Recent advancements in computing power and analytical capabilities have definitely enhanced the effectiveness of anti-money laundering (AML) RegTech solutions. However, the concept itself isn’t something new. The global RegTech industry has experienced consistent growth since 2015, driven by the increasing regulatory responsibilities and audit demands placed on financial institutions. Of course, let’s not forget the global pandemic, which also helped the RegTech market scale and reach new heights.

When we talk about RegTech, the first thing that comes to mind is artificial intelligence (AI). While we now have ChatGPT, we know that AI can be similar to the process of human intelligence. In RegTech, it helps recognize patterns and irregularities, a critical aspect of AML transaction monitoring. Not only that, but RegTech solutions can also benefit companies that want to streamline identity verification and AML screening processes.

What is RegTech in the Context of AML Compliance?

RegTech consists of various AML compliance solutions. RegTech isn’t related just to banking. It helps maintain regulatory compliance across various industries. In the context of AML compliance, RegTech solutions typically leverage advanced analytics. Popular examples include machine learning, natural language processing, and robotic process automation. They help create such RegTech solutions as identity verification, record-keeping, and screening or ongoing monitoring.

The term “RegTech” originated from “Regulatory Technologies” and has become a vital component of many industries. Fintech, iGaming, cryptocurrency — they all use RegTech solutions today for regulatory compliance, gaining prominence as a response to the growing number of regulations.

Use Cases for RegTech in AML

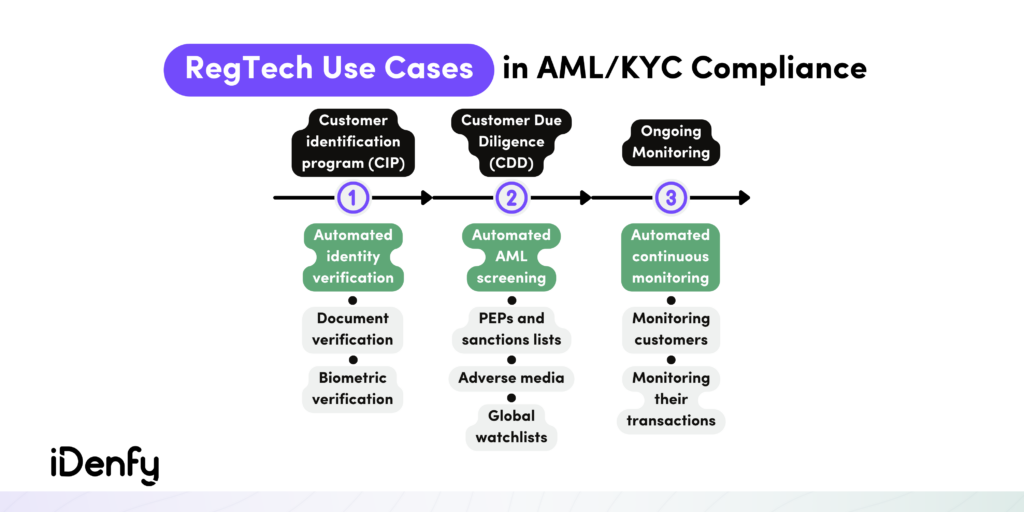

RegTech is the main option when it comes to effective AML and Know Your Customer (KYC) programs, which consist of three key elements: customer identification, customer due diligence (CDD), and transaction monitoring.

Customer Identification

First of all, RegTech solutions streamline identity verification by automating biometric and document verification checks. Biometric verification employs facial recognition, voice recognition, or fingerprint scanning to confirm an individual’s identity. In the meantime, document verification assesses the legitimacy of identity documents like passports and driver’s licenses using optical character recognition (OCR) and other verification methods.

Customer Due Diligence

Customer due diligence (CDD) is a mandatory process for organizations entering into business relationships with customers. It is a crucial component of both KYC and AML compliance frameworks.

For example, for Politically Exposed Persons (PEPs) and sanctions screening, RegTech solutions leverage algorithms and AI to cross-reference customers with sanction lists and PEPs databases. This screening process is adaptable to a financial institution’s risk tolerance and compliance needs. Companies also use adverse media checks to see if the customer isn’t mentioned in negative news outlets or isn’t listed in global watchlists.

In terms of risk assessment, RegTech solutions can automate it through risk-based scoring models. These models utilize machine learning algorithms to analyze customer data, encompassing transaction history and demographics. Such tools help with the determination of the necessary level of due diligence for that customer.

Related: What is the Difference Between CDD and EDD?

Transaction Monitoring

When it comes to transaction monitoring, RegTech solutions automate the process using machine learning algorithms to identify suspicious transactions. These algorithms scrutinize transaction patterns and flag any unusual activity, such as abnormal increases in transaction amounts or frequency, triggering alerts for further investigation.

