KYC, or Know Your Customer, is a regulatory compliance requirement for many industries, including forex trading, requiring obliged entities to conduct identity verification procedures. Companies that deal with trade or exchange of financial services, such as forex, must verify their customers to check who they’re working with.

Typically, this process of identifying and verifying a customer’s identity happens during the account opening stage and periodically afterwards. In simpler terms, forex trading platforms are required to confirm that their clients are indeed the individuals they claim to be.

According to recent statistics, investment-type scams resulted in a loss of over $115 million in the first half of 2023 alone. This accounts for nearly 60% of the total fraud losses of the year. While some customers don’t want to disclose their personal information when trading, and while some forex exchange businesses don’t want to invest in compliance tools, it’s safe to say that KYC is the only way to go.

Letting your customers slide without proper identity verification can lead to enormous non-compliance fines. Additionally, there are many underage traders and teenagers who are looking for ways to earn money online. That means forex trading platforms without KYC verification potentially allow minors access to age-restricted services. That’s both illegal and unethical.

Key discussion points:

- The definition of KYC in forex

- The importance of KYC checks for forex platforms

- KYC regulations in forex trading

- KYC challenges forex companies face today

- Best types of KYC solutions for forex trading

What is KYC in Forex?

KYC is a legal mandate for forex platforms to verify their customer identities. The specific customer data required for collection can vary across countries, but typical requests from forex trading operators include:

- Passport or national ID number, along with the country of issuance

- Residential or business address

- Date of birth

- Phone number

- Email address

Other financial details, including the purpose for opening a trading account and the source of funds. Forex companies typically verify this information using the document verification process. It typically involves verifying government-issued documents, such as passports, ID cards, utility bills, and bank statements.

The forex market is decentralized, lacking a physical location for currency trading. Instead, traders use the internet to access currency quotes from global dealers. As a result, KYC is crucial in forex trading because of its decentralized nature, which naturally brings a certain level of anonymity.

Why is KYC Important for Forex Trading Businesses?

There are several participants that make up the forex market. Key players range from central and commercial banks to investment funds. However, with that in mind and the global interest in the forex market, the threat of scams is on the rise.

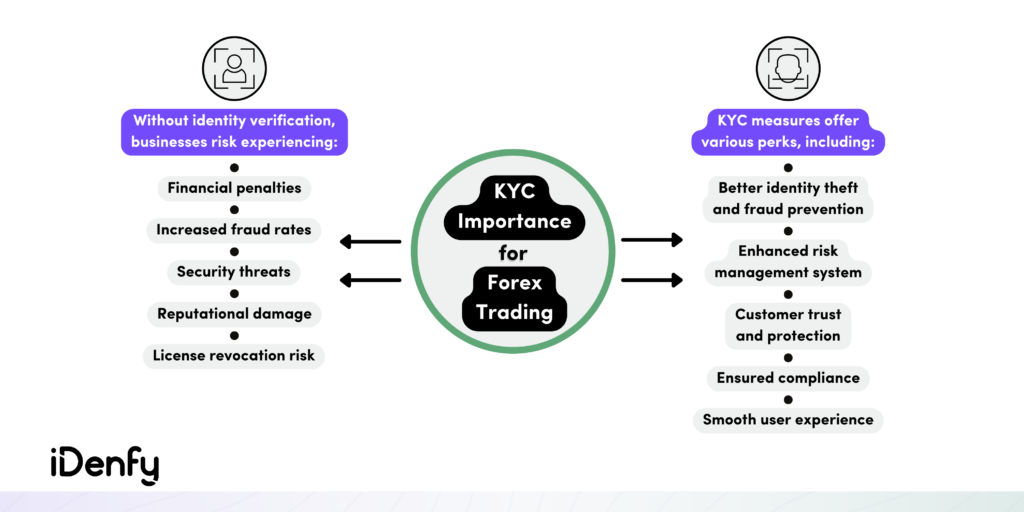

KYC is important for forex trading businesses that want to reduce the risk of fraud and associated dangers. Moreover, this proactive approach equips forex companies to navigate evolving KYC and anti-money laundering (AML) regulations, preventing steep fines and penalties.

