Unregulated entities have become a target for criminal organizations and their bad intentions. High fines and major consequences arise when companies don’t cut ties with sanctioned parties or fraudulent partners.

However, the lack of clarity in laws regarding beneficial ownership had opened a door for criminals to move illicit funds to offshore destinations. Especially after the fiasco that the Panama Papers scandal has put onto the table, authorities began taking action. New regulations were introduced, and Ultimate Beneficial Owners (UBOs) became a mandatory obligation for businesses to disclose their information.

So, to stop your business from becoming a money-laundering channel, you need to dig deeper and work harder to analyze every single detail of the company and its customers. The question remains – so what exactly are UBO regulations, and why are they necessary in today’s context? Keep on reading to find out.

Understand in a second:

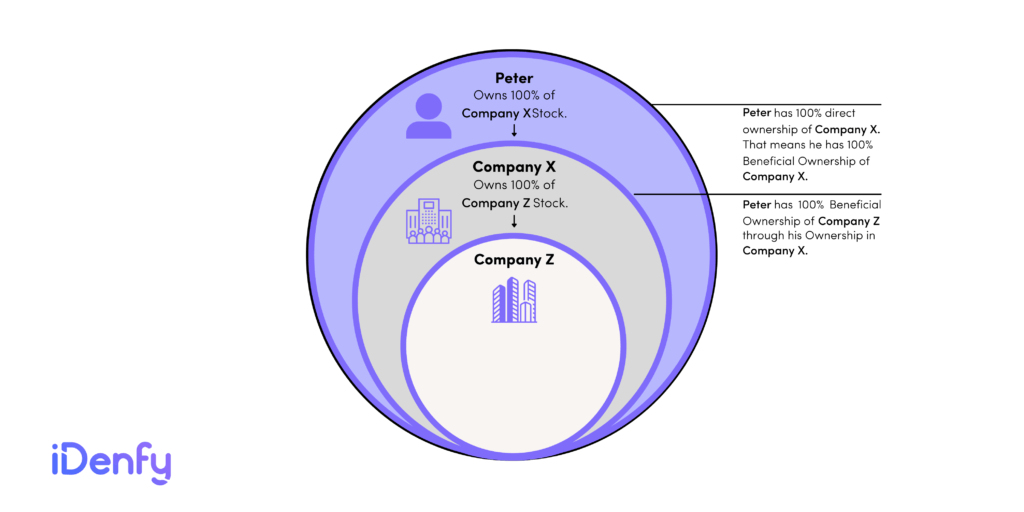

- An Ultimate Beneficial Owner (UBO) is a person or entity with ultimate ownership or control of a company or organization, regardless of the legal owner.

- Identifying the UBO is crucial for anti-money laundering, anti-corruption, corporate governance, and risk management efforts and compliance.

What is an Ultimate Beneficial Owner (UBO)?

The term Beneficial Ownership goes back to the US Securities Act of 1933. The main goals were to ensure financial transparency and to establish stricter laws against fraud in securities markets. The ownership of a security resembled the shares in a company. Afterward, authorities updated the laws, and we now have a more detailed definition of UBOs.

As per the Financial Action Task Force (FATF), an Ultimate Beneficial Owner or UBO is the ultimate interested party that controls or owns a customer or any person on whose behalf transactions are conducted.

In other words, as the name implies, an Ultimate Beneficial Owner is the individual or entity that ultimately derives benefits from owning a business or organization.

Key facts to remember:

- Financial crime numbers have been rising throughout recent years, pushing companies to prioritize countering money laundering and terrorist financing.

- The business or any financial entity must conduct Ultimate Beneficial Owner checks when involving another party.

- This is part of Customer Due Diligence (CDD) and an essential practice for effective fraud prevention.

Who is Considered an Ultimate Beneficial Owner?