Transaction monitoring goes further into disparities between the anticipated value of goods or services and the actual payment amount, a potential sign of fraudulent activity. Additional transaction monitoring methods consist of screening for high-risk merchants and velocity rules to assess whether spending aligns with the expected patterns.

Issues Companies Faced Before RegTech

Previously, without RegTech, AML regulations created several issues for financial institutions. Here are some key examples:

- Manual, intensive work. AML compliance was often a highly manual and labor-intensive process, requiring extensive paperwork, data entry, and the review of large volumes of transactions and customer records. This manual approach was not only time-consuming but also prone to errors.

- Inaccurate data records. Handling and managing vast amounts of customer data and transaction records was a significant challenge. Maintaining accurate and up-to-date information was a struggle, and it was difficult to cross-reference and analyze this data to detect suspicious activities efficiently.

- Overlooked regulatory changes. AML regulations frequently evolved, and companies struggled to keep their compliance programs up-to-date with the latest requirements. Adapting to new rules and guidelines was a complex and costly process.

Yet, thanks to RegTech solutions, this process has become more streamlined and faster, simplifying compliance with AML regulations. Today, RegTech solutions provide companies with automated tools to meet not only AML but also KYC requirements. This is crucial for accurately detecting money laundering and terrorist financing.

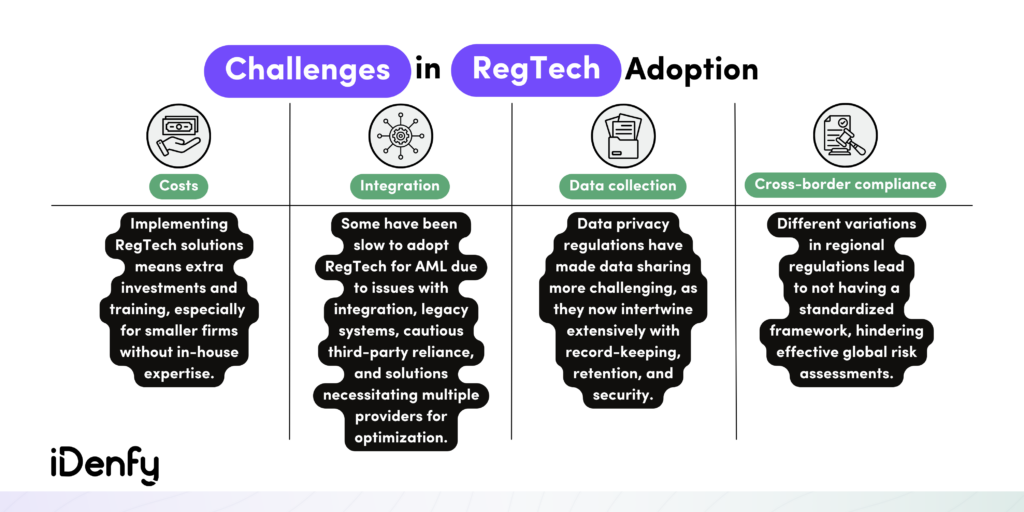

Challenges Regarding RegTech Solutions Today

While RegTech solutions solve many compliance-related problems, smaller businesses can sometimes find RegTech a serious financial commitment. There are other challenges regarding automated AML solutions, such as the continuous need for training, particularly for organizations lacking in-house expertise. Additionally, connecting older legacy systems with the most recent RegTech tools can prove to be a challenging endeavor.

Furthermore, it’s worth noting that AI models do not consistently surpass rule-based solutions in terms of performance. These AI-driven models may lack transparency in their processes, which could potentially raise concerns for regulatory bodies. Another crucial aspect to consider is that data collection and storage must adhere to stringent privacy and security regulations. For this reason, it’s important to choose only reputable RegTech service providers that have knowledge of your industry and can offer you an easily implemented AML solution with fair pricing.

Why is RegTech in AML Important?

In general, RegTech solutions are extremely important because they offer real-time monitoring and risk assessment. This helps companies detect and address potential compliance issues more swiftly. Even though RegTech solutions are one of the most common ways to stick to AML rules, non-compliance fines are still a major issue. The same goes for money laundering. According to estimates from the United Nations Office on Drugs and Crime (UNODC), roughly 2% to 5% of the global GDP is believed to be laundered annually.

Additionally, more criminals are using sophisticated techniques to launder funds, such as smurfing or structuring. This jeopardizes the reputations of financial service providers. However, with the growing number of threats, costs are also on the rise. As a result, to stay ahead, financial institutions are embracing innovative technologies and implementing policies to enhance their ability to identify fraudulent transactions.

