The US has reached a record-breaking number of 5.5 million new business applications in 2023 alone, most of the filings being sole proprietorships or limited liability companies (LLCs). These two structures are common because they’re flexible and easy to set up. Many small businesses first start out as sole proprietorships, later transitioning to LLCs or corporations.

Freelancers, contractors and consultants are often sole props because their business is owned by one person — meaning they’re responsible for both profits and losses. LLCs, in the meantime, are owned by one or more members, operating as a separate legal entity, protecting the company from personal liability in case of business debts.

Both business structures have differences when it comes to filing bankruptcy, dealing with lawsuits, or paying taxes. For regulated industries, such as banks, this means more factors to consider when adjusting the Know Your Business (KYB) process for onboarding new sole proprietorships or LLCs. For example, the state the sole prop is operating in, what documentation they’re required to file, and how the business is structured.

But what kind of due diligence processes does that mean sole proprietorships should go through? More on this and how LLCs differ from sole props below.

What is a Sole Proprietorship?

A sole proprietorship, also known as a sole prop, is a business that is typically operated by a single person, running the incorporated business alone. Legally, a sole proprietorship is not a separate entity from its owner, and that’s why sole props are the “sole” owners, receiving all responsibility, including dealing with debt.

Sole proprietorships aren’t required to report beneficial ownership because they are not considered to be registered entities. This type of business is relatively easy to set up. That’s why many local small businesses or freelancers choose to be sole proprietors. Sole props can also register a tax account or a trade name. They can also use a different name for their business, but it needs to be trademarked, depending on the jurisdiction in which they work.

A sole prop is also considered to be self-employed, but the term itself caters to a wider audience. Often, self-employed people need to make quarterly estimated tax payments and file annual income tax returns. This business structure is low risk. That’s why many small businesses use it to serve a dedicated customer group.

🟢 Factors that Make a Sole Prop Beneficial

The best part about a sole proprietorship is that it doesn’t require lots of paperwork. This makes it a relatively quick setup process compared to other business structures. The management and running aspect of the business is also straightforward. The owner manages their own expenses and income on their tax return.

Key advantages include:

- A possibility to qualify for a tax deduction.

- No need for an Employer Identification Number (EIN).

- Simple tax filing process using a Social Security Number (SSN).

Many individuals start as sole proprietors when turning a hobby into a business. As their customer base grows and they plan to scale, sole props sometimes decide to transition to a larger business structure to fit their expansion plans.

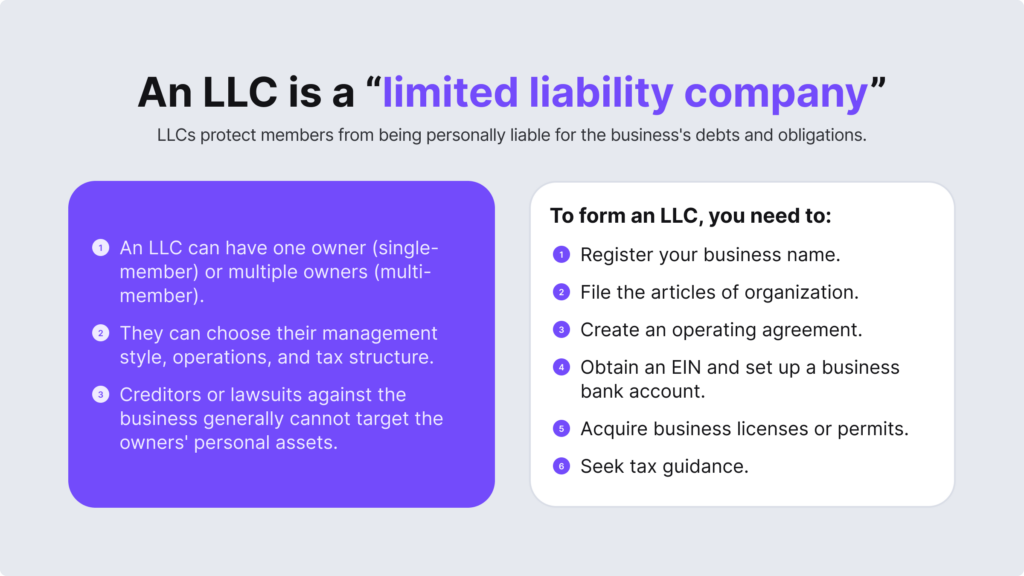

What is an LLC?

A limited liability company or an LLC is a separate state-formed legal entity that can be owned by one (single-member) or more members (multi-member). Its legal name ends with “LLC,” offering a mix of features that can also be found in sole proprietorships or corporations. An LLC chooses its tax structure, which makes it a flexible type of business structure in terms of tax savings.

