide certain data to tax officials, which means they’ll need to file relevant documentation annually to demonstrate to tax authorities that they aren’t involved in activities that we’ve mentioned above.

What Information Has to be Collected to Comply With DAC7?

It’s essential to stress that the platform operators will be obliged not only to collect information about the seller (name, primary address, date of birth, etc.)but also to verify the data received from the seller (except for data on permanent establishments) and that the conditions for fulfilling the definition of an excluded seller are met.

In brief, marketplace operators have an obligation to collect the following data on their sellers for tax authorities:

- Identity information. Their full name, address, and date of birth.

- EU member state of residence.

- Address and land registration number of each property.

- Tax identification number (TIN).

- Financial account identifier. For example, account identifiers or bank account numbers.

- VAT identification or business registration number. Keep in mind that certain sellers who are private individuals won’t have a business registration number.

- Total consideration paid or credited per year.

- Any taxes, commissions, or fees. In case the marketplace has withheld any funds each year.

The marketplace operator of the platform will be held responsible for the accuracy and reliability of the collected data.

Note: iDenfy has teamed up with the State Tax Inspectorate (STI) of Lithuania to create a special FAQ section for companies that fall under the DAC7 Directive. The STI allows platform operators to use third-party service providers such as iDenfy to validate and prepare the collected information for reporting. For further information, please refer to the 19th question.

What Are the Consequences of Not Complying With DAC7?

According to the STI, managers of legal entities or other responsible persons who fail to comply with the DAC7 Directive requirements can be fined from 1,800 to 3,800 Euros. If the offense is committed repeatedly, the fine can increase up to 6,000 Euros.

To obtain additional answers to specific queries regarding the directive, you may contact your local tax representatives. They can provide you with expert guidance on both DAC7 and country-specific tax regulations.

How Long Should You Keep Records of Collected Data?

You must keep records of the mentioned data points collected during the identity verification procedure for at least 5 years (depending on your country).

As an example, iDenfy verifies and maintains records for at least five years in compliance with both GDPR and the new DAC7 regulations. Additionally, iDenfy holds an ISO certification to ensure complete transparency and adherence to data protection standards.

What Data Has to be Verified to Comply With DAC7?

The DAC7 Directive informs about additional data collection and verification obligations for digital platform operators from 2023 onwards. At the latest, the first time online marketplaces will need to report their sellers’ data and revenue information will be the 31st of January, 2024.

So, what information needs to be verified to comply with DAC7, and how can iDenfy help?

Here are the main points:

1. The seller’s name

- Solution: ID verification

- How does it work? Identity verification collects the needed data and authenticates the seller’s full name while helping you stay compliant with DAC7.

2. The seller’s date of birth

- Solution: ID verification

- How does it work? Identity verification solves this issue by verifying the seller’s identity information to comply with the DAC7 Directive.

3. The seller’s address

- Solution: Address Verification

- How does it work? Address Verification check reviews any proof of address documents, such as utility bills or bank statements, in accordance with DAC7.

- FAQ: How can you verify the address?

You can use a utility bill or a bank statement to complete the proof of address check. Ask the customer to provide any of the mentioned documents and match the address with the info on the utility bill or bank statement, along with the collected information from the seller.

You can use iDenfy’s Address Verification to automate the collection of utility bills and bank statements during the verification process.

4. The seller’s tax information number (TIN)

- Solution: ID verification

- How does it work? Identity verification automatically checks the TIN number when filing tax returns or collecting and verifying data to stay compliant with DAC7.

- FAQ: How can you verify the TIN number?

The TIN number can be verified manually using the European Commission’s online module check or automatically using iDenfy’s ID verification solution.

Keep in mind that fraudsters can generate a fake personal code. In this case, the system will show the fraudster’s number as valid. For this reason, manual checks aren’t safe and completely fraud-proof.

iDenfy can make sure that the personal code matches the name and surname of the person through AI-powered identity verification.

5. The seller’s VAT identification number

- Solution: Business Verification

- How does it work? The Business Verification platform is fully customizable, providing various tools in one API and helping you collect and verify company data automatically.

- FAQ: How can you verify the VAT identification number?

You can collect the seller’s VAT registration certificate or another official document that would determine the VAT’s validity. Once that’s done, you can authenticate the number using the official VAT validation portal.

If you want a quicker, hassle-free process, you can automate VAT identification number collection through iDenfy’s custom Business Verification platform.

6. The seller’s business registration number

- Solution: Business Verification

- How does it work? Know Your Business (KYB) verification services collect, scan and review business registration numbers automatically.

- FAQ: How can you verify the business registration number?

Company registration number information is mandatory in respect of any permanent establishments in the EU. That’s why you need to ask the seller to provide their business registration certificate from the business registry.

An alternative would be to use iDenfy’s Business Verification services to collect and review this information automatically.