Here are the three key risks of non-compliance, leading forex trading businesses to these consequences:

- Damaged reputation

- Hefty compliance fines

- Rising fraud rates

When establishing a new forex trading business, non-compliance can even end in license denial. Additionally, the more fraudsters you open doors to, the more illicit activities you get. For example, dealing with chargebacks or account takeovers can be both expensive and time-consuming.

What are the KYC Regulations for Forex Platforms?

Each forex platform must adhere to KYC regulations as well as Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, depending on the operating country. Due to variations in requirements across jurisdictions, forex trading platforms should exercise caution in selecting the jurisdiction for business registration and licensing.

The universal KYC rule that helps companies comply with regulations consists of three key elements:

- Confirming the customer’s identity.

- Understanding their background and transactional behavior to ensure legitimacy.

- Continuously monitoring for additional money laundering and other fraud-related risks.

As forex trading occurs globally, not all platforms have a universal set of forex broker regulations. However, some rules, particularly a broader scope of the whole AML/CTF framework, overlap across regions. To align with both KYC and AML, forex businesses must establish a robust KYC/AML compliance policy.

This involves implementing key processes that help forex platforms comply with KYC regulations, including:

1. KYC Check

A KYC check is a three-step process. During the initial customer onboarding, the first two steps — Customer Identification Program (CIP) and Customer Due Diligence (CDD) — are conducted to verify the customer’s true identity and establish a risk profile. Based on the outcomes of these stages in the KYC process, forex companies can either allow the customer to access their services or deny this request.

Keep in mind that the extent of a KYC check varies for each customer. Those with higher risk factors necessitate more extensive research and in-depth verification to assess the reasonability and value of establishing a business relationship.

2. Customer Identification Program (CIP)

CIP is a vital due diligence process that financial organizations must undertake to meet their KYC compliance obligations. In other words, CIP sets the fundamental criteria for onboarding new customers, with forex businesses having the flexibility to customize their CIP programs.

KYC involves grasping a customer’s identity and the nature of their business activities, while CIP concentrates on verifying the information a customer provides. Simply put, CIP is a component within a broader KYC compliance program. In either case, the aim of both CIP and KYC is to assess the level of risk a customer presents to the business.

Related: What is the Difference Between CIP and KYC?

3. Customer Due Diligence (CDD)

The CDD process involves investigating the customer’s history to establish a risk profile. After verifying the customer’s identity, forex platforms can check the legitimacy of their documentation and evaluate the customer’s risk profile. KYC and CDD work together to prevent or promptly address crises arising from fraud and money laundering attempts.

In the meantime, Enhanced Due Diligence (EDD) is the ongoing application of KYC checks once an account has been established. EDD ensures continuous monitoring of account transactions, promptly flagging any suspicious activity and reporting it to the relevant regulatory authority.

That’s why forex businesses should always check customer account activity and ensure up-to-date KYC documentation. Record-keeping is crucial for ongoing CDD, aiding in maintaining a clear understanding of customers throughout their lifecycle.

What KYC Challenges Do Forex Companies Face?

Similar to any internal operations, implementing KYC measures in forex trading can add unnecessary friction to the user onboarding experience.

The primary challenges in KYC verification for forex platforms include:

- Questionable user experience. Improperly executed KYC checks might lead to a prolonged KYC flow, especially if low-risk users are repeatedly subjected to the KYC process.

- Insufficient fraud prevention. Certain KYC systems are not entirely fraud-proof, especially in the face of advanced technologies employed by criminals to circumvent verification procedures.

- Costly operations. Conducting KYC checks for every user can be expensive, particularly for small enterprises lacking dedicated in-house compliance teams.

While striving for swift customer access to forex trading, companies must incorporate suitable KYC verification measures. This involves assessing the customer’s risk profile and offering a streamlined KYC process for low-risk customers while implementing additional verification checks for those deemed high-risk. Additionally, automated RegTech solutions help overcome these challenges, especially in the rapidly growing landscape of forex trading.

