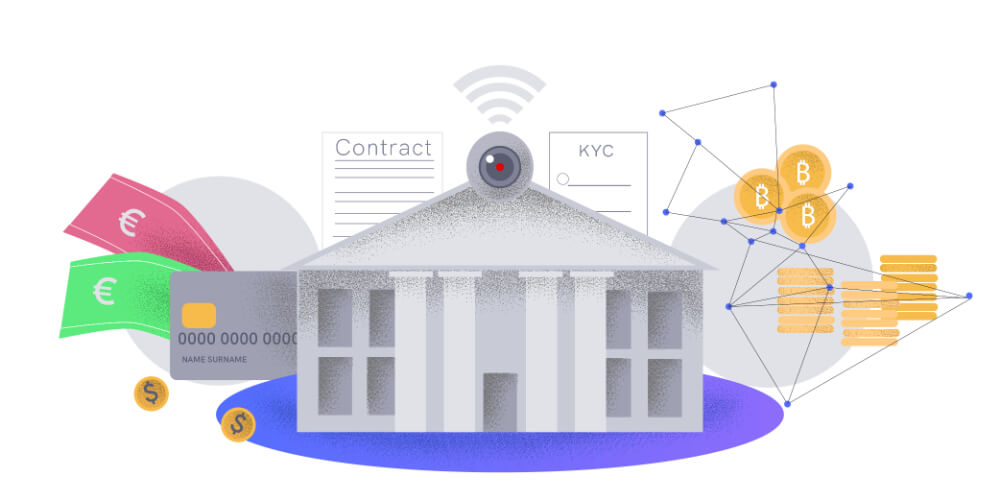

The KYC process forms the backbone of secure and simpler customer onboarding. That’s why video identification enhances authentication by verifying the identity of customers through real-time visual interactions. This reduces fraud, improves accuracy, and ensures regulatory compliance.

Video identification can be used for KYC to access fintech services when a user needs to create a new account. However, there are other cases where this process is beneficial. For example, when the user needs to sign documents remotely, such as lease agreements.

It’s clear that we need better and more capable KYC solutions, and video identification is one answer. But what exactly is video identification? How does it work? What sectors use it?

Let’s dive in deeper and find out.

