You can say that Know Your Business is a simple picture of your clients with all data that is required to prevent any potential fraud that might be in your environment. That includes a clear view of who your customers are, where they came from, and what type of products or services they are using.

KYB allows you to be aware of any red flags or suspicious activity that may indicate potential money laundering or terrorist financing. So it’s clear that by having all the up-to-date information in one place, you can better identify and mitigate AML risks and ensure compliance with relevant regulations.

But what does it actually take to create a robust compliance program, and how does KYB help? Let’s get into it.

The Difference Between Know Your Business and Know Your Customer

Believe it or not, it’s not uncommon for business owners to be unaware that Know Your Customer (KYC) and Know Your Business (KYB) are two distinct processes.

KYC is a set of procedures that financial institutions and other regulated businesses use to verify the identity of their clients and assess the potential risks they may pose for money laundering or financing terrorism.

The goal of KYC is to gather relevant information about a business’s customers, including their identity, background, and financial activities, to understand their needs better and determine whether they pose any compliance risks.

While both involve verifying clients or partners, KYC specifically focuses on identifying individuals, and KYB specializes in identifying businesses.

In general, KYC is a critical component of Know Your Business (KYB) because:

- It enables companies to identify the beneficiaries of the businesses with which they are establishing relationships.

- It’s essential in cases where businesses have complex ownership structures, as it can be more challenging to accurately assess the risks they pose without a thorough understanding of the individuals behind the business.

That’s why proper implementation of KYC procedures is essential for businesses to manage their compliance with anti-money laundering and other regulations effectively.

We cover this topic in more detail in our other article about KYC and KYB.

Why Know Your Business Is Very Complex, and Vice-Versa

Companies need to assess and understand their money laundering and terrorism financing risks through multiple activities, including verifying reports, issuing by government officials, checking credit scores, conducting AML research, retrieving ownership structure documents, etc.

That’s why the Know Your Business process can be complex and resource-intensive, as it involves collecting and analyzing a wide range of data and information on businesses.

Compliance with KYB regulations often requires dedicated compliance teams and a significant investment of time and resources. However, using a comprehensive and user-friendly solution with additional features minimizes the need for manual intervention while streamlining the KYB process more efficiently.

Use Case: The Importance of Anonymity for Non-Regulated Companies

The Business Verification procedure is mandatory for obliged/regulated companies. You can find the information that regulated companies must follow here.

Many companies, even those that are not regulated, are investing in Know Your Business processes to establish and verify the identities of their partners and clients. That’s why AI-powered KYB solutions are often used by non-regulated businesses worldwide.

A common challenge companies face is the reluctance to request information from their partners due to concerns about appearing mistrustful or implying that the partner is suspected of fraudulent activity.

As a result, these businesses may struggle to manage their KYB compliance and identify potential risks effectively. This is where iDenfy’s Business Verification platform comes in handy.

How iDenfy Ensures Automated KYB Checks

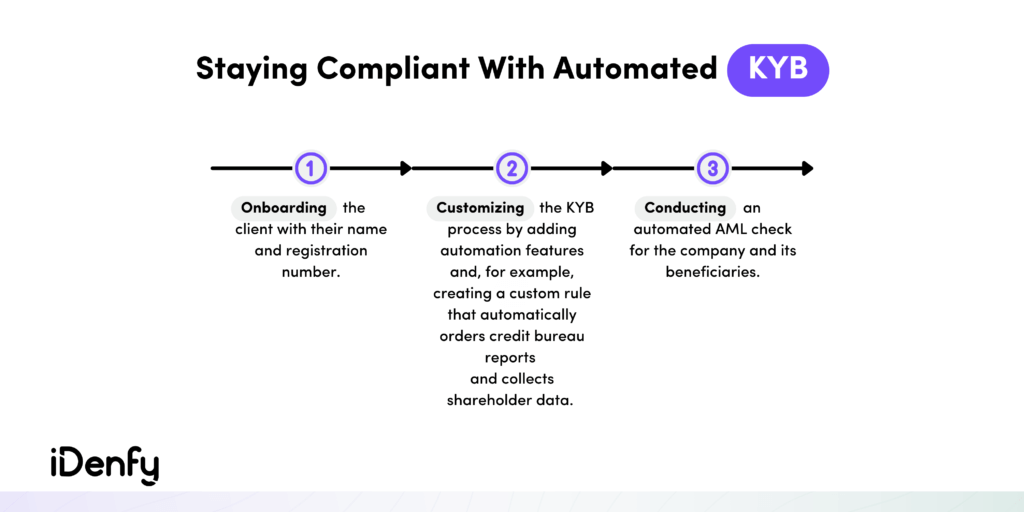

To address these concerns, we offer a solution that allows companies to obtain all necessary data simply by providing the company name and registration number. That means businesses can check other companies without the hassle and, more importantly, anonymously. The process involves three steps.

- Onboarding the client with their name and registration number.

- Customizing the KYB process by adding automation features. For example, creating a custom rule that automatically orders credit bureau reports and collects shareholder data.

- Conducting an automated AML check for the company and its beneficiaries.

By following these steps, companies efficiently fulfill their KYB compliance requirements and review the results of the AML checks easier to ensure a risk-free partnership.

While this is just one example of managing to maintain effective Know Your Business (KYB) compliance, there are many other approaches and tools available to help companies fulfill their KYB obligations.

It is important to choose the right approach and tools that meet the specific needs and requirements of your company and industry and to regularly review and update your KYB processes to ensure ongoing compliance.

The Importance of Flexibility in Know Your Business Systems

Flexibility is crucial in Know Your Business (KYB) systems, as different companies and markets may have different requirements and preferences for how they want to use KYB. So to meet the diverse needs of various businesses, it’s important that the KYB system is flexible.

This includes the ability to customize the design, text, automation customization, and overall functionality of the system to meet the unique requirements of each company.

This factor is essential in today’s competitive market, where companies may choose between different KYB providers based on their ability to meet their specific needs. At iDenfy, by creating a flexible and customizable system, we aim to provide our clients with the best possible solution for their KYB needs.

The Future Know Your Business Trends

It’s natural that the KYB process has significantly evolved as regulations and compliance requirements have changed. In the past, KYB was mainly a manual process conducted by compliance officers. It required time-consuming collection and analysis of various data points.

However, with technological advancements, many KYB providers have adopted digital tools and processes to automate and streamline their KYB processes.

Key facts to remember:

- While most modern KYB systems cannot fully approve companies on their own, iDenfy helps its partners to set custom rules that can automatically detect and reject potentially fraudulent companies.

- Such automated solutions help ensure the integrity and reliability of the KYB process while minimizing the need for manual intervention.

Companies are investing in more accurate and reliable automated systems that can detect fraudulent activity without producing false positive errors. Even though automation has greatly improved the efficiency and effectiveness of KYB, it is still challenging to fully replace human resources in this process.

iDenfy’s fully automated Business Verification services offer a comprehensive and user-friendly way to manage KYB compliance and minimize the need for manual intervention.

See it to believe it in a free demo.