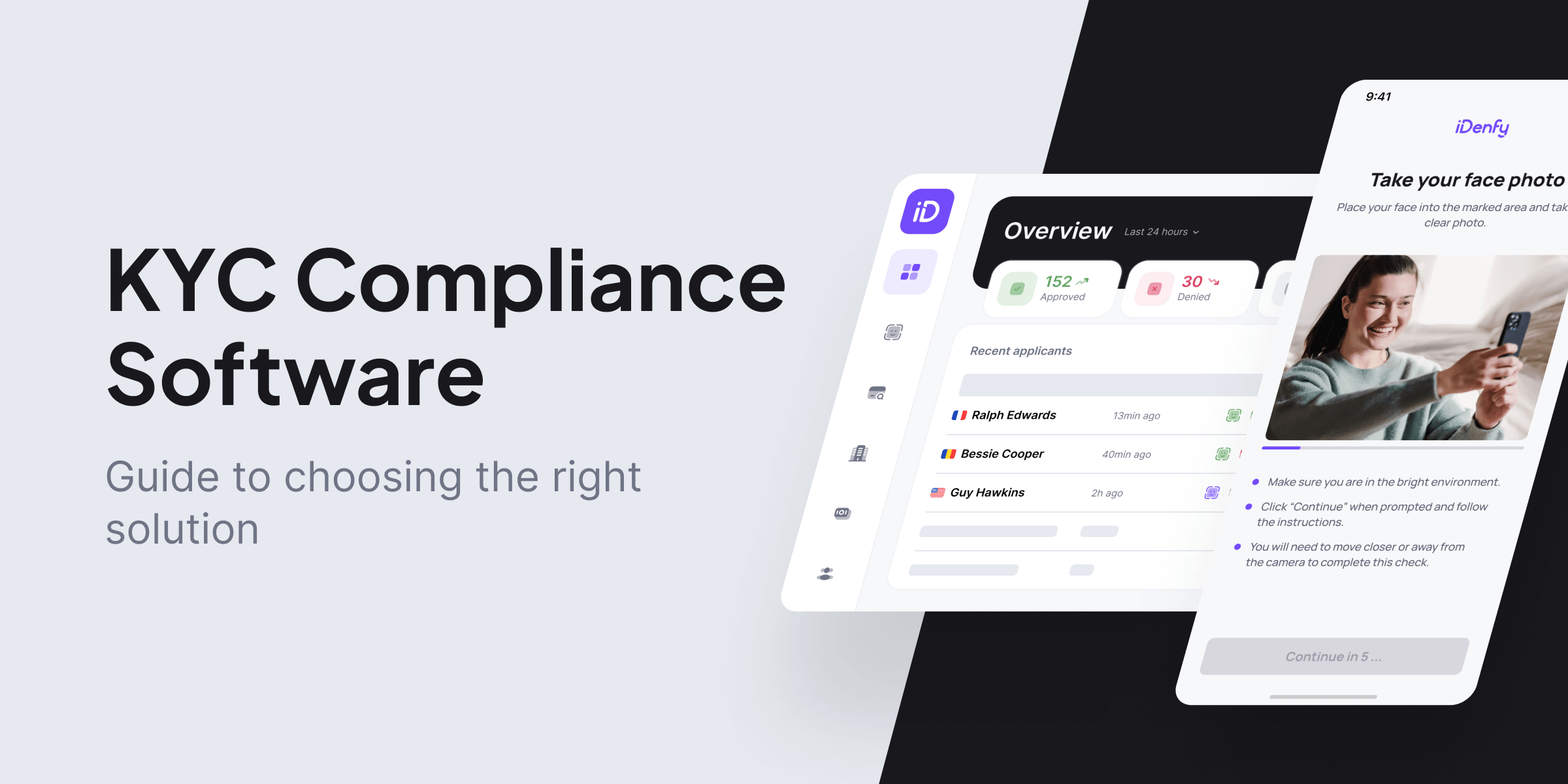

Implementing automated identity verification services is important. However, understanding the key factors and what makes a good KYC compliance software can be challenging. Especially if we talk about industry specifics that must align with your company.

So, when businesses onboard users from different countries, they encounter several challenges, such as detecting fraudsters and ensuring compliance with regulations. Often, especially large-scale businesses that deal with high volumes of data look for automated KYC compliance software. Consequently, this helps them reduce the time-consuming process of identity verification.

Yet, understanding the compliance requirements of each country is the most important hurdle to overcome. Some companies address this challenge by engaging numerous KYC compliance software providers for each operating region as well as to prevent operational crashes in case a vendor faces technical difficulties.

Consequently, this increases KYC compliance costs. That’s why companies that serve clients from multiple countries can opt for a software provider that possesses expertise in global compliance regulations. Additionally, customizable workflows, white-label options, or wide ID document coverage are just a few factors that you want to consider when choosing the best KYC compliance software.