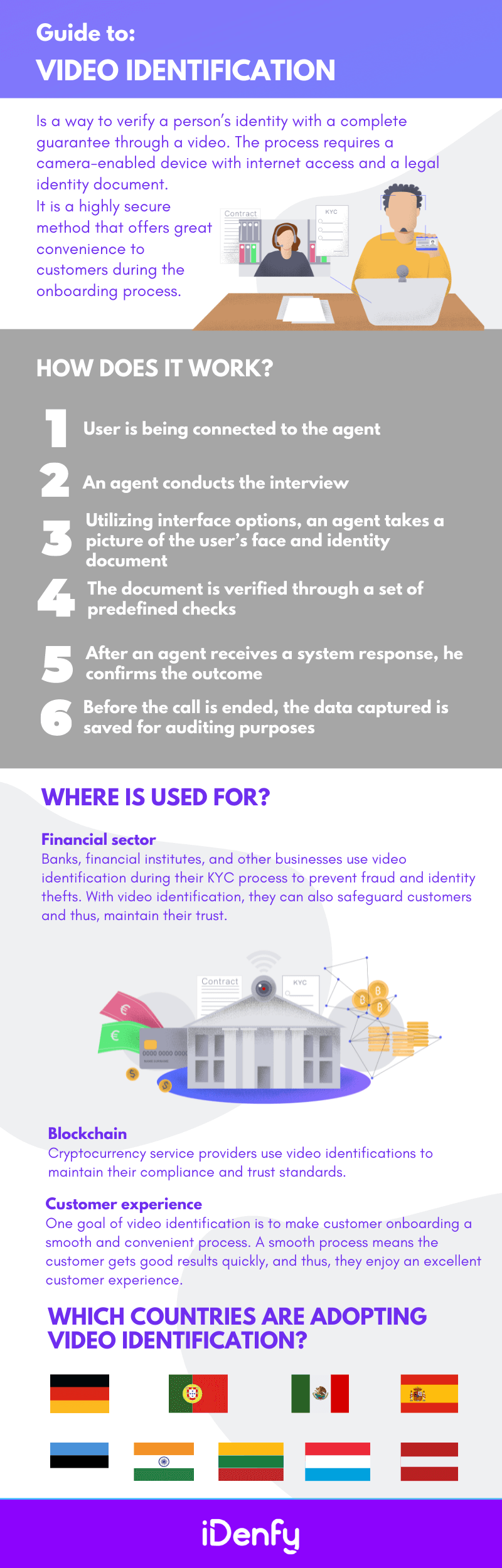

What is Video Identification?

Video identification is a way to verify a person’s identity with a complete guarantee through a video.

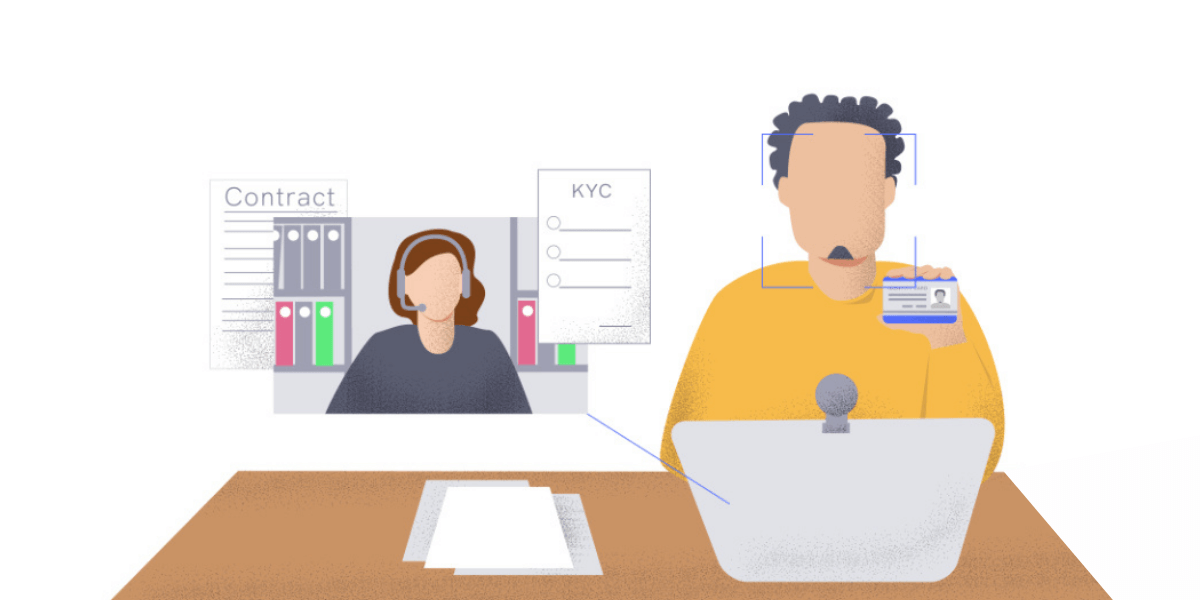

In simple terms, video identification is a process that involves using real-time video interactions to verify the identity of individuals, often as part of the Know Your Customer (KYC) procedures, ensuring authenticity and compliance in various industries.

The process requires a camera-enabled device like a computer, smartphone, tablet, internet access, and legal identity document. It is a highly secure method that offers great convenience to customers during onboarding. With a secure video identification process in place, there is a decreased chance of identity fraud of any kind. It works as a damper for fraudsters and identity thefts looking to attack.

How Do Video Identification Solutions Work?

Video identification involves using live video interactions to verify an individual’s identity. Video identification solutions like iDenfy work as a window between the business and new customers. It swaps places with personal identification at branch offices through accessible online platforms. An employee can conduct video identification asynchronously (timely deferred recording) or synchronously (live chat).