LLCs need to file articles of organization with the state. Despite that, LLCs must comply with industry-specific requirements since some sectors, like food services, have stricter regulations. A single-member LLC is typically taxed as a sole prop unless the owner elects a different tax structure during filing. Unlike sole proprietorships, LLCs separate personal liability from both lawsuits or any business debts. This level of protection makes it one of the biggest reasons why business owners choose this structure, shielding their personal assets.

🟢 Factors that Make an LLC Beneficial

The main factor that makes LLCs an attractive option is liability protection. Members become business partners that have clear responsibilities and roles in the business, including determining voting rights and similar functions. With an LLC, members have a legally registered name and can solidify it, making it easier to secure loans or raise funds. Financial institutions also see LLCs as more stable and legitimate business structures than self-employed individuals.

Key benefits include:

- Limited liability.

- Fewer record-keeping rules.

- Fewer costs for establishment.

- Operational simplicity.

- Less stringent compliance requirements.

LLCs can use the company’s assets to repay business debts while protecting the owners’ assets. That means the personal assets aren’t exposed to business liabilities. An LLC can select and register the business name officially, making it an established legal entity. As a bonus, LLCs are known for their management flexibility, making them less corporate-like business structures that do not have annual meetings or strict reporting to the board of directors.

What’s the Difference Between a Sole Proprietorship and an LLC?

A sole proprietorship differs from an LLC because it doesn’t create a separate legal entity, which makes the owner liable for any liabilities incurred by the business. Despite that, if a sole proprietor decides to incorporate their business, they can restructure it into an LLC.

Other factors that show the main differences between the two business structures include:

- Establishment. Sole props don’t require specific paperwork. However, forming an LLC requires filing articles of organization with the state (which costs from $50 to $500 on average).

- Management. Sole proprietors make business decisions independently (but they can hire legal counsel and other assistants). An LLC needs an operating agreement, with each member outlining their profit share and ownership rights.

- Taxes. A sole prop and a single-member LLC need to report their personal tax return, paying tax at their personal income rate. In the meantime, multi-member LLCs require each member to report their share of income.

- Legal matters. A sole proprietorship isn’t legally separated from the business and the owner. So, if the business fails, the owner files for personal bankruptcy (both for business and personal debts). If the LLC goes bankrupt, owners file for business bankruptcy without using personal assets to pay creditors.

So, when a sole prop wants to scale, they often restructure the business into an LLC. For this to happen, the sole proprietor needs to check the availability of the desired company name, create an LLC operating agreement to define the business structure, file articles of organization with the state where the business will operate, and obtain an EIN.

How Does KYB Verification Work for a Sole Proprietorship?

A sole proprietorship isn’t a separate legal entity from its owner, which makes beneficial ownership information clear (compared to other business structures that have multiple employees, shareholders, etc.) since it’s typically one person owning the business.

According to the Financial Crimes Enforcement Network (FinCEN), beneficial ownership helps identify details about individuals who directly or indirectly own or control a company. This is a legal requirement for a compliant KYB verification workflow, among other processes, including Know Your Customer (KYC) verification.

So, if you want to onboard a new sole proprietorship, you’ll need to:

1. ➡️ Ask the sole prop to complete a standard KYC verification process (no matter whether or not they have an EIN).

Your KYC process should:

- Verify the sole proprietor’s full name, date of birth, address, and SSN (a popular approach is to combine selfie verification with government-issued ID or document verification).

- Include other fraud prevention checks, such as automated risk assessment (to know whether enhanced due diligence (EDD) is necessary), phone verification, IP address check, etc.

2. ➡️ Perform standard AML screening before starting a business relationship with them.

Typically, AML checks consist of:

- Sanctions screening.

- Politically Exposed Persons (PEPs) screening.

- Adverse media screening.

- Watchlist screening.

