Many businesses overlook it, but data security is directly associated with user experience. Good user experience is an essential aspect of a business’s success. No matter what online business you’re into, until your customers feel confident that you can handle their digital identity or data, they won’t buy your services or products.

Know Your Customer (KYC), now digitized as eKYC, is a security practice found across all industries and sectors. Its digitization has opened up opportunities for new business models and paved the way for creating novel use cases that were previously impossible.

This post will discuss the role of user experience in a business’s success and how identity verification plays a vital role in improving user experience.

So, without further ado, let’s get started.

Why is User Experience Important for Building a Good Customer Relationship?

In today’s competitive era, customers have countless options to choose from. If your service is not up to the mark, they can jump immediately to your competitor to get a better user experience. So, if you want to retain your customers, you must pay attention to your customers’ data security.

User experience is crucial for business success and customer retention. In this fast-paced digital age, manual KYC process isn’t the first best option for users looking for a smooth onboarding experience. When it comes to making a purchase, 64% of people find customer experience more important than price. Another report reveals that companies lose $62 billion every year due to poor customer service.

It simply explains that providing a good user experience is no longer an added service but a necessity.

Related: What are the 3 Steps to KYC?

What is Customer and Identity Access Management?

Customer and Identity Access Management (CIAM) is the process of managing and monitoring customer data, typically using some sort of technology by the business that allows it to communicate with customers. This involves features to access digital services, products and apps, including ways to sign up and get verified during the account creation process.

Regulated industries like fintech, crypto or iGaming, need to build fast yet secure and compliant verification workflows. Typically, high-risk industries like this employ third-party KYC software providers that help them both collect and manage KYC data, as well as customize the ID verification process based on their risk appetite and different customer risk profiles. Companies don’t want to overcomplicate the verification process for low-risk users. At the same time, they should use additional checks for higher-risk scenarios and flag such users for further KYC verification before granting full access.

Related: AML Red Flags — Complete Breakdown

What is the Role of Digital Identity in Improving Security?

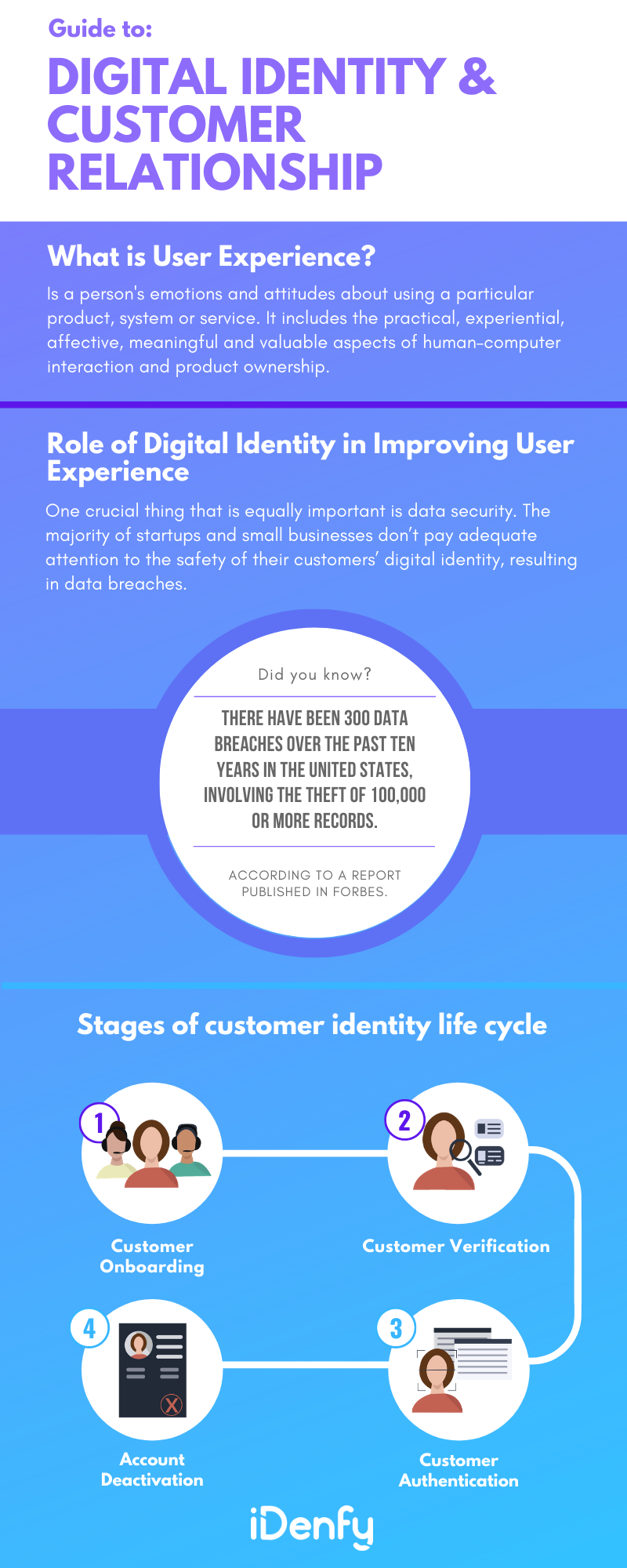

There are plenty of things that contribute to a good user experience. Everything plays a vital role in improving the overall user experience, from optimizing a website to improving customer service to improving the user experience, including the final stage, for example, the checkout process for e-commerce apps. However, one crucial thing that is equally important is data security. The majority of startups and small businesses don’t pay enough attention to the safety of their customers’ digital identities, resulting in data breaches.

By implementing digital identity processes and smooth verification practices, companies can improve security, including ensuring factors like:

- Regulatory compliance. Financial institutions must comply with KYC/AML rules and identity verification checks help ensure that only legitimate digital identities are accessing the institution’s financials, preventing the company from getting involved in legal trouble or reputational damage due to data breaches.