7. The seller’s financial account identifier

- Solution: Address Verification

- How does it work? Address Verification can be used to collect and verify the seller’s bank statements. Together with the seller’s financial account identifiers, this data can be used to verify sellers’ bank accounts. Collecting bank statements for Address Verification is recommended, as you will need one document for address and financial account verification to comply with DAC7.

8. As well as the following information:

- The seller’s address and land registration number of each property listing.

- The number of days each property listing was rented.

- The seller’s total consideration paid during each quarter.

- Any fees, commissions, or taxes withheld or charged by the platform during each quarter.

Key DAC7 Data Reporting Reminders

There are several requirements to keep in mind:

- The reporting platform operator must determine the primary address of the seller.

- The reporting platform operator must provide all reportable data to the seller before submitting it.

- The reporting platform operator must retain reportable information for five years after the reportable period ends.

- The platform operator must check all reportable information before the deadline of January 31st for data submission.

- Reporting platform operators must still adhere to GDPR regulations.

- Keep in mind that DAC7 obliges to collect and verify not only new data but also pre-existing sellers’ information.

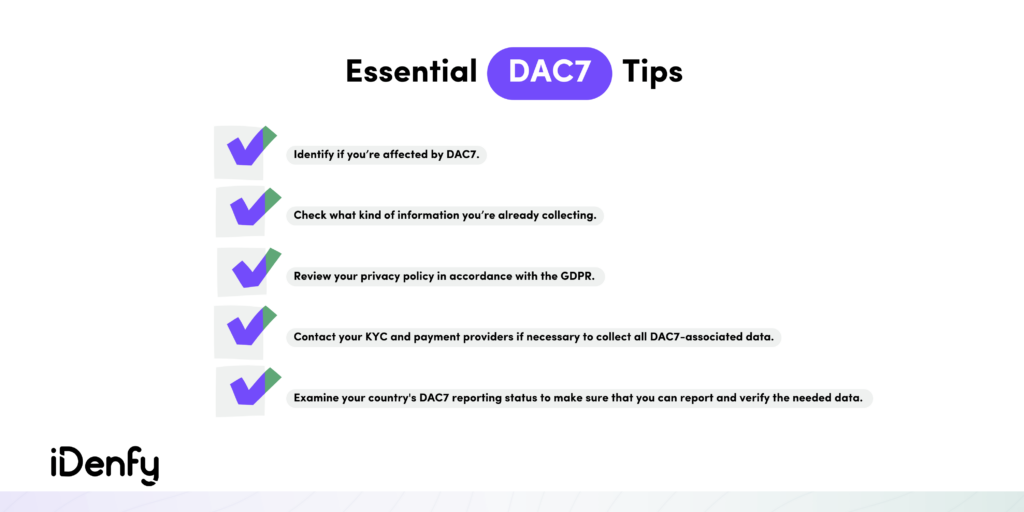

What’s Next For Your Marketplace Regarding the DAC7 Directive?

If your marketplace is impacted, make sure to review the data you are currently collecting from your sellers. It’s possible that you or your marketplace’s payment service provider may already be collecting some or all of the necessary information.

If not, adjust your data collection processes accordingly and request any missing data from previous providers. Start by confirming the deadline for data submission. Next, determine how to collect and report the required data.

If that sounds like too much of a hassle, iDenfy can take care of this whole process for you. Our automated system can collect and verify your reporting data, making it simple for your marketplace to comply with DAC7.

We can ensure that you overcome all challenges by helping you:

- Collect necessary seller information using custom forms and identity verification.

- Verify the collected information and keep it secured.

- Report the collected and verified data to local tax authorities.

Don’t hesitate to drop us a message. We can consult you during all stages of your DAC7 journey – free of charge.

Frequently Asked Questions (FAQ)

When Does the DAC7 Directive Come into Effect?

The DAC7 directive came into effect on January 1st, 2023, with the initial reporting period ending on December 31st of the same year.

Which Countries are Subject to the DAC7 Directive?

All EU member states are required to comply with the DAC7 directive and incorporate it into their legislation.

Where Can I Find Relevant Forms for Data Reporting Under DAC7?

The tax authorities of each EU member state will publish the relevant reporting forms for DAC7. More information regarding DAC7 is available on the official EUR-Lex website.

What is the Impact of the DAC7 Directive On Cross-Border Digital Services?

DAC7 will apply to digital platforms and their sellers who are either tax residents in the EU or have permanent business establishments within the EU. Additionally, digital platforms that are incorporated or managed within the EU are also required to comply with DAC7.

What are the Possible Penalties for Non-Compliance with DAC7 Directive?

Penalties for non-compliance with DAC7 include fines if all reportable data is not provided by the deadline of January 31st. If the data is still not provided 60 days after the deadline, operators must terminate their relationship with the non-compliant seller and close their account.