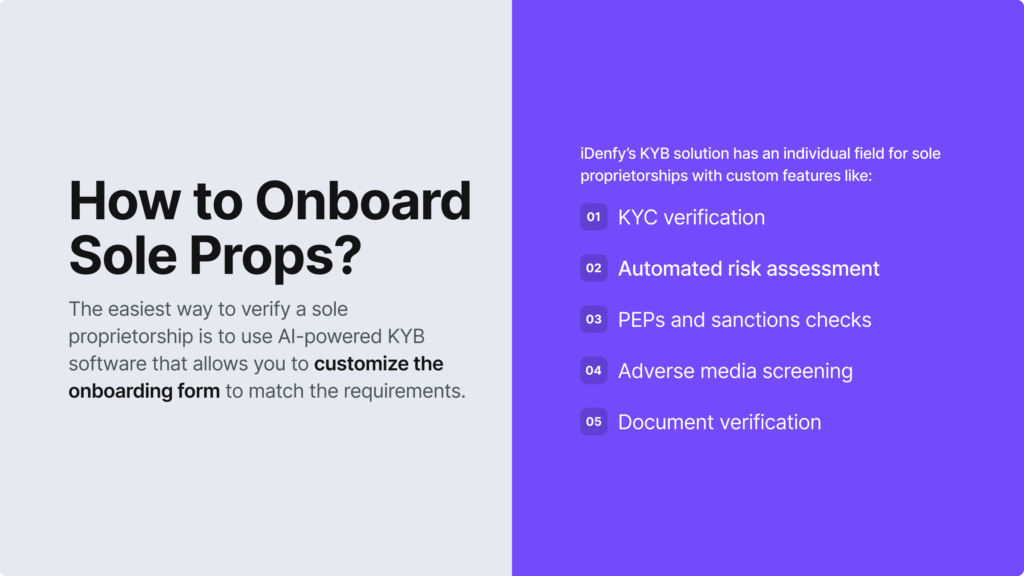

In general, KYB requirements depend on the jurisdiction and type of legal entity. Expanding into a new market may require adapting your KYB framework, as existing processes may not match the requirements of another country. The same principle applies to different types of business structures. For example, sole proprietors may require less documentation. Ideally, you should use a KYB solution that’s customized to different KYB flows.

In this sense, iDenfy’s KYB solution can be tailored to verify different entities, including sole props. You can select the specialized sole proprietorship questionnaire template and choose which information you would like to collect for the sole prop to be onboarded (full name, phone number, address, website, email, brand name, etc.). It’s a fast and simple way to collect and verify data automatically without overburdening the end-user.

How Does KYB Verification Work for an LLC?

KYB for LLCs should consist of the standard KYC/AML processes that complete a proper and compliant KYB verification process. This means cross-checking the LLC’s information with a government database or another reputable business identity data source, and running UBOs through KYC checks, as well as conducting AML screening, such as PEPs and sanctions checks.

Ultimately, KYB confirms the legitimacy of an LLC by assessing important data points, such as confirming the business’s registration and address with the Secretary of State and ensuring the LLC and its beneficial owners aren’t sanctioned.

KYB verification for an LLC is based on a three-step approach:

- Obtaining a valid business name and address.

- Requesting proof of incorporation or registration.

- Reviewing the ownership structure for a clear understanding of the business and the people behind it.

Business due diligence means that you need to assess the level of risk associated with each potential business partnership, in this case, focus on verifying the LLC’s identity and the risks associated with the business. Apply basic checks for low-risk clients and stricter verification and monitoring for high-risk clients, ensuring compliance without compromising the user experience.

In practice, your KYB flow should be based on collecting this data:

- Legal company name.

- Business registration status.

- Operating address.

- Verification of UBOs with 25% or more ownership.

- Employer identification number (EIN).

However, if you don’t have employees and are a single-member LLC, an EIN may not be required. In this case, you’ll file taxes using an SSN because the IRS treats single-member LLCs as sole proprietorships. Every LLC will have at least one beneficial owner, which should be KYC’ed. It’s public knowledge that hidden ownership structures can make the KYB process challenging. That’s why compliance teams often need to untangle layers of subsidiaries to identify who truly owns and controls the company.

How Do You Identify Whether it’s an LLC or a Sole Proprietorship?

The legal structure is the main difference, helping you to identify whether you’re dealing with a sole prop or an LLC. The onboarding process in KYB, compliance for sole proprietorships, is more straightforward because it requires less paperwork. In contrast, an LLC is a separate legal entity with a more complex ownership structureand more formal documentation. When verifying an LLC during KYB, you’ll need to assess different documents, such as a business registration certificate, an operating agreement, or a similar document, depending on the state.

In general, it’s best to implement an automated solution that allows you to customize the KYB flow. This could include:

- Adding a field where the end-user can self-identify their status.

- Customizing the questionnaire to specify which documents and due diligence information applicants need to provide.

That’s because it ultimately comes down to collecting the right data from the customer. Otherwise, your KYB process will be lengthy and inefficient both for you and your applicants — and, obviously, nobody wants that.

iDenfy’s Approach to Automated KYB Compliance and Sole Proprietorship Verification

At iDenfy, we’ve designed a feature-rich KYB platform with ready-made templates for unique onboarding cases, making it easy to collect data, as well as verify and onboard clients while handling KYC (including UBO verification) and AML checks (PEPs, sanctions, adverse media) in the same KYB dashboard.

We’ve just launched our latest verification solution specifically for sole proprietors, along with other new built-in features, such as AI cross-matching, which allows you to compare data against official government registries.

Get started right away.