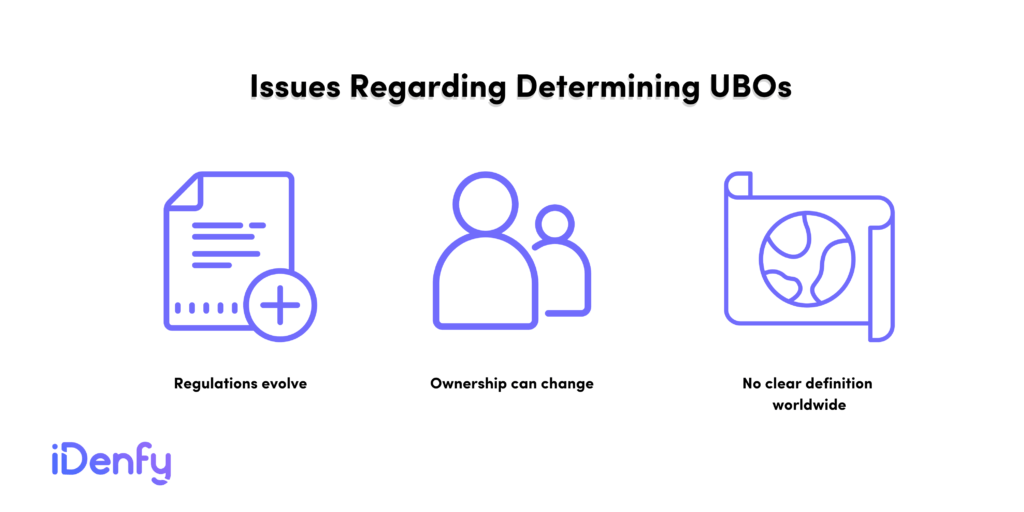

Like all regulations, they are constantly evolving. UBOs can conceal their identity by hiding it under a corporate structure. Different regions have different guidelines for UBO legislation, which also makes UBO hard to identify.

The FATF has set out specific requirements for defining an Ultimate Beneficial Owner:

- Holds at least 25% of the entity’s capital;

- Can exercise a minimum of 25% of the voting rights;

- Is the indirect beneficiary of at least 25% of the company’s capital;

- Is a nominee or corporate director who’s appointed to conceal the true owners of the given entity;

- Is a shareholder who could’ve been transferred anonymously;

- Is the guardian of minors;

- Has a power of attorney.

In general, UBO is the ultimate beneficiary who benefits from the given financial transaction. The jurisdiction varies, but usually, an UBO is a person who has a minimum of 10-25% of the company’s capital or voting rights. There’s an exception for banks. When conducting UBO research, they stick to the 10% threshold in contrast to the 25% that’s provided by the regulations.

In certain scenarios, a person may hold a company’s shares without actually reaping any benefits from them. In such instances, the individual is not considered a UBO because they do not have the privileges associated with:

- Voting rights

- Receiving dividends

- Gaining advantages from the shares and their value

Why is it Important to Verify UBOs?

The Ultimate Beneficial Owner doesn’t necessarily have to be the direct company owner. That means such structures are not illegal, but they come with certain risks. It’s necessary to review UBOs not only because of the law but also because they are often used for fraudulent purposes.

Reviewing the company’s ownership structure helps trace suspicious activity and detect fraudulent transactions as well as fictional addresses or private homes that have clueless residents.

The main issues in today’s context of fraud are:

- When criminals strive to launder money, they seek to conceal their true identities in order to avoid AML regulations;

- Sometimes, they use shell companies or conduct transactions using proxies.