Tag along and find out what metrics, guidelines, and best practices should guide your KYC compliance software decision-making process.

What are the Key Attributes of KYC Compliance Software?

KYC compliance software is a tool that helps businesses meet Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. It can be either conducted on the company’s internal servers or provided as a cloud-based service for real-time identity verification.

Typically, the best KYC compliance software means it can offer:

- A seamless user experience

- Robust security measures

- Advanced automation capabilities

- Comprehensive regulatory compliance

Customizable workflows, real-time data verification, and manual KYC customer support also contribute to the unique value proposition of KYC compliance software. By carefully considering such factors as efficiency, accuracy, and compliance readiness, your business can choose the best ID verification provider.

Factors to Consider Before Choosing Your KYC Software Provider

- Ensure that the software is compatible with your current systems to avoid any integration issues.

- Check if the KYC software provider offers the option to conduct testing before integration, allowing you to assess its functionality.

- Consider your budget and the specific features you require, and use these criteria to narrow down your options.

- Contact the customer support team to gauge their responsiveness and ability to address your concerns.

- Request a demo of the software to gain a clearer understanding of its functionality and how it aligns with your needs.

Companies that don’t use the help of a third-party KYC compliance software provider can face severe fines for non-compliance, which sometimes reach millions or even billions in damage. Once this happens, companies can also expect to attract stricter scrutiny from regulatory bodies, including more frequent audits and higher KYC standards.

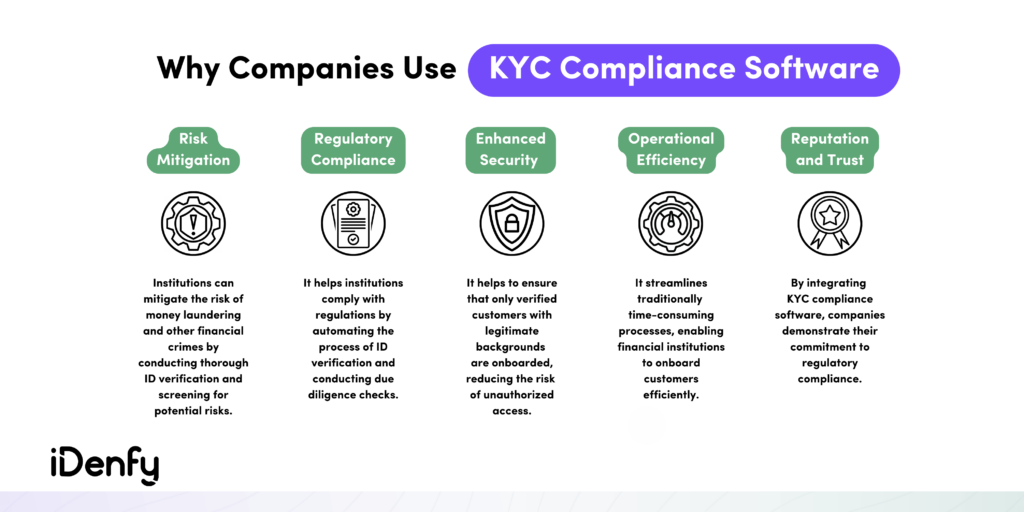

KYC Compliance Software Benefits

Integrating KYC compliance software, or digital KYC measures in general, can help businesses:

Fight financial fraud. Financial fraud often involves hackers who create fraudulent accounts on gaming sites and exploit other users, particularly minors, to extract money. KYC compliance software identifies and prevents criminals from conducting illegal activity.

Prevent identity theft. Especially in digital environments such as gambling or betting industries. That’s why adopting KYC measures allows companies to quickly verify a customer’s identity using personal data like address and age. This prevents hackers from exploiting forged or stolen documents.

Enhance customer onboarding. Using automated KYC compliance software enables businesses to streamline their identity verification checks. This improves user experience and minimizes friction, helping grow the customer base and onboard more customers in less time.

Why Must Financial Institutions and Companies Integrate KYC Measures?

To combat money laundering and other types of fraud, businesses must use KYC measures to build a compliance program. Implementing KYC compliance software helps financial service providers and other businesses ensure they have proper policies in place to meet regulatory requirements.

Different industries can benefit from having a robust KYC compliance system. Apart from banks and financial institutions, many other industries require identity verification by law.