- Fraud prevention. Identity verification practices that are built based on the risk-based approach help detect fraud in real-time and ensure that the customer’s digital identity is protected throughout the whole customer relationship and not just the initial onboarding stage. Verification measures also serve as a good method to prevent account takeovers and other fraudulent activities.

- Minimized insider threats. Companies can use identity verification technologies such as biometric verification controls to ensure that only authorized personnel can access sensitive data. Digital identities can be used as a concept inside the company and not just for verifying external parties and customers. That’s why banks use fingerprint scans to control access to secure areas.

According to a report published in Forbes, there have been 300 data breaches over the past ten years in the United States involving the theft of 100,000 or more records. Additionally, in an article, Security Magazine reported that consumers are abandoning brands after data breaches. The article further mentions that around 78% of customers stop engaging with brands that experience data breaches.

How Can Automated KYC Solutions Enhance Customer Experience?

The latest KYC tools have significantly boosted conversion rates, leveraging best practices in user experience and modern interface design tailored to digital identities.

That’s why several factors influence the onboarding user experience:

- Minimal information requirements. You can combine document verification and data extraction to reduce user input, requiring confirmation rather than manual entry.

- Intelligent recognition algorithm. Users no longer need to select a specific document; advanced systems can recognize any document type without prior user input.

- Guidance through the whole verification process. Providing user-friendly guidance with clear explanations ensures a smooth conversion process for individuals of varying characteristics.

- Easy accessibility. Enabling users to complete the process from any device, location, or time and allowing seamless transitions between devices through a simple link is essential.

Digital identity is essential to make your customers realize that you’re committed to their data security. When you invest in a robust identity verification solution, you minimize the risk of money laundering, financial scams, and identity theft and make the onboarding journey smooth.

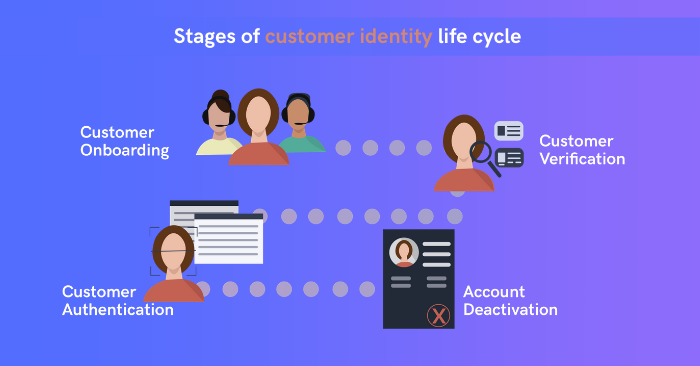

Different Stages of Customer Identity Verification

Since almost every business operation is performed digitally nowadays, the risks of identity fraud have increased at every step of a customer’s journey. Today, we can’t limit identity verification to the time of onboarding only.

KYC processes are executed almost instantly, facilitated by their cloud-based operation and real-time implementation. Specialized companies focus on streaming video identification, incorporating active and passive controls, and utilizing various biometrics such as face and voice recognition. These companies now play a pivotal role as technology providers for major consulting firms involved in designing digitization processes for high-volume multinational corporations.

Additionally, they function as direct sellers of onboarding systems and comprehensive platforms, distributing them in Software as a Service (SaaS) or Platform as a Service (PaaS) formats. As a result, we at iDenfy provide real-time identity verification solutions that help businesses cover all the customer identity stages and improve user experience.

Let’s get to know these stages in detail.

1. Customer Onboarding

Customer onboarding describes the process of how a customer goes through when they begin their journey as a customer of a product or service.

In 2018, over $24.2 billion was lost worldwide due to payment card fraud. The number is frightening, and the worst is yet to come. According to forecasts, card fraud will accumulate another $10 billion in losses in just three years.

So you can realize how important smooth onboarding is in today’s scenario. As iDenfy, we combine face recognition, liveness detection, and ID verification, and we can run various checks to identify whether the user is legitimate or not. We employ AI-enabled OCR technology that makes the verification process quick and frictionless. It reduces the requirement of human interaction to a great extent and ensures seamless onboarding for customers.

2. Customer Verification

As per the law, online businesses need to employ KYC measures to understand their customers better. Generally, the KYC process involves verifying government-issued ID cards, face verification, and other relevant verification of a customer’s identity.

We help you meet KYC and Anti-Money Laundering (AML) compliance regulations. AI-enabled ID verification solution that includes a face recognition feature can recognize facial biometrics over 160 different points.

We go one step further to help businesses comply with KYC and AML directives. We can check government and Interpol data to ensure the legitimacy of a person.

During the AML screening process, we check for the following databases:

- Sanctions EU, UN, HM Treasury and other sanctions databases,

- Politically exposed person list,

- Financial crime,

- Lost and stolen documents.

3. Customer Authentication

Even if you have onboarded a customer, you must make sure that only an authorized person is accessing your service. In modern times, when cybercriminals are becoming technologically advanced, you can’t rely on login and password security alone.

To ensure your customers’ authenticity, you must have a reliable face verification system that can quickly authenticate customers before letting them access your services.

Final Thoughts

Regardless of what business you’re into, customers are the backbone of your business. No matter how good your product or service is, if you cannot provide your customers with a good experience, you can’t expect them to visit your online store.

As a result, you must provide them with the best user experience throughout their onboarding journey and afterward. Implementing identity verification can be one good step to improve the overall user experience.

If you need help improving the user experience through automated compliance tools, feel free to book a free demo and see our RegTech solutions in action.

This blog post was updated on the 24th of July, 2024, to reflect the latest insights.