UBOs and Shell Companies

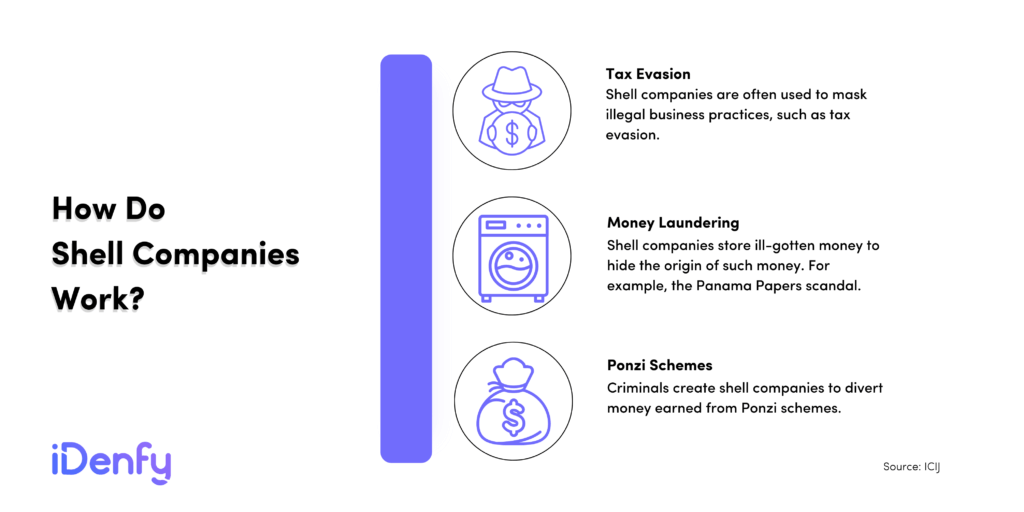

Shell companies can serve as channels for money laundering. Usually, they store funds and engage in financial transactions without creating actual products and generating revenue. In theory, shell companies have a more favorable tax treatment, which makes them the perfect transactional vehicle for criminals who hide their illegal money.

To fight this issue, the US Senate approved the AML Act in 2020 and banned anonymous shell companies, introducing new obligations. From that point, companies needed to disclose their Ultimate Beneficial Owner to the government. The newly presented requirements contributed to helping companies detect money laundering risks and identify shell companies.

Money Laundering Risks

The rules and regulations for Ultimate Beneficial Owner check are here for a reason, as the money laundering risks are sky-high. If the entity that’s being screened doesn’t want to submit financial information by creating suspicious excuses, keep in mind that it’s the first sign of possible money laundering.

Nowadays, fraudsters come up with smart ways to scam their way to success. They create inauthentic registration numbers, fake addresses, and personal information, such as emails, to paint the picture of a “real” company with no connection leading back to them. That being the case, the Ultimate Beneficial Owner check helps uncover the masterminds behind complex money laundering schemes.

Which Organizations are Responsible for Identifying Ultimate Beneficial Owners?

Regulations on Anti-Money Laundering and Anti-Terrorist Financing specify which organizations must identify Ultimate Beneficial Owners and their business relationships. Non-compliance with these regulations can result in consequences for a company, including fines and other penalties such as license revocation.

Every financial organization, including:

- Commercial and investment banks

- Brokerages and investment firms

- Insurance firms

- Other entities involved in financial transactions, like credit unions, money transfer businesses, and payment gateways,

is required to conduct UBO checks.

That said, if UBO information is incompletely disclosed, it can create obstacles when a corporation attempts to open a business bank account or secure financing. That’s why it’s crucial for businesses to treat UBO identification very seriously, ensuring that accurate information is provided to financial institutions to prevent any potential legal or financial repercussions.

What are the Main UBO Red Flags?

Businesses need to be aware of specific suspicious behavior that shows potential signs of criminal activity. Using the most common red flags can help detect money laundering schemes and prevent fraud.

Make sure to be vigilant for these signs:

- If the entity doesn’t provide complete data about its transactions;

- If the business has an unusual number of beneficiaries;

- If the company has transactions with addresses of off-shore locations and high-risk jurisdictions;

- If the entity has untraceable invoices and suspicious payments that are unusual for its industry;

- If the company’s transaction amounts exceed its wealth profile.

Under the circumstances, UBO requirements are mandatory for many entities. For example, currency exchange officers, banks, casinos, and blockchain companies – all need it. This part of the obligation refers to Know Your Customer (KYC) and Know Your Business (KYB) compliance processes, where companies must screen other businesses to prevent money laundering and find out more about the entities they are dealing with.

