June 21, 2024

Domestic PEPs and Foreign PEPs — What You Need to Know

Learn the risks behind different types of high-ranking individuals, also known as domestic PEPs and foreign PEPs, and explore the tactics that regulators recommend for proper identification and AML screening procedures.

June 17, 2024

How Does Student Identity Verification Work?

Explore the options for student identity verification and find out why universities and e-learning apps choose to onboard their learners using third-party KYC software as a way to prevent unwanted fraud scenarios, including forged documents, like fake student visas.

June 13, 2024

How to Combat Document Forgery?

Learn how to spot document forgery by identifying red flags, and see concrete examples of why automated document verification solutions might be the perfect fit for you.

June 12, 2024

Age Verification Law in Texas [2024 updated]

We’ve covered the new age verification law passed on 28th of April 2024 by the Texas state and shared the concrete steps to build identity verification procedure.

June 10, 2024

Best KYC Software Providers of 2024

Explore the latest coverage of best KYC software providers and recommendations on where each of the service excels the best.

Customer Risk Assessment: How to Do it Right [Step-By-Step Guide]

Learn all about customer risk assessment, factors that help determine the level of risk, automation options, and concrete steps you have to take to comply with AML regulations.

How Does AML Apply to Crypto? [With Examples]

Learn all about crypto compliance, AML regulations, new Travel Rule updates, and what kind of measures are now required for VASPs.

May 28, 2024

How Does Driver’s License Verification Work?

Find out why so many platforms incorporate driver’s license verification into their onboarding flow and why it’s considered the go-to method to achieve a simple and efficient Know Your Customer (KYC) process.

Money Laundering in Forex Trading [AML Risk Guide]

The forex market isn’t an exception and, like many high-risk industries, is associated with money laundering risks. Learn how to build a proper AML program for your forex trading business, find out how to identify key red flags, and more.

April 30, 2024

Source of Funds (SOF) and Source of Wealth (SOW) Checks [Guide]

Get a bigger picture of the intricacies surrounding Source of Funds (SOF) and Source of Wealth (SOW) checks. Discover the main challenges in AML and KYC compliance, and learn the best practices that will help you enhance your compliance procedures and mitigate the risks of money laundering.

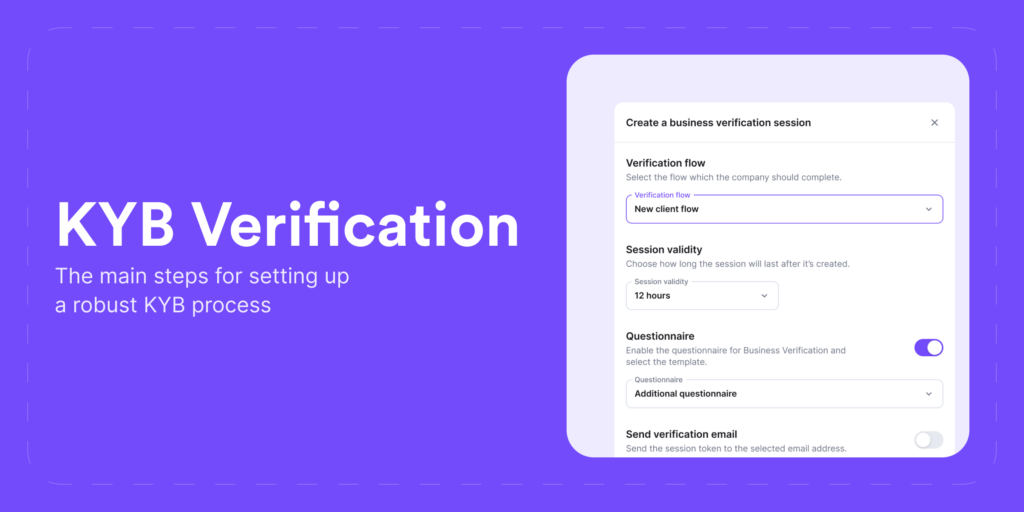

6 Steps to Conduct a Know Your Business (KYB) Verification Check

Discover the specific steps and examples of how to conduct a compliant Know Your Business (KYB) verification process.

Get Ready for Your AML Audit [Best Practice Guide]

Understanding how to select the right automation tools, assessing the effectiveness of internal controls like prepared reports, and setting the scope and frequency of an AML audit can be challenging. Learn how to verify the effectiveness of your AML program with a straightforward AML audit guide.

April 22, 2024

What is the Crypto Travel Rule? An Overview

Explore the Crypto Travel Rule and learn what data needs to be collected, who qualifies as a VASP, as well as the necessary steps and tools for crypto platforms to comply with the FATF guidelines.