Here are some examples:

- Cryptocurrency

- Adult entertainment

- Online gaming

- Brokers and investment platforms

- Transport and ride-sharing services

- Gambling and casinos

- Real-estate firms

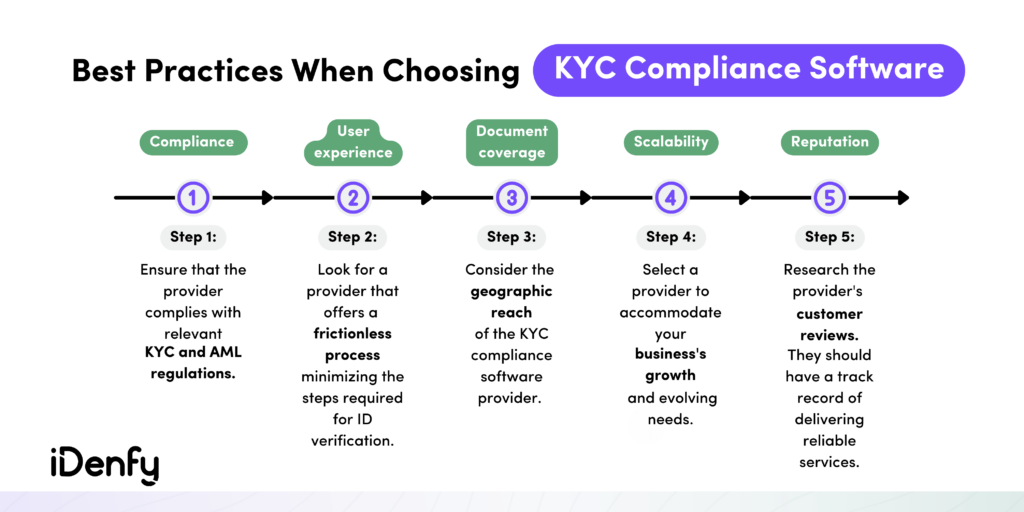

Best Practice When Reviewing Compliance Software Specifications

Before going deeper into the specifics of how KYC compliance software can meet your needs for identity verification services, it’s important to understand some recommended practices and considerations to take into account when selecting a provider.

Assess Industry Requirements

Every company and industry is different, which makes it crucial to evaluate your needs and determine what kind of level of security you’re opting for. If your business requires a simple verification system to confirm the identities of individuals entering your premises, such as an attendance system, a standard biometric fingerprint verification process would work fine. In this scenario, there is no need for AI-powered KYC software with multiple steps.

On the other hand, banks, crypto players, and other regulated entities require comprehensive KYC compliance solutions. This is because simple authentication is insufficient. Such companies must also comply with AML compliance regulations. This practice involves conducting AML screening and ongoing monitoring – cross-referencing customer information against multiple data sources. Therefore, the first step in selecting a KYC verification solution is clearly understanding your business needs.

Create a Shortlist of KYC Software Providers

Building a shortlist of KYC software providers is crucial when selecting the best vendor for identity verification. You must check their features, capabilities, and pricing structures. By narrowing down your choices, you can focus on providers that align with your requirements.

For example, if you’re in crypto operating in the US, you should look into specific regulations, such as the Financial Action Task Force (FATF) guidelines and the requirements imposed by state-level regulatory bodies. These measures aim to ensure that virtual asset service providers (VASPs) comply with KYC obligations to prevent illicit activities within the crypto space.

Additionally, creating a shortlist of providers helps you look into insights from user reviews and references. You can explore case studies and testimonials to understand how each KYC provider has performed for businesses similar to yours. For instance, if a particular vendor consistently receives positive feedback for their user-friendly interface and quick onboarding process, it can indicate that it could also fit your company.

Analyze the KYC Process Flow

What services does your business necessitate? What specific information do you require to verify during the KYC check? What will be the steps of your verification process? These are crucial inquiries that you must think of when choosing the best KYC software. If your company solely requires document verification for verifying the user’s identity, there’s no need to include an additional step with selfie checks.

This layer of defense often arises in age-restricted services where there’s a requirement for ID verification services specifically for age-verification purposes. Unfortunately, companies sometimes make the mistake of incorporating unnecessary features into the KYC process. However, this approach can backfire and create unnecessary friction, which today’s users especially do not like. When implementing KYC software, it’s essential to ensure that each step prioritizes both security and user experience.

