Today, identity proofing is essential to access an online service or product. Whether you’re receiving an online payment or buying a subscription to an entertainment portal, probably, you will be asked to submit a legit identity document, which can be an ID card, passport or driver’s licence. So, essentially, if the platform is secure, people will feel confident about using its services. However not every industry has the same requirements for identity verification. For example, banks and crypto service providers have stricter security processes because they are high-risk businesses that handle sensitive data and are more likely to be used for criminal activity, such as money laundering, identity theft, etc.

If you’re a business owner or a compliance officer looking for a new ID verification software and aren’t sure about your needs, you can go for a flexible identity verification solution. It gives you the liberty to choose the verification method as per your requirement and reduces your overall identity verification costs. Using automation and customization, such Know Your Customer (KYC) software typically allows you to tailor the KYC flow and add or remove certain checks, depending on the user’s profile and your company’s risk appetite.

In general, no matter if you work in a regulated industry or not, all businesses must invest in a powerful identity verification solution that helps them learn the difference between legit and counterfeit customers and prevents different types of fraud. Implementing flexible identity verification is one great solution to prevent identity frauds.

We’ll outline the benefits of flexible identity verification, explain what it really means, and highlight key factors to consider when choosing a KYC provider.

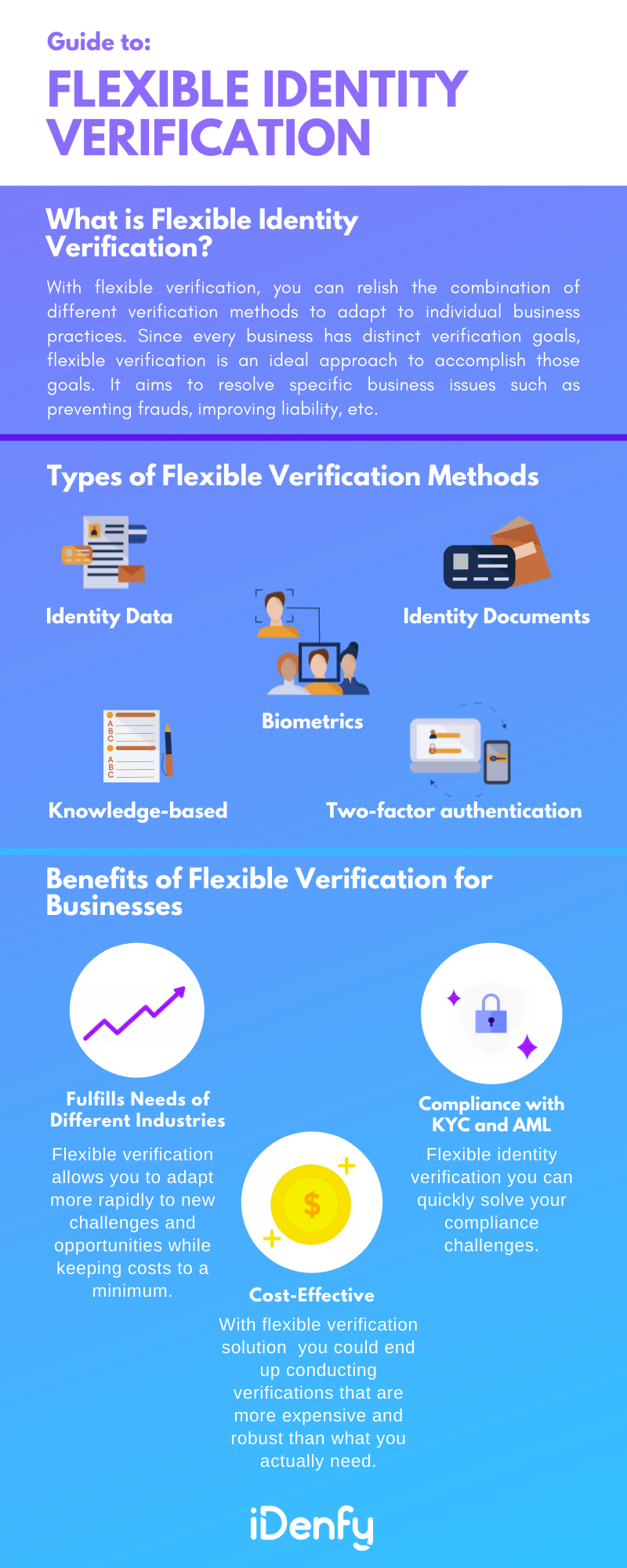

What is Flexible Identity Verification?