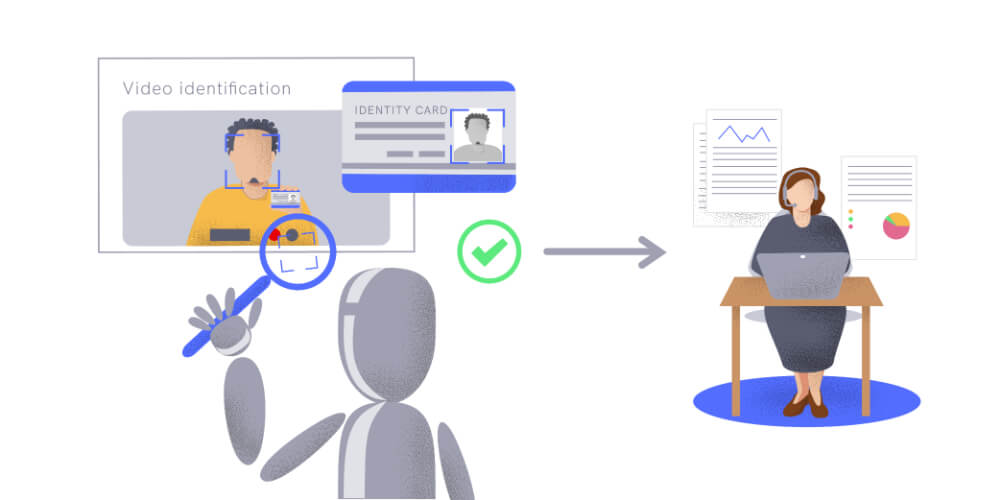

The employee can even use Artificial Intelligence (AI) to scan ID documents and match biometric features in real-time. The AI can use liveness detection to differentiate between actual humans and fakes like photos or recorded videos. Using facial recognition software, the AI can look for unconscious movements or request specific actions from the person, like blinking the right eye twice.

Here are some use-case examples of video identification solutions:

- Bank Account Opening: A customer applying for a bank account initiates a video call. They display their driver’s license to the camera, and the agent verifies their appearance and document details. Liveness detection confirms their presence.

- Digital Identity Verification: An online service requires new users to verify their identities. Users show their passports to the camera while responding to live questions. AI algorithms assess the facial match between the passport photo and the user’s appearance.

- Cryptocurrency Exchange: When signing up on a cryptocurrency exchange, users are asked to undergo video identification. They display their government-issued ID to the camera, and the agent ensures the document’s legitimacy.

Video Identification in the Context of Customer Onboarding

The whole idea of digital customer onboarding is to offer a better user experience through accessibility and convenience while maintaining complete security. Identification companies like iDenfy have developed solutions that provide complete remote identification and adapt according to company requirements to encourage customer acquisition techniques.

The customer onboarding process is quite simple and involves these steps:

Step 1: The customer will register with the financial institution for the onboarding process. The system verifies the details mentioned in the form and approves it.

Step 2: An agent from the institute will schedule an interview with the customer.

Step 3: Once the interview starts, the agent will ask a few questions to the clients and use different interface options to take the user’s and their identity document pictures.

Step 4: The AI will verify the documents based on presets, regulations, and checks.

Step 5: Once the system verifies the documents, the agent will confirm the outcome.

Step 6: All the data collected during the interview is stored for auditing and analysis purposes.

What is Customer Due Diligence (CDD) in the Context of Video Identification?

Customer due diligence (CDD) is a legal requirement for organizations when establishing business relationships with customers. It is also a key component of KYC and Anti-Money Laundering (AML) compliance.

However, CDD isn’t a one-and-done process, it’s an ongoing matter. Verifying customers’ identities at onboarding isn’t sufficient. Companies must implement specific steps, such as storing and regularly updating data to ensure easy access for regulatory audits, including building a proper video identification process at the user onboarding stage.

CDD and Video Identification Guidelines Around the World

Germany’s Anti-Money Laundering Act (GwG) controls all cases where banks, financial institutes, and other entities use video ID applications. According to the general due diligence stated in the GwG, all entities must identify the contracting party using their legal ID documents before establishing any business relationship or executing specific transactions.