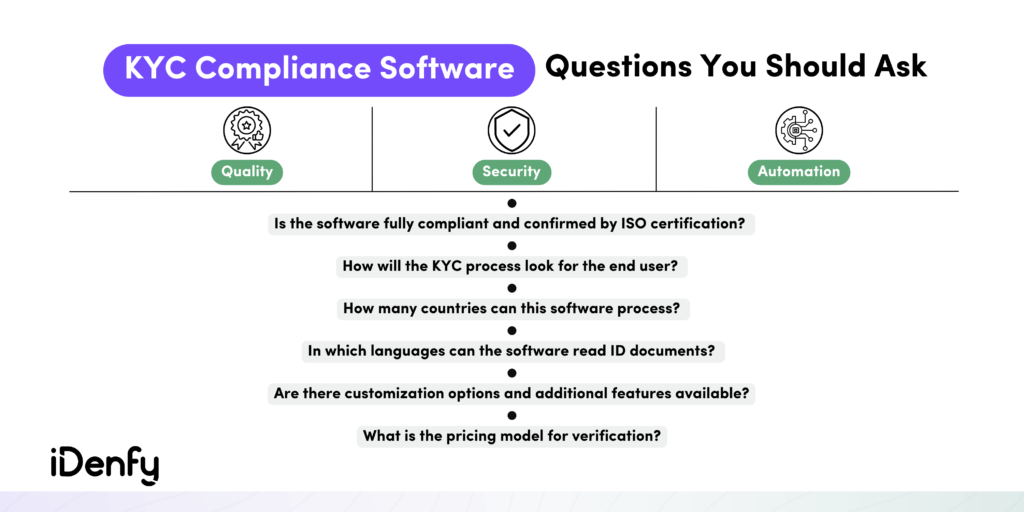

What Features Do You Need to Look for in KYC Compliance Software?

After making the decision to implement KYC compliance software, the next step is to examine certain features that ensure secure and compliant identity verification.

To help you make the best decision, here’s our checklist of features that you shouldn’t ignore when choosing the right solution.

Ease of Integration

A KYC software integration enables you to fulfill KYC compliance requirements by leveraging third-party ID verification providers. It helps you streamline the KYC process, offering a more straightforward alternative to developing a KYC solution from scratch.

Proper KYC compliance software should be easy to integrate. Here are the most common integration options:

- API integration

- Verification link or QR-code

- WebSDK integration

- MobileSDK integration

Typically, KYC integrations rely on APIs (Application Programming Interfaces). APIs enable seamless communication between applications, allowing external ID verification software to receive customer data and provide relevant responses, such as review status, approval, or denial of the verification. Understanding the integration timeline is crucial as well.

Prior to integration, review the IDV solution’s API documentation and check if a free trial is available. That said, one notable benefit is that businesses are not required to store customer data on their systems. That’s because third-party providers are equipped to handle large volumes of data efficiently.

Global Document Coverage

Some KYC compliance software options provide coverage restricted to a specific country due to limited access to global databases. Each country has its own unique laws, regulations, and variations in data availability. To address this, ensure that the chosen KYC service provider offers wide document coverage, enabling you to verify the identity documents from global markets.

To assess the KYC provider effectively, check their list of supported documents and examine the accuracy of each ID type during the proof-of-concept (POC) stage. Many providers employ an original equipment manufacturer (OEM) for optical character recognition (OCR) of ID cards, and their accuracy levels can differ. Ensure that the chosen KYC software supports a diverse range of racial face types and evaluate the performance of the KYC provider’s facial recognition abilities.

User Experience

When selecting a KYC compliance software provider, prioritize real-time identity verification as a key feature. To ensure high conversions and low friction, look for other features:

- Data extraction: The KYC software automatically captures a photo of the identity document and converts it into text without user intervention.

- Language and country support: The KYC compliance software should have extensive language support and adapt to specific requirements in different countries. Additionally, it should offer white-labeling options to match the brand’s specific needs.

- KYC workflow customization: The KYC software should have customization and variations of automation of the verification flow according to different user segments.

That’s why the capability to verify a user’s identity within seconds, particularly during the customer onboarding process, must strike a balance between security and customer experience. Lengthy and complex verification procedures often lead to lost conversions and overwhelmed clients.

Security and Privacy

Check whether the KYC compliance software provider complies with appropriate data security standards. It’s also important to ensure that there’s a legally enforceable agreement between your company and the third-party provider. You must have a clear understanding of what happens to the data when a customer decides to opt out of the service.

Ideally, the best solution would be one that complies with the General Data Protection Regulation (GDPR) and other relevant laws related to consumer data protection. Remember, engaging in KYC services through a third-party vendor is completely legal, with your company serving as the data controller while the third-party company acts as the data processor.

Look for certifications such as SOC 2 or ISO/IEC 27001, which serve as a seal of approval for meeting rigorous standards of security and data protection.

Other Tips for Evaluating Which KYC Compliance Software to Choose

When choosing KYC compliance software, ensure it can handle your business’s data and transaction volume. Look for seamless integration with your existing systems and infrastructure to simplify the implementation process and minimize disruptions to your internal operations. Don’t forget to inquire about the available customer support options from the KYC provider.

At iDenfy, we offer a multi-layer fraud prevention hub for complete compliance, meaning you won’t have to integrate multiple solutions. We back up our KYC and AML software with internal KYC specialists, who manually review all AI-enabled software results in real-time.

Do you want to scale faster and pay only for approved verifications? Test our KYC compliance software for free today.