Fraudsters are also getting advanced with technological advancements. That’s why you can’t rely on conventional identity verification solutions only to combat frauds. Today, you can’t rely on a single verification solution.

To ensure your services are being used by genuine users only, you should look for a flexible identity verification solution that lets you choose the appropriate verification method as per the issue.

With flexible verification, you can relish the combination of different verification methods to adapt to individual business practices. Since every business has distinct verification goals, flexible verification is an ideal approach to accomplish those goals.

It aims to resolve specific business issues such as preventing fraud, improving liability, etc.

A flexible identity verification process involves using multiple verification methods to protect a business from different identity threats. This type of verification protects your digital resources with various authentication methods. In the most straightforward words, flexible identity verification employs versatile technology to provide the exact verification method you require.

Now let’s get to know about different types of identity verification methods used in flexible verification.

Types of Flexible Verification Methods

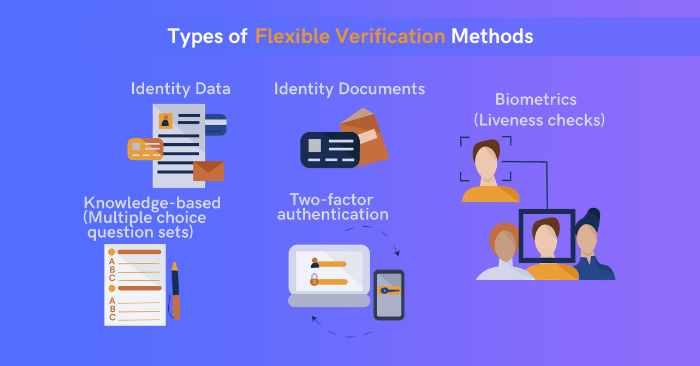

Flexible identity verification enables businesses to use various types of verification methods, but a few common ones include:

- Identity data.

- Biometrics.

- Document verification.

- Two-factor authentication.

- Knowledge-based authentication.

Benefits of Flexible Verification for Businesses

Implementing a custom and flexible ID verification solution means that it:

1. Is a Cost-Effective Option

Observing the risks, nowadays, companies are spending a massive amount on identity verification solutions. However, you can limit your identity verification expense by choosing flexible identity verification.

Every identity verification method costs a certain amount. For example, identity data verification might cost less than a dollar, but document verification might cause a few dollars. The difference might seem small at first.

However, if you’re into a business where you need to conduct thousands of confirmations in a day, you will notice that you’re spending a lot of budget than your expectation.

For example, if you want to verify a customer’s identity on simple transactions, using document capture and verification on every purchase might unnecessarily drive up costs. One right way to keep the verification cost minimum is to use the suitable identity verification method for each transaction.

A more cost-effective way is to use the method for each transaction. For a standard transaction, you can conduct verifying with identity data that is inexpensive. However, sometimes, identity data alone is not adequate to verify a customer. You can then switch to a method that provides a higher level of verification solutions, such as biometric verification.

That’s why you should optimize the verification process’s cost and choose the right identification solution for different issues.

2. Helps Stay Compliant with KYC and AML

Criminals use online financial platforms to conceal their crimes and money derived from them. As a result, legal authorities have made it necessary for banks, corporations, fintech, and other financial institutions to comply with KYC and AML (Anti Money Laundering) directives.

Unfortunately, it’s challenging for many businesses to comply with multifaceted legislation and regulatory requirements. Not only do they have to manage their liability, but they also stay compliant at the same time.

Luckily, with the perfect and smooth verification solutions, you can comply with these directives in no time. A flexible verification solution lets you do so relatively quickly.

Imagine a new regulation requires you to enhance your verification process quickly. With flexible identity verification, you can deploy a robust identity verification method such as biometrics in a day or two. Thus you can quickly solve your compliance challenges.

3. Meets the Requirements of Different Industries

Today, every industry requires a robust identity verification solution to prevent frauds and provide their customers with a secure user experience. However, it’s crucial to learn that every sector has different requirements for identity verification.

Depending on your business practices, industry standards, and regulation, your customer onboarding process might be different. For example, financial firms and healthcare companies are other, so are their verification processes.

Moreover, industries also change with time. Consequently, it would help implement an identity verification solution that lets you choose an identity verification method as per your needs and without breaking your bank.

A flexible identity verification solution uses various technologies to provide the exact verification method you require.

Since you get a customized verification solution, you can reduce verification expenses to a great extent. If you want to implement a flexible identity verification solution, you can get in touch with us for the consultation.