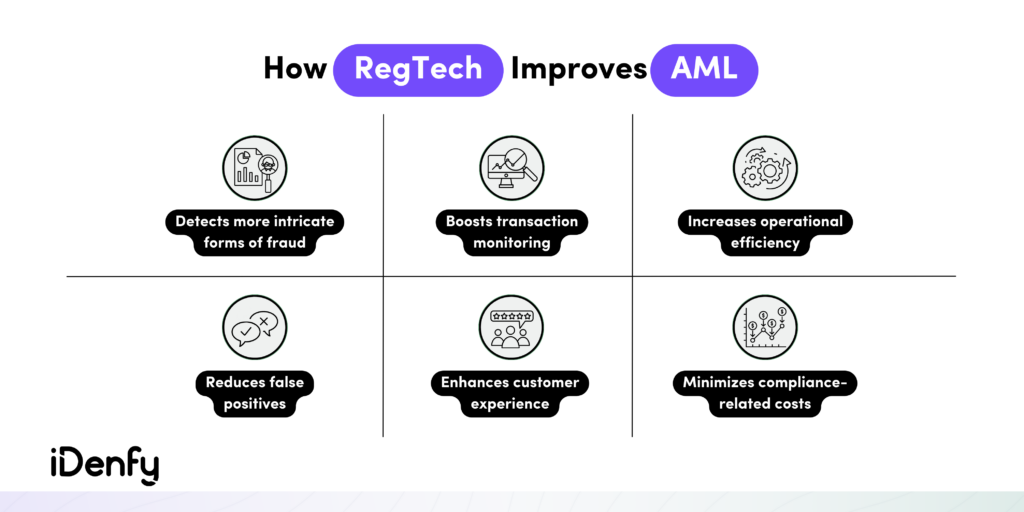

How RegTech Improves AML

Two fundamental reasons why companies choose to improve their AML processes through RegTech is the necessity to comply with AML regulations. That said, RegTech solutions can provide tangible advantages to financial institutions seeking compliance with AML and the Bank Secrecy Act (BSA) requirements. However, AML regulations also serve as a protective shield for both companies and their customers, mitigating the risks associated with financial crimes, including the mentioned money laundering.

Despite that, some businesses don’t want to see that a well-optimized AML program can serve them a dual purpose. Not only does it help in deterring money laundering on their platforms, but it can also eventually lead to saved costs. That’s because automation costs less than hiring a fully stacked internal compliance team.

Here are the key factors of RegTech showcasing how it improves AML compliance:

Detects More Intricate Forms of Fraud

Trying to identify fraud manually is difficult. AI-powered network analytics enable the exploration of connections between entities, uncovering suspicious patterns and common behaviors that signal a high likelihood of fraud, such as money laundering. AI-based RegTech solutions can also scan and monitor a significantly greater number of transactions, resulting in a more comprehensive risk assessment.

Boosts Transaction Monitoring

AI-driven transaction monitoring goes a step further by detecting suspicious interactions between entities. This is vital, especially since transactional behavior serves as a valuable indicator of potential money laundering. Additionally, we’ve already established that AML specialists often face challenges in identifying illicit transactions in a swift and accurate manner.

With RegTech transaction monitoring solutions, companies can continuously track customer behavior and raise alerts on suspicious activities for further scrutiny. By comparing transaction behavior with historical data, RegTech solutions can identify behavioral anomalies, prompting risk analysis and flagging suspicious activities in real-time. This saves time and resources for companies that automate their AML compliance workflows.

Increases Operational Efficiency

AI and machine learning contribute to efficient AML operations by continuously learning from new data without explicit programming. That’s how RegTech solutions conduct in-depth pattern analysis to identify potential indicators of heightened criminal risk. This knowledge is then integrated back into the algorithm, progressively refining the process and minimizing the need for manual intervention.

Otherwise, conducting manual AML checks is a laborious and resource-intensive process, requiring employees to examine transactions for compliance practically 24/7. Consequently, RegTech can significantly improve operational efficiency, allowing employees to redirect their efforts towards more valuable tasks.

Implementing Effective RegTech AML Solutions

RegTech has brought us wonderful things. For example, advancements in image analysis, data extraction, and matching technology can enhance the customer onboarding process, making it a hassle-free identity verification experience.

On top of that, with RegTech, we have a completely different perspective on record keeping, screening and monitoring data. What’s more, we can say buh-bye to manual, complex fact-checking processes that are full of errors.

At iDenfy, we offer RegTech AML solutions that can be custom-tailored to fit your business needs. We have expert-level industry knowledge, and multiple AML and KYC tools under a single platform. Intrigued? Book a demo with sales.