What KYC Solutions are Best for Forex Trading?

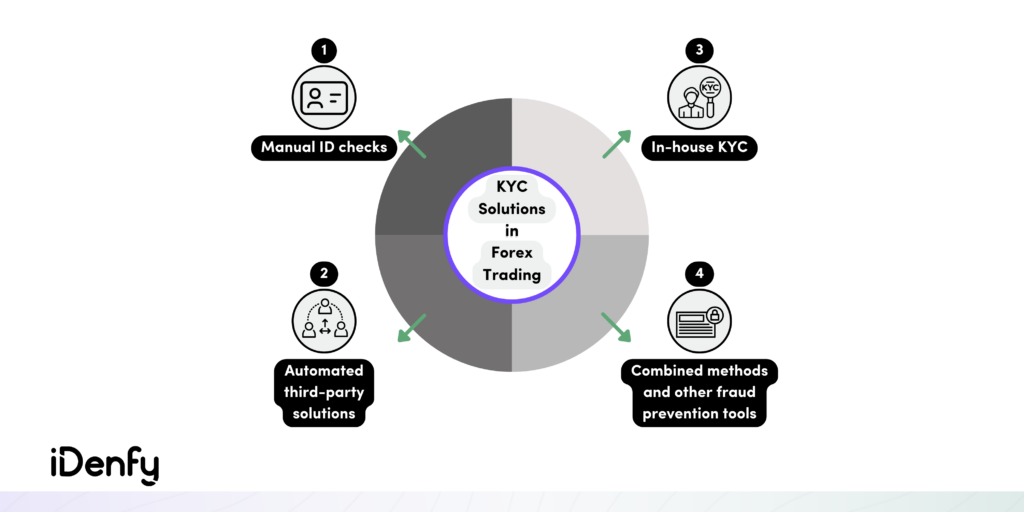

There are two main types of KYC solutions based on their approaches: manual and automated. While both follow a similar process, their implementation and effectiveness differ. That’s why, with businesses facing stricter regulations and increased market demands, choosing the right solution for your forex trading platform is crucial.

While a combination of both KYC options is common, it’s helpful to examine each KYC solution separately:

- Manual ID checks. In-house manual verification can be laborious, slowing down internal compliance operations, introducing friction to the end-users, and posing a risk of false positives due to human error. On top of that, manual ID checks can be costly, demanding substantial resources and personnel for management.

- Automated third-party solutions. Preferred by many banks and forex trading platforms today, this KYC solution outsources development work through various APIs and automates the whole KYC verification flow. So, by employing advanced technology and AI solutions to streamline the KYC process, forex companies enhance efficiency, accuracy, and cost-effectiveness.

- In-house KYC. Implementing in-house KYC enables forex companies to enhance their understanding of the customer base. However, it comes with a major drawback. Businesses that choose this method deal with high costs involving substantial investments in technology, personnel, training, and maintenance.

Companies often combine approaches, employing both manual KYC checks and AI software from a third-party KYC service provider. Additionally, compliance-related anti-fraud tools like Fraud Scoring assist forex trading platforms in automatically evaluating customer behavior for suspicious indicators, such as fraudulent IP addresses.

When coupled with an automated identity verification solution, this combination-based comprehensive approach ensures a higher level of assurance, safeguarding your forex platform from individuals employing stolen identities or forged documents.

iDenfy’s Approach to KYC for Forex Trading Platforms

Different from the majority of KYC solution providers in the market, iDenfy offers fully automated identity verification services, backing that up to complete accuracy with in-house KYC manual checks. iDenfy’s dedicated KYC team can review each verification result in real-time, increasing approval rates for your forex trading platform and onboarding more customers in less time.

More importantly, iDenfy carries the complete fraud prevention package under one roof, meaning your forex trading platform can use a single third-party provider to cover all KYC/AML compliance needs.

Get started today.