Related: AML Red Flags — Complete Breakdown

Global UBO Compliance Regulations

Legal measures around the world strive to protect businesses from being used for criminal activities. UBO legislation helps companies review and ensure up-to-date beneficial ownership data, making legal entities and their arrangements sufficiently transparent. As a result, the Ultimate Beneficial Owner check prevents getting tied with shell companies that are engaging in tax evasion, corruption, and other crimes related to money laundering. Naturally, the measures differ depending on the country:

➡️ European Union. The EU’s Fourth Anti-Money Laundering Directive initiated the implementation of domestic UBO registers in 2015. As of 2020, due to the Fifth Anti-Money Laundering Directive, businesses need to register their owners and other people who have control in an Ultimate Beneficiary. For instance, in Lithuania, the country of iDenfy’s HQ, non-compliance with these requirements entails liability:

- For legal entities: 500 – 2400 Euros;

- For managers of legal entities: 2100 – 6000 Euros.

➡️ United States. The US authorized the Corporate Transparency Act in 2020. It requires organizations to report beneficial ownership data to the government. That’s why businesses need to determine the structure of each entity to avoid non-compliance issues.

➡️ United Kingdom. The UK presented a register of company beneficial ownership in 2016 via the People with Significant Control (PSC) Register. Fast forward to 2022, the UK Parliament passed the Economic Crime Act in response to Russia’s war in Ukraine in February. It’s designed to set up a register of overseas entities and their beneficiaries, requiring “overseas entities who own land to register in certain circumstances to make provision about unexplained wealth orders and to make provision about sanctions”.

How to Establish UBOs?

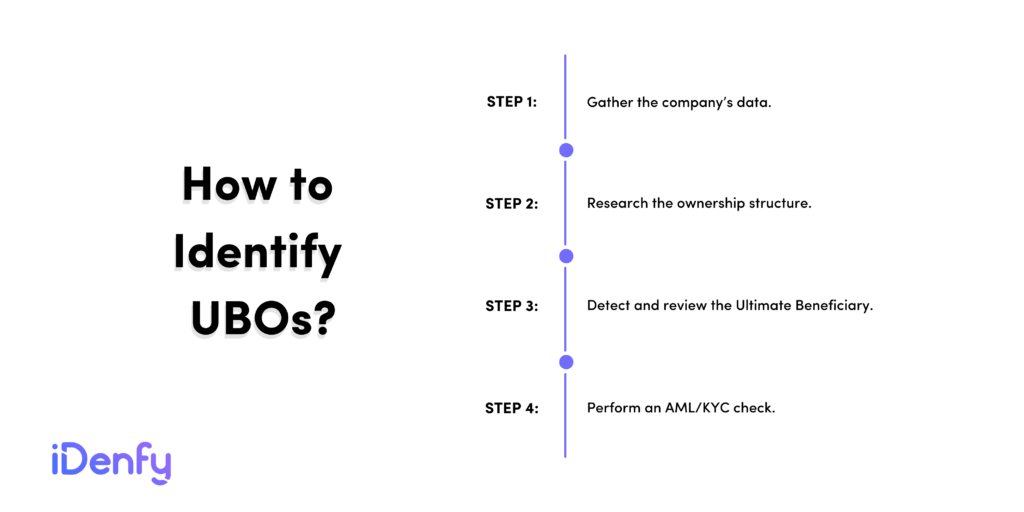

Businesses need to establish the Ultimate Beneficial Owner and its structure by implementing different measures as part of their AML program. At the same time, companies should strive to utilize efficient UBO investigation methods.

In practice, such an effective UBO strategy should have these processes incorporated into KYB compliance:

Customer Due Diligence

Businesses need to collect identifying information about their clients, including address data and full names of company directors. For instance, a crypto exchange platform needs to check the customer’s identity document before allowing them to create an account.

By identifying UBO and conducting due diligence, companies detect entities that have been previously flagged. This means that in case an established Ultimate Beneficial Owner poses a high-risk level, the company would need to perform enhanced due diligence (EDD) to ensure that they’re proceeding with a secure business relationship.

Related: What is the Difference Between KYC and CDD?

Sanctions & PEP Screening

Sanctioned individuals pose a higher risk when it comes to illicit funds and various criminal activities. Customers who fall into international sanctions lists may also seek to conceal their identities and use shell companies. The same principle goes for Politically Exposed Persons (PEPs). Some politicians and government officials are notorious for money laundering; therefore, the right move is to screen all of the customers, especially those that present financial crime dangers.

