The modern, technologically advanced world demands its’ inhabitants to follow an ever-increasing number of guidelines to prevent financial, governmental, and other institutions from disaster. The increasing number of fraudulent activities has an immense impact on governments, organizations, and various institutions. Identity and business verification rules and regulations are set up to fight these issues. Still, at the end of the day, organizations are responsible for complying with and implementing them efficiently.

Running an organization involves continuous risk analysis to maintain compliance and adhere to best practices. It’s essential to avoid violations of anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. These checks on corporate customers are a critical part of a compliance procedure known as Know Your Business (KYB).

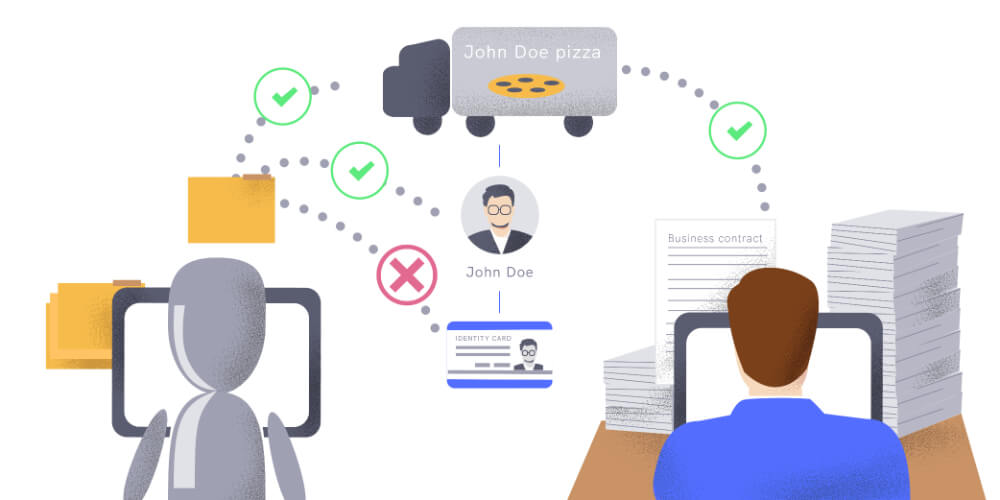

Regulated organizations must conduct thorough due diligence on corporate customers, which means they must implement a proper KYB process. This approach of verifying your business partners helps identify who actually controls the business and who benefits financially from its operations.

For example, in the United States, KYB regulations are primarily dictated by the 1970 Bank Secrecy Act (BSA) and the USA PATRIOT Act. The BSA mandates that financial institutions help government agencies detect and prevent money laundering. As part of such rules, companies are obliged to screen other entities, identify the real ownership structure, screen related persons against global watchlists and sanctions lists, and much more.

Find out what KYB actually is and learn the key factors that make this process so important beyond regulatory compliance.

What is the Real Cost of Money Laundering?

Individual fraud cases are enough to mount up to a large sum over the year. For example, synthetic identity theft cost United States lenders up to $6 billion in 2016 alone. Large sum as it may be, it’s but a fraction of what various money laundering schemes add up to. Financial Crimes Enforcement Network (FinCEN) Files revealed that banks worldwide have contributed to moving more than $2 trillion in suspicious payments.

The United Nations Office on Drugs and Crime estimates a similar amount—according to them, 3 to 5 percent of global GDP is lost to money laundering annually, which adds up to $800 billion—$2 trillion. In the context of the ever-widening gap between the rich and the poor, this reflects poorly on our institutions and further burdens citizens with taxes. At the same time, corporations exploit the gaps in security measures aiming to prevent money laundering schemes.

Verify customers identity within 15 seconds. Schedule a free identity verification demo here.

The Burden of Responsibility

Financial institutions are always at the front lines in the war against fraud. Not only does money laundering affect the parties involved financially, but it is also a matter of national security throughout the world, as terrorist organizations are also relying on financial transactions. Therefore, the banking industry has a massive responsibility to implement rules, and financial institutions are always at the front lines in the war against fraud.

Not only does money laundering affect the parties involved financially, but it is also a matter of national security throughout the world, as terrorist organizations are also relying on financial transactions. Therefore, banking industries have a massive responsibility to implement rules and restrictions and reliably execute said policies, especially in business verification.

Knowing who your customers are and ensuring they are trustworthy is now becoming key to preventing fraudulent activities and strengthening security. That is why Know Your Business (KYB) guidelines are implemented worldwide at an increasing rate each year. These guidelines require the professionals to make an effort to verify the identity and suitability of their clients and critically assess the risks involved with establishing a business relationship with them. However, knowing who your partners and business are is arguably an even more significant issue.

What is Know Your Business (KYB)?