The regulations or guidelines direct “physical examination” of identity documents or use “another procedure” that offers equal security. The German Federal Financial Supervisory Authority (BaFin) sanctioned a similar procedure and permitted using video ID, given that they fulfill specific criteria.

Apart from Germany, other countries that have allowed or are in the process of adopting video identification in their KYC system are:

- SEPBLAC (Servicio Ejecutivo de Prevención de Blanqueo de Capitales) – Spain

- BdP (Banco de Portugal) – Portugal

- FKTK (Financial and Capital Markets Commission) – Latvia

- CSSF (Commission de Surveillance du Secteur Financier) – Luxembourg

- FCIS (Financial Crime Investigation Service under the Ministry of Interior) – Lithuania

- FINMA (Swiss Financial Market Supervisory Authority) – Switzerland

- RBI (Reserve Bank of India) – India

- Finantsinspektsioon – Estonia

- CNBV (Comisión Nacional de Bienes y Valores) – México

Related: What is the Difference Between CDD and EDD?

What are the Main Benefits of Video Identification?

Naturally, implementing advanced identity verification methods like video identification instills trust in customers, showing that the business takes security seriously. Video identification also adds an extra layer of security by verifying customers’ identities through real-time interactions, reducing the risk of impersonation and fraud.

We’ve compiled a short perk list down below:

For the Company

1. Faster customer onboarding: With video identification, the KYC process is quicker and more thorough while reducing onboarding costs and improving user experience.

2. KYC/AML: Video identification with KYC helps in complying with KYC/AML regulations. With KYC/AML compliance, financial institutes and banks can build their trust and gain a good reputation.

3. Global Reach: Businesses can verify customers’ identities remotely, allowing them to reach a wider audience beyond their geographical location.

4. Personalization: During the video interaction, businesses can gather additional information about customers that might aid in tailoring services to their needs and preferences.

5. Fraud elimination: Video identification acts as a significant deterrent for fraudsters since the process mixes human inspection with software and AI machine learning. The whole process ensures decreasing online fraud risks.

For the Customers

The biggest benefit for the customer is a smooth and guided onboarding process. Video identification reduces the need for customers to physically visit a branch or submit paper documents, making the onboarding process more convenient and efficient.

With video identification in place, the onboarding process will take a few minutes, and the customers can return back to their activities. On top of it, the customer can schedule KYC onboarding anytime they want, so they have full control over when and how the process goes.

Related: Top 3 KYC Automation Benefits for Businesses

What Industries Use Video Identification?

Of course, the financial sector is one prominent industry that has asked for and is using video identifications. Other users include ICO’s and cryptocurrency service providers.

Financial sector: banks, financial institutes, and other businesses use video identification during their KYC process to prevent fraud and identity theft. With video identification, they can also safeguard customers and, thus, maintain their trust.

Telecommunications: Telecom companies use video identification for SIM card activations and other services to prevent unauthorized use of phone numbers.

Blockchain: Cryptocurrency service providers use video identifications to maintain their compliance and trust standards.

Healthcare: Telemedicine platforms can use video identification to verify patients’ identities and ensure compliance with privacy regulations.

E-Commerce: Online marketplaces and e-commerce platforms can employ video identification to enhance trust and security, especially for high-value transactions.

The main goal of video identification is to make customer onboarding a smooth and convenient process. That’s exactly why so many industries integrate AI-powered video identification solutions. A smooth process means the customer gets good results quickly, and thus, they enjoy an excellent customer experience.

Final Thoughts

So, with all things considered, video identification is not just about a video. Designers created a well-thought-out process that involves different subjects like criminal psychology and deep analysis of documents and biometric features.

AI machine learning uses several valid criteria to ascertain a clear-cut direction for video identification. Identification through video offers complete regulation compliance set-up by different countries, thus, safeguarding business and customers.

Read our case studies to find out more, or book a free demo to see our KYC service options in action.