Related: PEPs and Sanctions Checks Explained

Adverse Media

In other words, it’s a process of screening an individual or a company in the context of news articles, legal prosecution, and similar content that possibly makes a negative impact on the business. For example, screening adverse news can reveal UBO-related crimes, exposing money laundering schemes. The reputation of an entity depends on the media. That’s why news screenings help protect the business and safeguard it from being compared with suspicious entities.

Challenges in Verifying UBOs

According to Thomson Reuters, 58% of the surveyed compliance specialists state that the biggest challenge at work is the inability to access reliable UBO data. On top of that, the survey results showed that financial institutions spend $48 million annually on global Customer Due Diligence and Know Your Business (KYB) procedures.

Criminals often use complex structures to hide shell companies and launder dirty money, which makes it hard to determine the true identity of the Ultimate Beneficial Owner. With corruption in the bargain, financial criminals successfully use the loopholes in the system to launder millions all over the world.

When it comes to compliance, there are challenges in ensuring UBO norms:

- Corporate entities come from multiple geographies.

- Different jurisdictions have different methods of defining UBOs.

- Financial institutions are also required to proceed with ongoing monitoring.

- This makes the required data stored in different locations hard to find.

Criminals have their base in one country while, at the same time, they conduct business from another location. Since structures and laws vary, such circumstances create legal loopholes that allow criminals to successfully launder illicit funds. Also, it’s important to note that there is no universal threshold or standard percentage of ownership requirements across jurisdictions, making the compliance and UBO check process prone to error.

The second issue regarding the Ultimate Beneficial Owner check is that companies need to continuously update customer data and develop customer profiles to ensure a smooth ongoing monitoring process. In a traditional scenario, such a review is manual, making it challenging for compliance officers to research large amounts of data within short periods.

What is an Effective Approach to UBO Verification?

Several factors complete an effective UBO check. According to FATF, Ultimate Beneficial Owners must be verified and identified. The challenging part of this process is that compliance officers need to find and review reliable data manually, which itself isn’t an easy task.

Our KYB platform has a built-in Ultimate Beneficial Owner check option. The key points that highlight the solution’s benefits are:

- Our Business Verification platform that provides UBO services is specifically designed to solve compliance issues and ease off the work for specialists who are tied to time-consuming, manual UBO data checks.

- On top of that, our AI-powered platform carries various databases in one place, eliminating the need for unreliable secondary sources or registries.

iDenfy’s UBO Check Workflow

The main goal of conducting UBOs and shareholders’ AML checks is flexibility, as there are many different companies, starting from small enterprises and ending in large corporations. Depending on the industry, the workload, and the type of collaboration, we suggest custom UBO AML check options:

- Manual. For instance, let’s say that the company needs to conduct the AML check only for specific clients, then the UBOs can be identified with a single mouse click. Once the AML check progresses, the manager has full rights to review the results and decide whether the specific subject is a fraud or not.

- Partially automated. If the company must conduct the AML check for all of its clients, our automation is here to help. Once the client submits the form, our software conducts the AML checks automatically for UBOs and/or all the Shareholders. In this case, the manager has full rights to review the results manually.

- Fully automated. It’s a similar variant to the second automated option. Despite that, the reviewing part here is done automatically, which means that the clients with detected suspicious UBOs and/or Shareholders can be blocked without an additional manager’s manual check.

The Ability to Personalize Our Platform

According to the laws and regulations, AML Screening is one of the key aspects of helping companies stay compliant. The same requirements are valid when it comes to Ultimate Beneficial Owner checks. You can add entities to the monitoring list manually or automatically so that the AML checks proceed daily.

Furthermore, the old findings (for example, False Positives) are not duplicated. The manager using our platform receives emails only regarding the new suspicious activities that were found during the check.

Additionally, companies with risky monitoring subjects are flagged automatically in iDenfy’s dashboard, so there wouldn’t be any chance of human error. Also, it’s important to note that the same customization options can be applied when proceeding with the Adverse Media check.

Check out our multi-functional Business Verification platform to try out the UBO check and get the full scoop on who really owns the companies to prevent money laundering.

By sending us a message here, you can test our go-to tool for compliance officers with automated audit and report services.