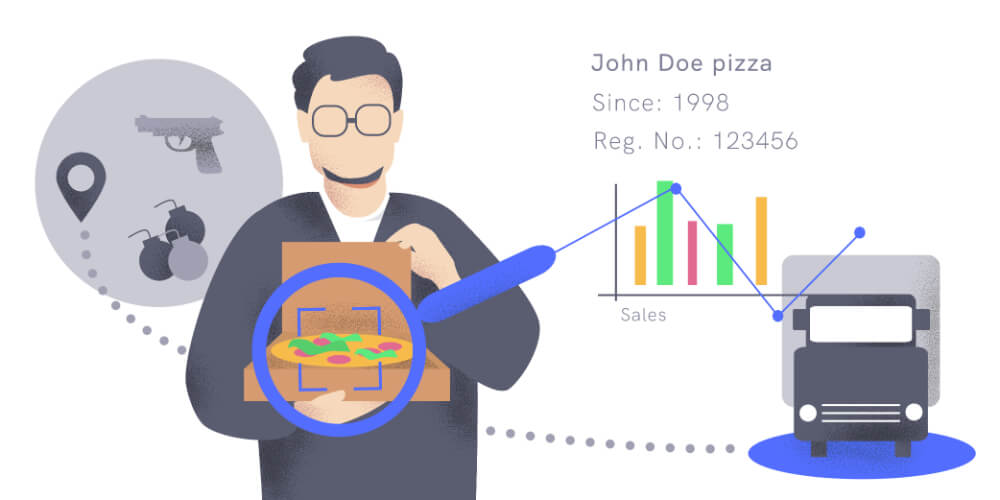

Know Your Business (KYB) is a set of practices in business verification aimed at minimizing the risk of money laundering and other fraudulent activities. It’s an extension of Know Your Customer (KYC) guidelines and includes verification of the company’s data as well as its Ultimate Beneficial Owners (UBOs). Screening businesses against blacklists and grey lists is also part of the process to check if they were involved with any criminal activities.

Know Your Business (KYB) Regulations

KYB is similar to KYC. Based on the latter, institutions ask the customers to provide their:

- Name

- Date of birth

- Address

- Telephone number

- Identity documents

- National ID number

The KYB Guidelines Require Businesses to Provide their:

- Company name

- Company address

- Business registration number

- Operational status

- Incorporation date

- Key management personnel

Regulations and policies adopted by various institutions may differ from one another and ask for additional information in both the KYC and the KYB processes.

KYB requirements differ across regions, with distinct regulations in the United States, the European Union, and the United Kingdom. Despite these differences, all these regulations align with the 40 recommendations set by the Financial Action Task Force (FATF). These recommendations are mandatory for member states and provide a unified standard that helps FATF countries work together to prevent and fight financial crime globally.

KYB Rules and Customer Due Diligence in Europe

In the EU, The European Parliament and The Council of The European Union set the KYB requirements in a Directive aiming to prevent using the Union’s financial system for money laundering and terrorist financing.

It is directed to credit and financial institutions as well as other legal persons, exercising their professional activities. While it’s an extensive document, it can be summarized by the customer due diligence (CDD) measures:

- Identifying the customer and verifying the customer’s identity on the basis of documents, data or information obtained from a reliable and independent source;

- Identifying the beneficial owner and taking reasonable measures to verify that person’s identity so that the obliged entity is satisfied that it knows who the beneficial owner is, including, as regards legal persons, trusts, companies, foundations and similar legal arrangements, taking reasonable measures to understand the ownership and control structure of the customer;

- Assessing and, as appropriate, obtaining information on the purpose and intended nature of the business relationship;

- Conducting ongoing monitoring of the business relationship, including scrutiny of transactions undertaken throughout the course of that relationship to ensure that the transactions being conducted are consistent with the obliged entity’s knowledge of the customer, the business and risk profile, including where necessary the source of funds and ensuring that the documents, data or information held are kept up-to-date.

Under these rules, organizations and their employees can be held criminally liable due to negligence and irresponsibility in enabling the flow of illicit funds.

Ensure your customers are real. Schedule a free demo here.

Customer Due Diligence Requirements in the US

In the US, the Department of The Treasury issued their own CDD requirements for financial institutions back in 2016. They believe that four critical elements of CDD should be adopted as explicit requirements in the AML program:

- Customer identification and verification.

- Beneficial ownership identification and verification.

- Understanding the nature and purpose of customer relationships to develop a customer risk profile.

- Ongoing monitoring for reporting suspicious transactions and, on a risk basis, maintaining and updating customer information.

“This division requires certain new and existing small corporations and limited liability companies to disclose information about their beneficial owners. A beneficial owner is an individual who (1) exercises substantial control over a corporation or limited liability company, (2) owns 25% or more of the interest in a corporation or limited liability company, or (3) receives substantial economic benefits from the assets of a corporation or limited liability company.”

Official document by the U.S. government issued a Corporate Transparency Act, 2019

The division also authorizes criminal penalties for either failing to provide said information or providing false/fraudulent information. It can result in a fine or prison term for up to three years.

Other Key Regulations Around the World

We have only reviewed the EU and U.S. regulations, but most responsible countries worldwide are issuing similar laws and regulations in the fight against fraud and money laundering. These and other upcoming measures are there for a reason and will help to ensure transparency in financial operations.

Why KYB Compliance is Essential for Many Industries

It is crucial for all institutions to follow the guidelines and take measures to prevent fraudulent activity – and not for legal reasons alone. To maintain the reputation and trust of their clients, companies should strive to establish partnerships only with trustworthy individuals and businesses.

While checking the validity and background of different businesses to assess the risks they bring with them and ascertain that they’re trustworthy may be a time-consuming and challenging task for individuals, automated systems can do this job just as, if not better. Powered by artificial intelligence, such systems can detect fraudulent information more quickly and more reliably than any human ever could.

iDenfy’s Approach to KYB Verification

Here at iDenfy, we pride ourselves on our capabilities to handle identity verification to the highest standard. Using our KYB software, organizations can quickly and efficiently identify various business institutions and beneficial owners.

Complying with KYB guidelines will prove to maintain a reputation of a responsible organization and minimize the risks of being involved with untrustworthy institutions. We provide and verify data intelligence for 250 million business entities in over 80 countries and offer an on-demand business verification service analyzes.

We believe that taking an extra step in the process of identity and business verification is critical for the betterment and security of our digital environment.

Let’s chat for more info and custom-tailored RegTech solutions based on your use case.

This blog post was updated on the 2nd of May, 2024, to reflect the latest insights.

Fraud detection and prevention service from market leaders. Schedule a free demo here.